Trading platforms offer a variety of options for users, but few specialize in decentralized perpetual futures. dYdX stands out in this niche, providing users with an innovative platform for perpetual trading, characterized with high transaction speed, low fees and numerous possibilities for DYDX token holders. It is also perfectly suitable for newbie traders, simplifying the DeFi experience and making the transition from centralized exchanges seamless.

The recent developments in dYdX’s offerings make it an ideal choice for those looking to explore decentralized finance (DeFi) with ease. This guide is designed to help beginners navigate dYdX and its features, providing the essential steps needed to start trading.

What is dYdX?

dYdX is a decentralized perpetual exchange. Launched in 2018, it has established itself as a leader in decentralized perpetual trading through its combination of cutting-edge technology and affordability. The platform’s growth is supported by prominent venture capital firms and investors, including Andreessen Horowitz, Paradigm, and Polychain, among others.

In 2023, dYdX announced its migration from the Ethereum blockchain to the Cosmos ecosystem with the dYdX Chain. This transition marked a significant milestone for the platform, allowing for increased scalability, full decentralization, distribution of 100% of protocol fees to Stakers and higher throughput. The migration also enabled dYdX to implement a fully decentralized order book system and matching engine providing more control and precision for traders.

dYdX Chain is fully decentralized, so users can easily onboard using a variety of wallets or socials thanks to the Privy integration and aren’t required to complete Know Your Customer (KYC) checks. All you need is a funded crypto wallet or social account and you can start trading in a matter of minutes.

dYdX has established itself as a leading platform for perpetual trading of crypto assets. The platform’s average daily transaction volume consistently exceeds $1 billion, reaffirming its position as a significant player in the trading landscape. It has outpaced many decentralized trading platforms and competes with prominent centralized exchanges, demonstrating dYdX’s growing influence in the market.

How to Trade on dYdX?

Step 1: Getting Started

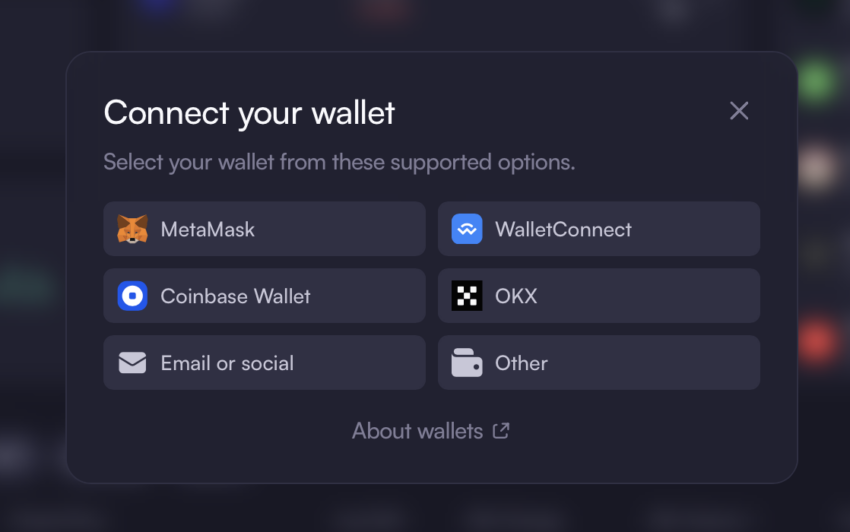

Before you begin trading on dYdX Chain, you need a compatible cryptocurrency wallet, e-mail or socials (X or Discord). Here’s how to set up a wallet:

- Choose a Wallet: Popular options include MetaMask, Trust Wallet, and Ledger. Make sure your chosen wallet is compatible with dYdX on the dydx.trade interface. A hardware wallet like Ledger offers added security by keeping your private keys offline.

You can also set up a new wallet using Privy and log in using your existing email or social accounts. It doesn’t require memorizing a seedphrase — just choose a preferred log in method and click Authorize.

- Install and Configure: Download and install the wallet app or browser extension, and set up your account by following the prompts. Make sure to securely store your recovery seed phrase. Never share this phrase with anyone, as it gives full access to your wallet.

- Fund Your Wallet: Transfer some cryptocurrency, such as USDC, into your wallet. This is necessary for trading on dYdX Chain. Depending on your chosen wallet, you may need to purchase cryptocurrency from an exchange or transfer it from another wallet.

Step 2: Connect to dYdX

With your wallet ready and funded, it’s time to connect to dYdX Chain:

- Visit dydx.trade — the front end user interface for dYdX Chain.

- Connect Your Wallet or socials: Click the “Connect Wallet” button and select your wallet type. Follow the prompts to complete the connection. Ensure your wallet extension or app is open and ready for interaction.

- Authorize: You’ll be asked to authorize transactions through your wallet interface. Make sure to review the details before confirming. This step ensures you understand and approve the connections and transactions taking place.

dYdX Chain is available for iOS: the same dYdX Chain trading experience you know and love — now directly in your pocket!

Download dYdX for iOS here.

Step 3: Explore the Platform

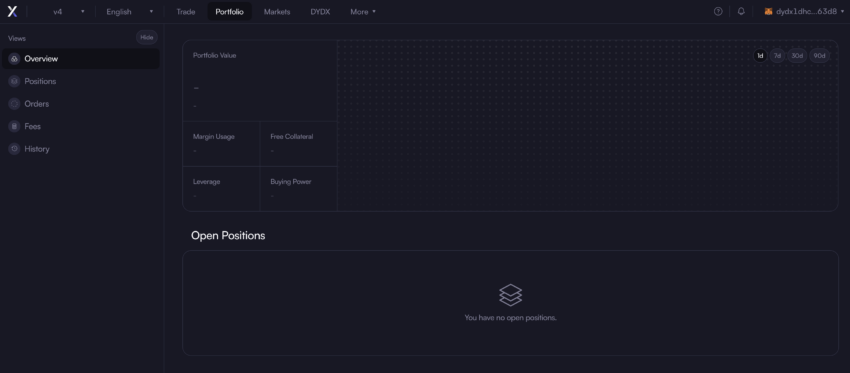

Once connected, you can explore dYdX Chain’s interface:

- Dashboard: The dashboard provides an overview of your account, including balances, open positions, and trade history. This section also offers shortcuts to key functionalities, making it easier to manage your portfolio.

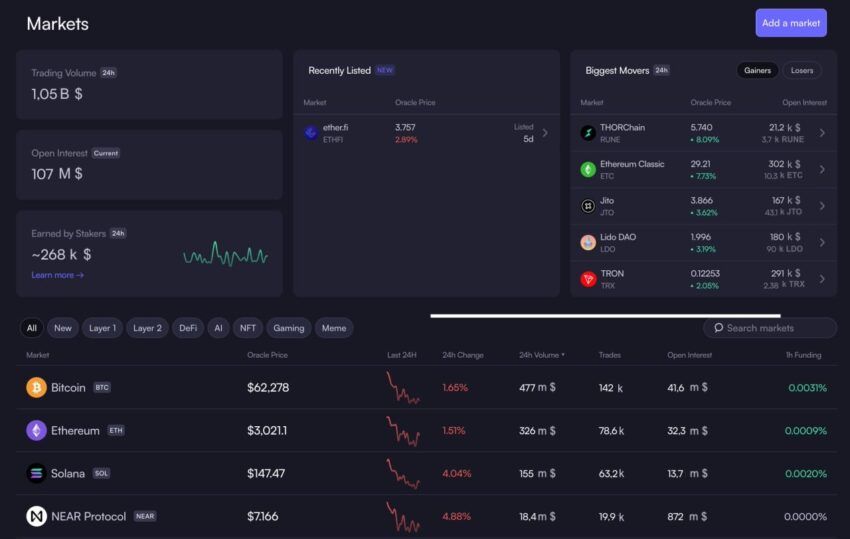

- Markets: Navigate to the Markets section to view available trading pairs, recently listed markets, 24h USDC distribution, biggest movers, current prices and 24h trading volumes. You can also view price trends, helping you make informed decisions.

- Order Book: dYdX Chain’s orderbook and matching engine is fully decentralized and purpose built for the optimal trading experience. It shows active buy and sell orders, giving you insights into market trends. This information can guide your trading strategy, especially when placing limit orders.

Step 4: Start Trading

Now that you’re familiar with the interface, you’re ready to place trades:

- Select a Market: Choose a trading pair from the Markets section. dYdX Chain offers over 63+ pairs, allowing you to diversify your portfolio or focus on specific assets. You can switch between the selected market and all available pairs using the All Markets button in the top left menu.

- Order Type: Decide on an order type, such as a market order (instant execution at current prices) or limit order (executed at a specified price). Limit orders are useful for specifying exact entry or exit points for your trades. For a detailed overview you can view this comparison table.

- Enter Trade Details: Specify the amount and price for your trade. Double-check these details before finalizing to avoid mistakes.

- Set The Leverage: Deciding what leverage to use is a crucial aspect of perpetual trading. Leverage refers to the funds borrowed from the platform to amplify a trade, acting as a multiplier on gains or losses. dYdX Chain offers up to 20x leverage trading. The liquidation price is calculated automatically before you enter the trade, helping effectively manage the risk.

- Understand dYdX Trading Fees: Fees vary based on the type of trade and your trading volume in the last 30 days. Fee is between 0,025% and 0,05% for taker orders. Generally, the fees are lower than that on centralized exchanges. Up to 90% of your trading fees are distributed instantly back into your dYdX Chain address. Additionally there is an incentive program currently live that subject to governance will distributed 5M USD in DYDX to eligible traders.

- Review and Confirm: Double-check all details before executing your trade.

- Manage Your Positions: Monitor open positions from the dashboard and manage them by closing or modifying as needed. Keeping track of your positions helps you adapt to market changes and protect your investments.

Step 5: Get The Most Of dYdX Trading Rewards and Launch Incentives

Trading rewards incentivize users to trade on the protocol. dYdX rewards users for every successful trade based on the amount of fees paid. The system automatically distributes trading rewards directly to the trader’s account per block. Prior to each trade, the UI will also show the expected amount of rewards a trade of that size will receive.

The dYdX Chain also runs a Launch Incentives Program, tailored to expand and transition the current dYdX user base to the new protocol. The governance proposal set aside $20M of DYDX from dYdX Chain Community Treasury to be distributed as rewards for trading and market making activity. You can find an extensive blog post describing the program details here.

Step 6: Stay Informed

Trading on dYdX Chain requires staying updated:

- Community: Join the dYdX community on social media or participate in forums to stay informed about updates and opportunities. Engaging with the community can also provide valuable insights and support.

- Learning Resources: Explore educational materials provided by dYdX Academy and other DeFi resources to enhance your trading skills. Continuous learning can help you refine your strategies and navigate the platform more effectively.

- Security: Always keep security in mind, enabling two-factor authentication (2FA) and avoiding sharing sensitive information. Regularly review your security settings to protect your assets.

Although perpetual trading is inherently risky and not recommended for beginners, dYdX Chain offers an excellent starting point for those interested in trading perpetual futures. The platform boasts high liquidity, support for a wide range of assets, and low fees due to its advanced technology. These features make dYdX Chain a serious competitor to prominent centralized exchanges.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.