Mt. Gox exchange has made repayments in Bitcoin (BTC) and Bitcoin Cash (BCH) to more than 17,000 eligible rehabilitation creditors. Some have already confirmed receipt through designated cryptocurrency exchanges, such as Kraken.

After a long wait, Mt. Gox and its creditors steadily approach the end of a decade-long ordeal, with markets bracing for impact.

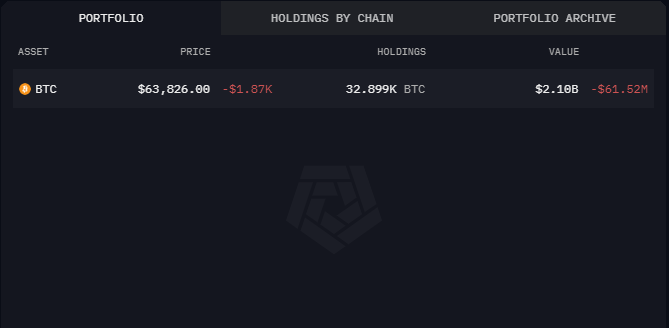

Mt. Gox Still Has Over 32,000 Bitcoin

After making over 17,000 repayments, Mt. Gox still holds 32,899 Bitcoin, worth approximately $2.099 billion at current rates, Arkham data shows. The balance comes after the exchange moved 33,960 BTC worth $2.25 billion to BitGo exchange-owned addresses on July 31. According to Arkham, BitGo is the fifth and final custodian working with the Mt. Gox trustee in the creditor rehabilitation process.

The exchange also moved 33,105 BTC, worth around $2.19 billion, to a new address late Tuesday. This added to the billions of dollars worth of BTC moved to designated crypto exchanges over the past few weeks, including Bitbank, Kraken, Bitstamp, and SBI VC Trade.

In mid-July, for example, Kraken said it successfully received funds From the Mt. Gox trustee and would work to distribute within the next 7-14 days. Recently, Bitstamp indicated plans to start distributing the assets to Mt. Gox creditors starting July 25.

Read more: Top Crypto Bankruptcies: What You Need To Know

According to rehabilitation trustee attorney Nobuaki Kobayashi, repayments to other rehabilitation creditors will be made promptly once certain processes, including due diligence, are completed.

“Repayments to other rehabilitation creditors will be promptly made once the following conditions have been met. (i) confirmation of the validity of registered accounts and other matters; (ii) acceptance of the intention to subscribe to the Agency Receipt Agreement by Designated Cryptocurrency Exchanges etc.; (iii) completion of discussions between the Rehabilitation Trustee and Designated Cryptocurrency Exchanges etc. regarding repayments; and (iv) confirmation that repayments can be made safely and securely. We ask eligible rehabilitation creditors to wait for a while,” Kobayashi wrote.

The repayments come after over a decade of legal processes, with creditors opting to receive BTC rather than fiat. The creditor distribution scheme totals $9 billion worth of crypto recovered from the Mt. Gox exchange collapse.

The exchange was established in 2010, operating as the largest BTC trading platform globally. Tables turned, however, in 2014, when Mt. Gox suffered a major security breach, losing at least 850,000 BTC. As repayments continue, markets brace for a possible impact in case creditors decide to cash out.

Crypto Markets Brace for Impact

Since Mt. Gox went under, the price of Bitcoin has increased significantly, making profit booking possible once some of the traders are compensated.

“It’s impossible to know just how much of these repaid assets will then be sold. The rumors around these are one of the main reasons why Bitcoin and the rest of the crypto market by extension have been struggling in recent weeks. Mt. Gox is a cloud that has been hanging over the crypto market for over a decade now. The sooner the repayments are completely done the better. But until then, there will be continued uncertainty as to just how much Bitcoin and Bitcoin Cash will hit the market and therefore keep prices suppressed,” Coin Bureau’s team said.

Popular trader Daan Crypto Trades also commented on the possible implications. He observed that the supply overhang makes altcoins look more attractive than Bitcoin. Nevertheless, Glassnode recently indicated that long-term holders and investors could absorb some of the sell-side pressure.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

CoinShares researcher Luke Nolan gave a different perspective. He said Bitcoin’s extensive liquidity and the creditor distribution dynamics could soften any potential sales impact. He believes Bitcoin Cash is much more likely to suffer from creditor sales. Alex Thorn, Galaxy’s Head of Research, also said the actual effect of the Mt. Gox distribution on Bitcoin’s selling pressure might be overestimated.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.