Bitcoin is nearly reaching a pivotal milestone, poised just $400 short of $70,000—a peak it last touched nearly 50 days ago on June 10. This potential breakthrough marks a significant moment, with Bitcoin currently trading at $69,600.

Now, Bitcoin is down by just around 5.5% from its March 2024 all-time highs.

Bitcoin’s Future Trajectory Might Depend on Macroeconomic Events

Markus Thielen from 10X Research has indicated a potential slow period for Bitcoin, noting historical trends that show a flattening in August and a decline in September. Despite these trends, upcoming events could play a crucial role in pushing Bitcoin past its current resistance. The much-anticipated Federal Open Market Committee’s (FOMC) meeting on July 31 could be a decisive factor.

“While we expect an eventual breakout, Bitcoin will likely need ‘macro’ help in the form of projected Fed rate cuts or another dose of lower inflation. Traders must observe Bitcoin when prices trade near the top of the range. The FOMC meeting on July 31 and the US CPI report on August 14 will be critical,” 10X Research said.

Over the weekend, several developments have fueled the upward momentum. At the Bitcoin 2024 conference in Nashville, former President Donald Trump made headlines with a commitment to fire Gary Gensler, the chairperson of the US Securities and Exchange Commission (SEC).

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

His declaration was met with enthusiastic applause, especially his proposal to create a “strategic BTC reserve” if he wins the upcoming election.

Following Trump’s speech, Senator Cynthia Lummis announced her intentions to introduce legislation aimed at establishing a Bitcoin strategic reserve. This proposed reserve would secure approximately 1 million Bitcoin, accounting for about 5% of the global supply.

Simultaneously, Cantor Fitzgerald revealed a major new initiative at the conference. This well-established financial services firm is launching a $2 billion venture focused on Bitcoin financing and lending.

On the technical front, 10X Research shared insights into Bitcoin’s price trends.

“Bitcoin has been in a gradually declining but well-defined downtrend since early March. The upper trend line was tested more frequently (five times) than the downtrend line (three times), so we expect a breakout is more likely than a breakdown as the upside pressure appears larger,” 10X Research said

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

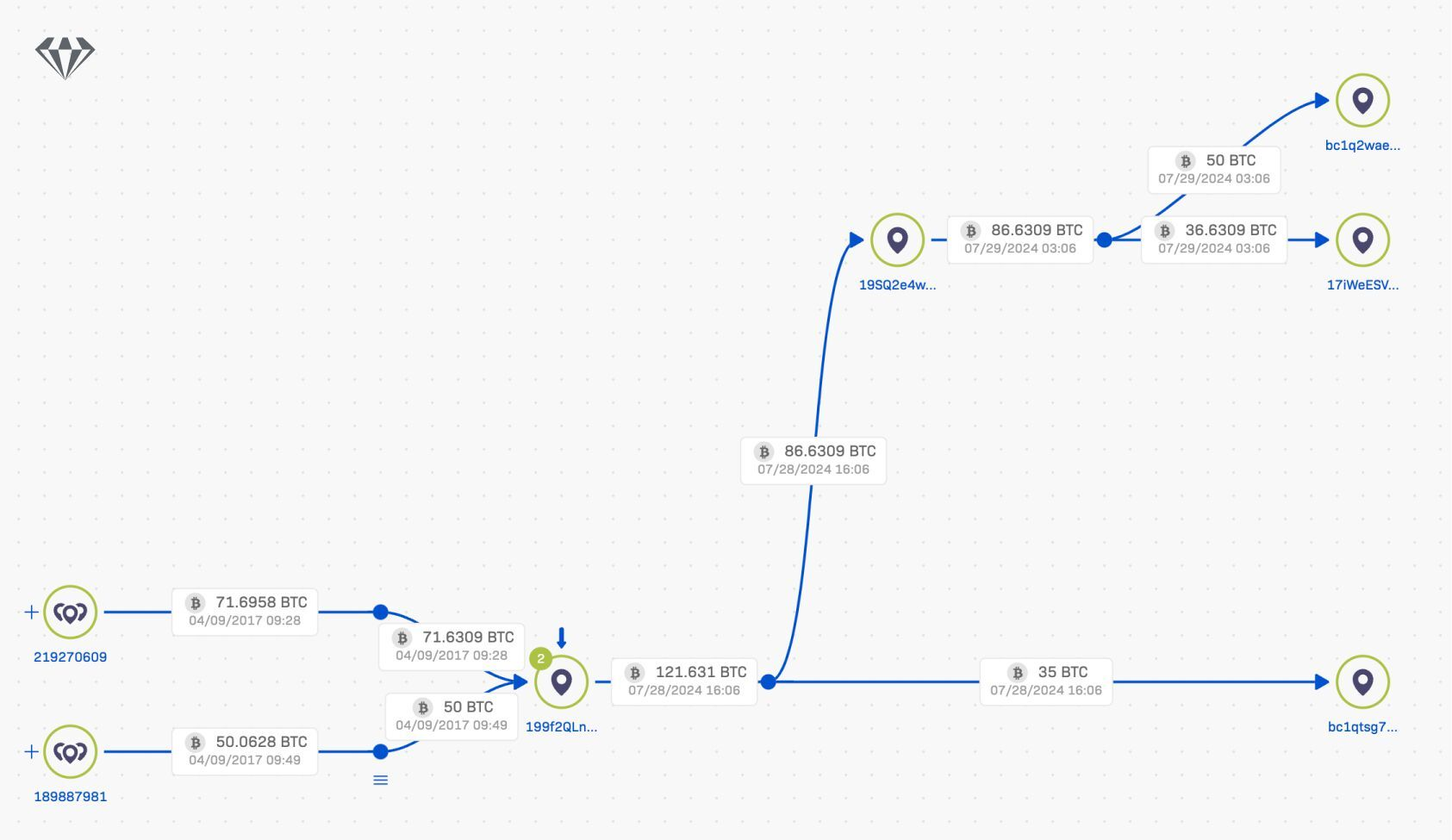

Moreover, a dormant Bitcoin wallet, which had not seen activity for 12 years, was activated this weekend, as reported by Whale Alert. This wallet’s value has surged from $301 in 2012 to about $1.8 million today.

“After looking further into one of the addresses, we noticed that the funds were stored in a legacy address. We can see the owner is moving their funds to three addresses — one which appears to be another legacy address, although it is receiving funds for the first time. The other addresses are possibly newly created and appear to be Native SegWit. We can only speculate that they are preparing to sell off in the event the bull run finally takes off,” Federico Paesano, Lead Investigator and Trainer at Crystal Intelligence, told BeInCrypto.

The reactivation of such long-term players adds another layer of intrigue to the Bitcoin narrative.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.