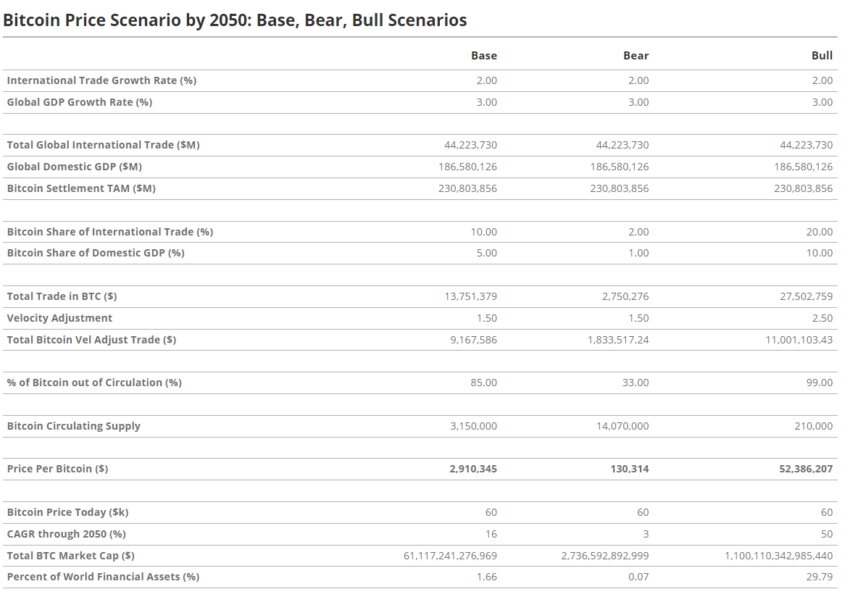

Asset management giant VanEck has projected a staggering bull-case scenario where Bitcoin’s price will reach $52.38 million by 2050.

This prediction stems from the anticipated transformation of the global financial system and Bitcoin’s increasing role within it.

A New Era for Bitcoin: VanEck’s Vision for 2050

VanEck’s projection of Bitcoin is based on a detailed analysis of global trade, GDP growth, and Bitcoin’s monetary velocity. The firm’s model assumes that Bitcoin will evolve to become a key international medium of exchange. Additionally, it is expected to become one of the world’s primary reserve currencies by 2050.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

VanEck’s research also suggests that the dominance of key currencies like the US Dollar, Euro, GBP, and Yen in the international monetary system is weakening. It attributes this trend to various economic and fiscal challenges.

The firm predicts a significant reduction in the use of these currencies for cross-border payments by 2050. This presents an opportunity for Bitcoin to capture a larger market share.

The anticipated decline in the global GDP contributions of economic leaders such as the US, the EU, the UK, and Japan is also expected to boost demand for Bitcoin as a neutral and alternative exchange medium. This trend supports the shift towards Bitcoin. Combined with diminishing confidence in traditional reserve currencies due to excessive deficit spending and geopolitical actions, it will become even more significant.

“Bitcoin is the money equivalent of the wheel. It is the first, and perhaps only instance, where humanity creates sound money with transparency. The common high end prediction is Bitcoin could reach $1 million. VanEck has set the bar higher for bullishness on Bitcoin’s world-changing properties,” Money On Chain Co-Founder Manuel Ferrari told BeInCrypto.

Furthermore, VanEck anticipates that businesses and consumers will seek a reliable currency with predictable monetary policy and immutable property rights. Unlike fiat currencies, which are subject to inflationary pressures and political decisions, Bitcoin’s decentralized nature ensures a stable monetary policy. Bitcoin’s stability and strong security features make it an attractive option for individuals and institutions looking for a reliable store of value and medium of exchange.

“It is conceivable that by 2050 Bitcoin could be used to settle 10% of the globe’s international trade and 5% of the world’s domestic trade. This scenario would result in central banks holding 2.5% of their assets in BTC,” VanEck’s analysts wrote.

Another key component of VanEck’s prediction is the role of Bitcoin layer-2 (L2) solutions in addressing scalability issues. These solutions, including the Lightning Network and various sidechains, enable faster and more efficient transactions on the Bitcoin network.

L2 solutions enhance Bitcoin’s practicality as a medium of exchange by facilitating higher transaction volumes. As these technologies mature and gain traction, they will eventually provide the necessary infrastructure for Bitcoin to handle the demands of a global financial system. Combining these factors, VanEck projects Bitcoin’s price to reach $2.9 million per BTC in the base case and $130,314 in the bear case scenario.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

VanEck’s recent predictions further strengthen the bullish stance among industry experts on Bitcoin’s future. In the shorter time frame, BeInCrypto reported that key industry figures believe Bitcoin will reach the $100,000 mark by year-end.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.