Jersey City Mayor Steven Fulop said on Thursday that the city will use its pension fund to invest in spot Bitcoin ETF. The announcement came as the Bitcoin 2024 Conference in Nashville kicked off, marking one of the industry’s landmark events.

Jersey City is not the first to make this decision, following Wisconsin’s lead. This development highlights the growing demand for Bitcoin ETFs and crypto adoption.

Jersey City To Invest In Bitcoin ETFs

Mayor Fulop admits that Bitcoin is here to stay, a belief that inspires the resolve to invest in ETFs. He highlighted his belief in crypto and the potential of blockchain as a new technology.

“The Jersey City pension fund is in the process of updating paperwork to the SEC to allocate % of the fund to Bitcoin ETFs. This is similar to what the Wisconsin Pension Fund has done (2%). It will be completed by the end of the summer and I’m sure eventually it will be more common. I have been a long-time believer (through ups/downs) in crypto but broadly. Beyond crypto I do believe blockchain is amongst the most important new technology innovations since the internet,” Mayor Fulop shared in an X post.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

While the announcement is significant for the cryptocurrency adoption, it is not entirely unexpected. Notably, Mayor Fulop is seeking the Democratic nomination for governor of New Jersey. As politicians look to scoop crypto votes, such announcements have become a political imperative.

“This will go down as an immensely forward-thinking choice,” Bitcoin veteran Kyle Chassé commented.

Jersey City follows in the footsteps of the State of Wisconsin, which made a significant move in the cryptocurrency market in mid-May. As BeInCrypto reported, the State of Wisconsin Investment Board (SWIB) purchased nearly $100 million worth of BlackRock’s Bitcoin ETFs, iShares Bitcoin Trust (IBIT).

“The objective of a portfolio manager or a fund is to maximize return while minimizing risk. Bitcoin, like other alternative investments, does not move in parallel with stocks and bonds. So, therefore, it adds a nice diversification effect. The potential upside returns are as high as they could be with any new technology. Finally, because this is a currency with a limited supply, it actually can serve as an inflation hedge,” Marquette University professor emeritus David Krause commented on States investing their pension funds into spot Bitcoin ETFs.

A May 13F filing showed that the SWIB holds almost $64 million worth of Grayscale Bitcoin Trust (GBTC) in addition to IBIT. The board is a Wisconsin state agency managing investments for public retirement and other trust funds.

Spot BTC ETFs Demand Continues to Grow

After Wisconsin and soon-to-be Jersey City, more investments toward Bitcoin ETFs could continue. As Bloomberg senior ETF analyst Eric Balchunas remarked, “Institutions tend to move in herds.” Other market experts echoed this sentiment.

“Public funds are notoriously underfunded, as made clear in high profile cases in Illinois, Kentucky, and New Jersey. They don’t have the assets to meet future obligations. If Bitcoin reaches $52 million dollars per, as Van Eck predicts, then you can begin to see why public pension funds are buying Bitcoin. Pension funds have also faced challenges in a low interest rate environment as fixed-income investments, which make up a considerable part of pension fund portfolios, see lower returns. In this environment, we have seen pension funds turn to riskier investments, including real estate, equities, and now Bitcoin, the latter of which probably being the least risky,” Manuel Ferrari, Money On Chain Co-Founder, told BeInCrypto.

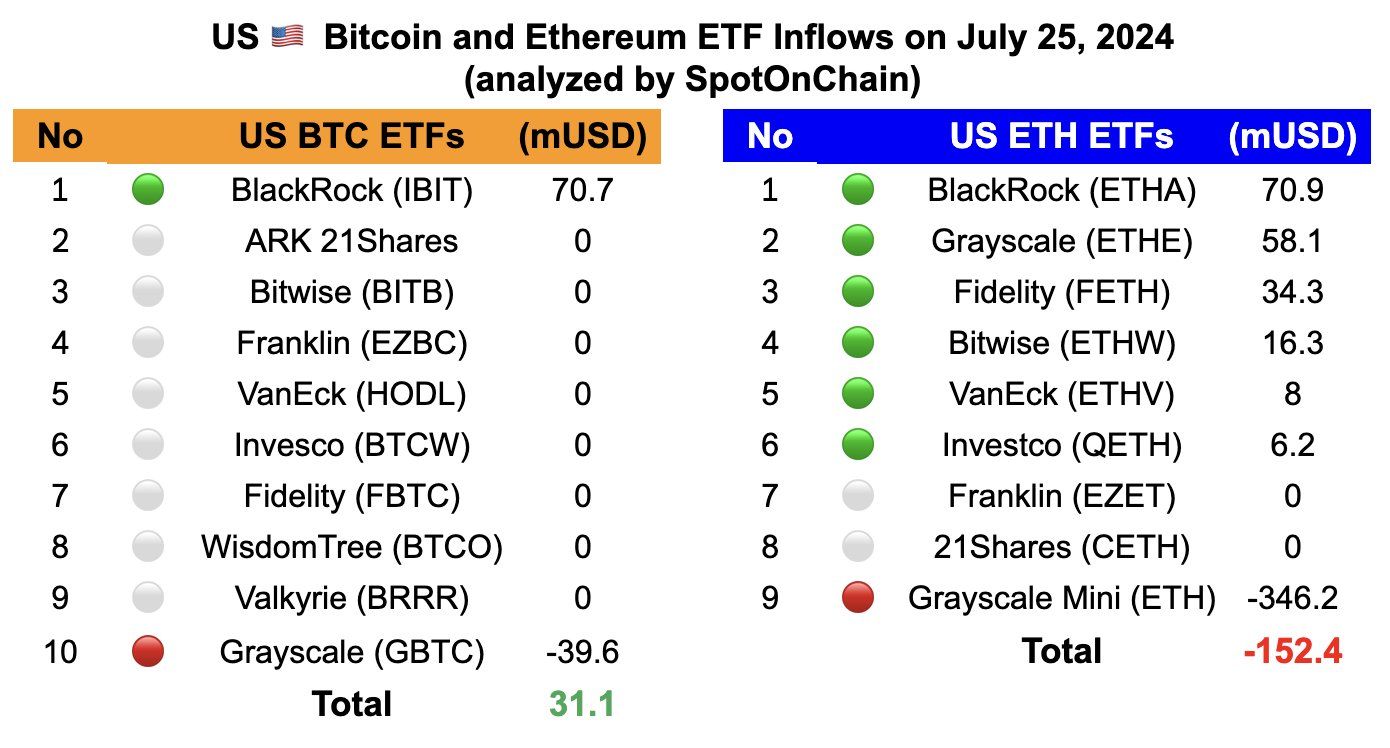

The demand for these financial instruments has already far exceeded BTC new issuance, with Thursday’s inflows at $31.10 million. Last week saw a net inflow of over $1 billion into Bitcoin ETFs, indicating renewed institutional interest.

Read more: Bitcoin (BTC) Price Prediction 2024 / 2025 / 2030

The recent developments highlight a major shift in the financial sector, with institutions entering the Bitcoin market through Bitcoin ETFs. This trend indicates growing acceptance of cryptocurrencies as a legitimate asset class and sets the stage for broader adoption and integration of digital assets into mainstream finance.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.