Approximately $5.65 billion in Bitcoin (BTC) and Ethereum (ETH) options are set to expire today.

This massive expiration is anticipated to introduce considerable volatility, with traders and investors keenly observing the potential impacts on the crypto market.

How Will the Spot Ethereum ETFs Launch Impact the Crypto Options Market?

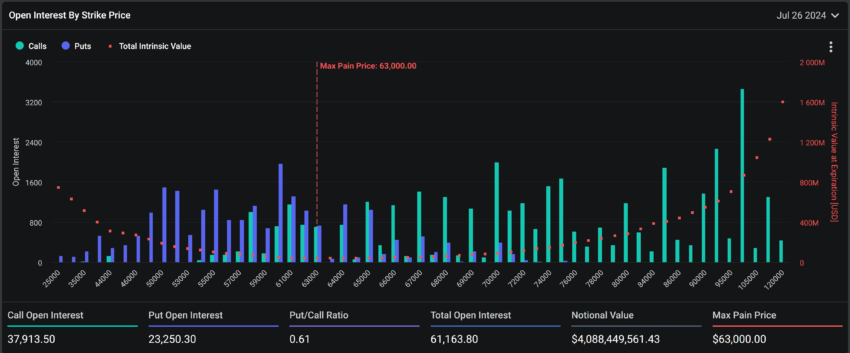

Today’s expiration includes 61,320 Bitcoin contracts worth roughly $4.07 billion, according to Deribit’s data. This is a notable increase from the previous week’s figure of 20,679 contracts. The current put-to-call ratio stands at 0.61, with a maximum pain point of $63,000.

Read more: An Introduction to Crypto Options Trading

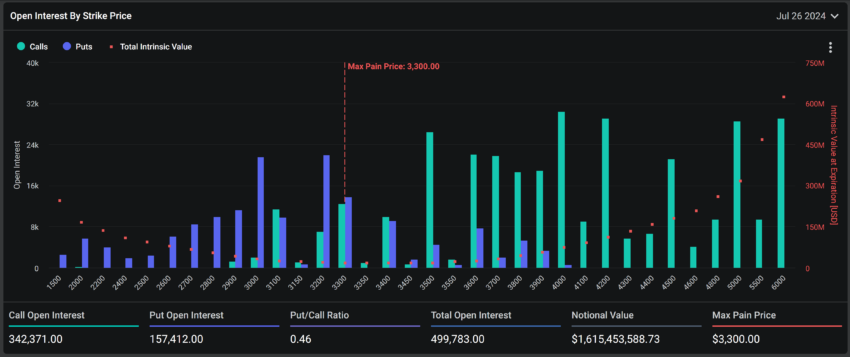

Similarly, Ethereum options are also witnessing significant expirations, with 499,803 contracts valued at over $1.59 billion set to expire. The put-to-call ratio for Ethereum is 0.46, with a maximum pain point of $3,300.

The maximum pain point in the crypto options market represents the price level that inflicts the most financial discomfort on option holders. Meanwhile, the put-to-call ratio suggests a prevalence of purchase options (calls) over sales options (puts). This week’s put-to-call ratio shows that traders prefer to purchase options over selling them, which signals an optimistic market sentiment.

The recent launch of spot Ethereum exchange-traded funds (ETFs) in the US has added an extra layer of interest to the current market situation. Analysts at Deribit highlighted the combined effects of the Mt Gox distribution, ETF outflows, and a dip in the Nasdaq as contributing factors to the current market trends.

“A combination of Mt. Gox distribution, [Grayscale Ethereum Trust] ETHE outflows, and NDQ fall was too much for the collective crypto optimism over the last couple of days,” they wrote.

Initially, BTC held strong, with August 2 calls bought ahead of the Bitcoin Conference in Nashville. However, the situation shifted as the market faced a series of selling pressures. Deribit analysts observed a reduction in BTC option exposure, with ETH puts being bought, reflecting a cautious stance among traders.

Adam, an analyst at the crypto options trading tool Greeks.live, also shared his observations on the current market conditions.

“Affected by the German government’s sell-off, the cryptocurrency market formed a deep V trend in July, with BTC and ETH rebounding sharply in the past two weeks. Stimulated by multiple positive factors, the major term IVs of cryptocurrency have also rebounded significantly,” he said.

Adam further noted the impact of the recent rebound and external factors, such as Donald Trump’s potential policy influences on the market. He highlighted the calendar spread strategy, advising traders to choose the right implied volatility (IV) at the right time to optimize their positions.

On July 25, Bitcoin’s price momentarily dipped to the $64,000 level but recovered to $66,404 at the time of writing. Ethereum, meanwhile, saw a significant drop from $3,469 on July 24 to $3,098. It has since recovered slightly, trading at $3,183.

Read more: 9 Best Crypto Options Trading Platforms

Historically, the expiration of options contracts tends to cause sharp, albeit temporary, price movements. The market usually stabilizes soon after. However, traders should remain vigilant, analyzing technical indicators and market sentiment to navigate the potential volatility effectively.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.