Blockchain-based tokens represent specific physical assets on a blockchain network, including bonds, cash, and real estate, among others. This article explores tokenized real-world assets (RWAs), how tokenization works, its benefits, and its significance in decentralized finance (DeFi). By the end of this article, you should know what is RWA in crypto and why does it matter?

Methodology

Our process for selecting the top real world assets (RWA) platforms was conducted over a period of six months. The criteria for the top platforms depended on whether the platform offers real world assets or uses incorporates RWAs in some capacity. The top platforms that made this requirement are:

- SummerFi

- Ark7

- SunContract

SummerFi

SummerFi is the rebranded frontend to the Maker protocol. MakerDAO is a decentralized autonomous organization (DAO) that allows users to borrow and lend cryptocurrencies. It has RWAs in its DAI escrow fund. RWA assets support the liquidity of DAI and allow it to be used as a currency.

Ark7

Ark7 is a technologically advanced, SEC-approved platform for fractional real estate investments. It has an investment concept that is share-based, allowing multiple investors to purchase rental property shares. This greatly increases the accessibility and flexibility of real estate investing.

SunContract

SunContract is a marketplace that allows users to sell energy with one another. People can buy and sell energy directly through their NFT marketplace, eliminating the need for middlemen. This means lower pricing for buyers and higher profits for sellers.

To learn more about BeInCrypto’s Verification Methodology, navigate here.

Where to buy real-world assets

SunContract

- What are real-world assets (RWAs)?

- Why are RWAs important in DeFi?

- How does tokenization work?

- What are the advantages of RWAs?

- Facing the risks and hurdles of RWAs

- What are some examples of RWAs?

- Market insights and growth trends: How RWAs are evolving?

- Why are RWAs useful?

- Clever use cases for tokenized RWAs

- The role of regulatory technology in a tokenized economy

- RWAs: Bridging traditional and digital markets

- Frequently asked questions

What are real-world assets (RWAs)?

Real-world assets (RWAs) exist in the real world and can be assigned a value. They encompass artworks, commodities, government bonds, and real estate. The tokenization of assets is one of the most promising use cases for blockchain, leading to the conversion of real-world assets into digital tokens. These real-world tokenized assets then find storage on a blockchain network.

The tokenization of real-world assets changes how we access and manage RWAs. At its core, this process enables something new, facilitating the creation of a blockchain-based digital investment vehicle linked to tangible assets. These include art, commodities, and real estate.

Tokenization has helped unlock a wide range of new opportunities in the blockchain, allowing for the ownership of various physical assets to be put on-chain. Different parties can then trade this property directly or fractionalize it and extend it to many people to purchase. Fractionalized real estate is an excellent example of parties achieving fractional ownership.

RWA tokenization continues to be a growing market sector in the crypto economy because nearly anything of value can be tokenized and stored on the blockchain. The potential market value of real-world tokenized assets is considered to be trillions of dollars.

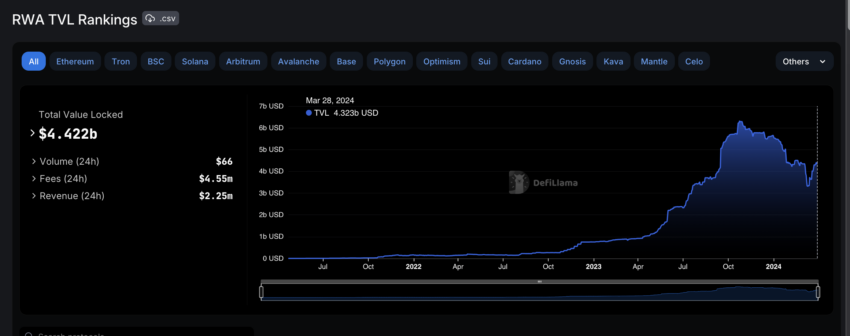

According to data on DefiLlama, the total volume locked (TVL) in real-world asset tokens as of June 2024 is approximately 5 billion dollars.

Why are RWAs important in DeFi?

The advent of decentralized finance has transformed the traditional financial markets by offering innovative solutions targeted at borrowing, lending, and trading. The blockchain tokenization of RWAs is among DeFi’s most promising features.

Besides linking the virtual world of blockchain with the real world of physical assets, real-world assets have the potential to democratize investment, increase accessibility, and unlock liquidity opportunities in DeFi. DeFi platforms use RWAs such as art and real estate as collateral in borrowing and lending. This allows borrowers to borrow loans in various crypto assets, such as stablecoins, while lenders earn interest.

Moreover, real-world assets play a crucial role in making DeFi more relevant and versatile, as their integration allows the addition of a new aspect to decentralized finance. Real-world tokenized assets are making it possible for people to turn universally hard-to-sell assets such as art or real estate into divisible pieces on a blockchain network that can be easily transferable.

Index funds in decentralized finance could use RWAs to give investors new opportunities to gain exposure to a myriad of assets via a single investment, which helps spread risk. In addition, RWAs present new options for less risky investments within the DeFi ecosystem. By offering assets linked to stable goods, DeFi investors can potentially engage with markets that aren’t as volatile as the crypto sector.

While RWAs offer the DeFi sector a chance to be more versatile, their integration into DeFi introduces regulatory challenges, which require a robust mechanism to secure asset-backed tokens and guarantee their security.

“The tokenization of RWAs will revolutionise DeFi and TradFi,”

Oculus Crypto, crypto investor: X

How does tokenization work?

The tokenization of real-world assets transforms the concept of physical asset ownership, changing those rights into a digital token that can be verified and stored on a blockchain network.

Using blockchain technology in real-world asset tokenization helps deliver various benefits, such as fractional ownership, increased liquidity, security, and transparency.

The process starts with selecting and valuing a real-world asset that will be tokenized, like art, real estate, or stocks. As the worth of the RWA is determined at this point, a decision is also made about how many digital tokens the item will be divided into.

Next, there’s the creation of a robust legal framework to define the token’s ownership rights. The developed legal framework will also ensure participants follow all applicable rules. Developers then create smart contracts that spell out how the digital tokens will be created, managed, and traded.

The next step involves selecting a compatible blockchain platform. Various blockchains offer the tokenization feature. Remember, a good tokenization blockchain should also have advanced smart contract features as that automate vital processes. The next step is the creation of digital tokens that constitute ownership over the physical, tangible asset.

Each token represents a small piece of the asset’s worth and is developed using the token standard of the respective blockchain. Once created, the blockchain keeps a record of who owns each token and records each token’s transaction data, ensuring transparency and validity and thus reducing the risk of fraud. The digital tokens are then available for investors to purchase and trade on relevant exchanges and marketplaces.

What are the advantages of RWAs?

Real-world tokenized assets have revolutionized the investment and asset management sector. The tokenization of real-world assets presents a plethora of benefits:

Pros of RWAs:

- Accessibility and inclusivity: The tokenization of RWAs allows fractional ownership, lowering the entry barrier for high-value assets. It also improves financial accessibility and inclusivity for small-scale investors who cannot participate in traditional financial markets.

- Automated asset ownership: Using smart contracts in DeFi allows tokenized RWAs to be automatically managed and transferred without third parties. Smart contracts can also facilitate the settlement of real-world tokenized assets by automating various processes such as compliance checks, account transactions, and settlement.

- Investment diversification: DeFi investors can invest in other digital assets outside the digital currency sphere. Additionally, real-world assets can potentially offer investors a chance to earn yield from borrowing and lending activities in the DeFi landscape.

- Increased liquidity: The tokenization and fractionalization of RWAs also help to increase liquidity in DeFi exchanges and protocols. Investors can easily and quickly trade in and out of positions without intermediaries.

- Reduced volatility: Tokenized RWAs are much more stable than cryptocurrencies. Incorporating them into the DeFi ecosystem helps to create some stability. They stabilize the DeFi ecosystem by reducing the risk of price crashes and stabilizing interest rates, which makes DeFi more attractive to mainstream users and investors.

- Trading of tokenized RWAs: While tokenization platforms allow users to tokenize RWAs and represent them on the blockchain, DeFi platforms enable users to access, manage, and trade tokenized RWAs in a borderless and decentralized manner.

- Unlocking new investment vehicles: The tokenization of real-world assets enhances the liquidity of historically illiquid assets, such as real estate, creating new investment opportunities. This helps to bridge the gap between digital and traditional finance by bringing illiquid assets on-chain and unlocking their value.

Did you know? The on-chain value of RWAs grew by over $1.2 billion in the first half of 2024 alone, reflecting the rising demand for tokenized assets.

Facing the risks and hurdles of RWAs

Like most innovations, real-world tokenized assets have risks associated with them. Although tokenized RWAs are gaining traction from mainstream businesses, you must do your own research and educate yourself on the potential challenges and risks associated with RWA tokenization.

Some challenges and risks include:

- Custody of physical assets: While tokenization allows for fractional ownership of RWAs, it also presents a risk. The risk entails custody of physical asset ownership, which needs to be reliable to include the connection to the real world.

- Liquidity issues: Although real-world tokenized assets help improve liquidity, the trading volume of certain tokenized RWAs can be limited. This affects their liquidity in the crypto economy.

- Market volatility: As digital assets, tokenized RWAs are subject to high price fluctuations and market volatility. This is especially true for tokenized real-world assets in niche or emerging markets.

- Security concerns: As an investment instrument that’s still new, tokenized assets lack a robust investor protection mechanism, which leaves room for fraud. In addition, real-world tokenized assets can be exposed to cyber threats such as hacking, smart contract bugs, and technical malfunctions.

- Unclear regulation: A significant challenge that RWA tokenization faces is an unclear regulatory framework. The RWA tokenization ecosystem keeps changing, and so does its regulatory framework. This means that investors face uncertainty in wanting to comply with local laws that impact the tokenization of real-world assets.

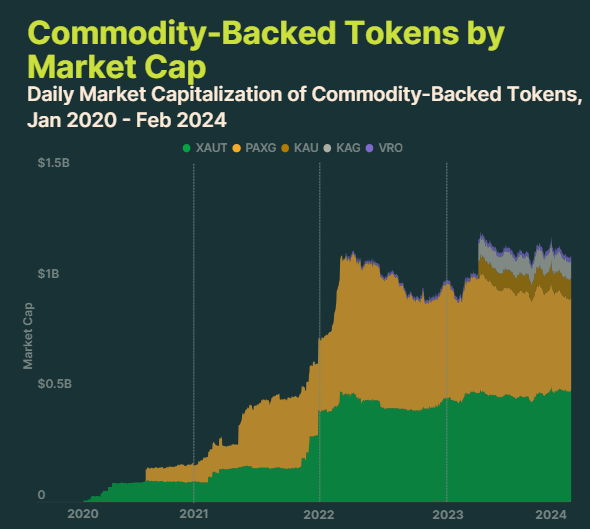

What are some examples of RWAs?

With their continued growth, the tokenization of RWAs has created various use cases. These include:

- Art and collectibles tokenization: Tokenizing a piece of art or collectible helps transform ownership, enabling collectors and enthusiasts to invest in art that is high-value thanks to fractional ownership. Platforms like Angelo or Maecenas make it possible for art collectors to purchase fractional art.

- Bonds tokenization: Digital tokens created from tokenizing real-world assets, such as tokenized bonds, can be used to earn yield. A good example is the U.S. government bonds that have been tokenized and can be traded on the blockchain.

- Real estate tokenization: Real estate tokenization is a promising aspect of tokenized RWAs. Tokenized real estate creates a new investment vehicle for small-scale investors to buy and own a fraction of a specific property and even get rental income. This allows investors to gain exposure to assets that are traditionally hard to acquire due to financial constraints. In addition, fractional ownership also allows for crowdfunding for property development. Ark7 is an example of a fractional real estate investing company.

Market insights and growth trends: How RWAs are evolving?

The tokenization of real-world assets (RWAs) has seen significant growth, highlighting the increasing interest and adoption within the crypto and decentralized finance (DeFi) sectors. The market for RWAs in crypto has been expanding at a clip, driven by the need for more stable and tangible investment opportunities within the volatile crypto environment.

Rapid market expansion

In recent years, the value of tokenized real-world assets has surged, with billions of dollars being moved onto blockchain platforms. For instance, the on-chain value of RWAs grew by over $1 billion in 2023 alone, reflecting the rising demand for tokenized assets. This growth is not just limited to a single type of asset; it spans across various sectors including real estate, bonds, commodities, and even art.

Adoption by major DeFi platforms

Major DeFi platforms are increasingly incorporating RWAs into their ecosystems. MakerDAO, one of the leading DeFi protocols, has integrated RWAs as collateral for its stablecoin, DAI. This move has proven highly successful, with a significant portion of MakerDAO’s revenue now being generated from real-world assets. The inclusion of RWAs has added a layer of stability and diversification to the DeFi ecosystem, attracting more traditional investors to the space.

MakerDAO’s integration of RWAs has led to a 15% increase in its collateralized assets, with RWAs now accounting for over 30% of its total collateral.

Diversification and stability

One of the primary reasons behind the growing popularity of RWAs in crypto is their ability to provide diversification and stability. Unlike purely digital assets, RWAs are backed by tangible assets, which tend to be less volatile. This stability is particularly appealing to investors looking for long-term, secure investments in the crypto market. The ability to fractionalize high-value assets like real estate and art also lowers the entry barriers, making these investments accessible to a broader audience.

Technological advancements and legal frameworks

Advancements in blockchain technology and smart contracts have made the tokenization of RWAs more efficient and secure. Legal frameworks are also trying to accommodate the growing market, with many jurisdictions developing regulations to ensure compliance and protect investors. These advancements and regulatory developments are crucial for the sustainable growth of the RWA market in crypto.

Future Prospects

The future of RWAs in crypto looks promising, with continuous innovations and increasing institutional interest. As more traditional assets are tokenized, the market is expected to grow exponentially. This should further bridge the gap between traditional finance and the decentralized digital economy. This growth will likely lead to the creation of new financial products and investment opportunities, enhancing the overall maturity and stability of the crypto market.

Institutional investments in tokenized RWAs have surged, with platforms like Centrifuge and Franklin Templeton collectively managing over $2 billion in tokenized assets.

Why are RWAs useful?

Tokenized RWAs can help investors build a more robust, borderless, decentralized, and regulated investment portfolio.

RWA tokens provide an innovative solution to several challenges plaguing most traditional financial assets. For instance, RWAs exist outside the digital world. However, their tokenization allows them to exist digitally and find a spot within the DeFi ecosystem.

Tokenization also opens RWAs to new opportunities, allowing for the lowering of the entry barrier for investors through fractional ownership. The fractionalization of assets helps to reduce the upfront capital needed, which improves financial accessibility and inclusion for people who previously had no access to such markets.

Fractional ownership has seen massive adoption, with platforms reporting a 20% increase in user participation and a 25% increase in the number of tokenized assets available for fractional ownership.

RWAs utilize blockchain technology. Blockchain networks offer a platform where assets formerly limited to jurisdictional restrictions become globally accessible to people. As a result, people from all over the world can get exposure to new opportunities that they would otherwise be denied.

Using crypto exchanges and marketplaces also improves the liquidity of these traditional illiquid assets. Investors can quickly enter and exit trading positions based on the evolving market conditions. Because tokenized RWAs allow for the democratization of investments, given that the division of physical assets becomes possible, they allow for a more level playing field for investors.

Clever use cases for tokenized RWAs

The tokenization of real-world assets creates a new paradigm shift in asset investment and management. Real-world tokenized assets help to improve accessibility, efficiency, and liquidity. This approach has led to some innovative use cases for tokenized RWAs across various industries:

The art and collectibles industry

Tokenization is revolutionizing the art and collectibles industry. This has made it possible for investors to own and trade pieces of high-value collectibles and artworks, thereby transforming access to what was previously a private market.

Carbon credits

Carbon credits are tradeable assets that depict reduced greenhouse gas emissions. They can be tokenized on the blockchain, tracked, and sold to various businesses. This could improve their liquidity while assisting companies in complying with emission regulations and offsetting the needed emissions.

Private Equity

Private equity investments are an alternative investment instrument that acquires or invests in privately held companies. These types of investments tend to be risky and illiquid. However, they can also be profitable. The tokenization of private equity would open doors for more investors to gain access to this asset class and enhance the competency of the private equity market.

Real estate

Real estate is a relatively stable and large global asset class. It’s also one of the most illiquid assets as it’s not easy to buy and sell quickly. Tokenization in real estate can create fractional ownership of properties, which can help make real estate a lot more accessible to small-scale investors who lack the capital to purchase an entire property.

The role of regulatory technology in a tokenized economy

Blockchain technology continues to find more use cases across multiple industries. The rapid growth gives rise to the need for markets to be compliant and have a uniform way of addressing this innovative technology. With different jurisdictional laws linked to RWAs globally, trading these assets can be an uphill task with the need for a common regulation.

Blockchain tokenization can provide potential solutions to address the absence of a regulatory framework. Key players can utilize different blockchain networks to automate various compliance and legal frameworks through smart contracts. Simply put, it means utilizing technology to govern technology. This would make the cross-border transactions of RWAs more secure.

There is a continued call for a universal standard for tokenized RWAs to build investor confidence. Tokenization has the power to transform markets. Additionally, it can create new opportunities by building a regulated and standardized system that allows blockchains to be interoperable.

RWAs: Bridging traditional and digital markets

Tokenized real-world assets have a lot to offer as they can bridge the gap between traditional finance and digital finance. As an innovation, the tokenized RWAs market is quickly growing, and various companies are already exploring their various use cases. Asset management companies like BlackRock already use blockchain technology to tokenize traditional assets and offer them to their clients as new financial investment vehicles. With more companies joining in, this has continued to create room for new opportunities to emerge.

Additionally, the tokenization of RWAs has resulted in improved liquidity provision, financial accessibility, and diversified investment portfolios. Despite the risks and challenges associated with real-world tokenized assets, such as regulatory uncertainty, tokenized RWAs have the potential to transform asset ownership.

Frequently asked questions

Tokenized real-world assets are digital tokens issued on a blockchain representing ownership of real-world assets. These assets could be anything valuable, such as art, commodities, real estate, and stocks.

The RWA tokenization process is the process through which real-world assets are tokenized and converted into secure tokens that are then managed and stored on the blockchain. The process involves the selection and valuing of an asset, the creation of its legal framework, the creation of a smart contract, the selection of a blockchain network, and the creation of the digital token.

The tokenization of real estate assets refers to the process through which a real estate property is fragmented into digital tokens using blockchain technology, with each digital token representing a portion of the underlying property.

An example of tokenized real estate would be a $10 million apartment in your favorite neighborhood, tokenized into 10 million digital tokens, with each token representing a $1 share of the underlying property.

One major problem with the tokenization of real estate is the lack of a clear legal framework which poses various risks. Additionally, while tokenized real estate allows investors to invest in fractional ownership of a property, proving ownership of a digital token doesn’t automatically grant them equal rights to the physical property.

Some of the challenges of tokenization in real estate include an ever-evolving legal landscape, given that it’s a new innovation. Moreover, an acceptable universal legal framework around real estate tokenization doesn’t exist. This means that not all jurisdictions can handle this new investment instrument, which poses cross-border issues.

Several benefits of tokenization in the U.S. include increased liquidity, automated asset ownership, financial inclusion, diversification of investments and new investment opportunities.

Unclear regulation is one of the major risks of tokenization, as investors face uncertainties trying to comply with changing regulations. Other risks of tokenization include custody of physical assets, lack of sufficient liquidity, market volatility, and security concerns.

Real-world assets (RWAs) benefit the DeFi ecosystem by providing stability, diversification, and increased liquidity. Tokenizing tangible assets like real estate, art, and commodities allows for fractional ownership, making high-value investments more accessible. This tokenization also enhances transparency and security through blockchain technology, attracting more traditional investors to the DeFi space and fostering trust within the ecosystem.

RWAs are increasingly being used to promote sustainable finance by enabling the tokenization of green bonds and other environmentally friendly investments. By integrating sustainability metrics into the tokenization process, investors can more easily support projects with positive environmental impacts. This trend fosters a new era of transparency and accountability in sustainable investments, allowing for better funds tracking and ensuring that capital is directed towards genuinely impactful initiatives.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.