Ethena Labs, the entity behind synthetic dollar protocol Ethena Protocol, has taken a significant step forward by updating its roadmap and unveiling several upcoming launches.

This move aims to reshape the future of its native token, ENA, and the entire ecosystem. It will also focus on long-term stability and growth.

Key Details of Ethena’s Updated Roadmap

Ethena Labs introduced a major update to the tokenomics of its native token, ENA. Users receiving ENA through airdrops, such as the Shard Campaign, must lock at least 50% of their claimable tokens as part of this update.

Users can lock in through Ethena locking, PT-ENA on Pendle, or Symbiotic Restaking. Failure to comply will result in redistributing unvested ENA to compliant users.

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

“To be clear: the intent of the [updated tokenomics] is to incentivize a realignment of ENA holders from mercenary capital to long-term aligned users,” the Ethena Labs team stated.

Ethena Labs emphasizes that forfeited ENA will not be retained by the foundation, team, or investors but will solely benefit users who comply with the new rules. The instructions for the latest requirements will be provided on June 23, when users claim their weekly ENA vest.

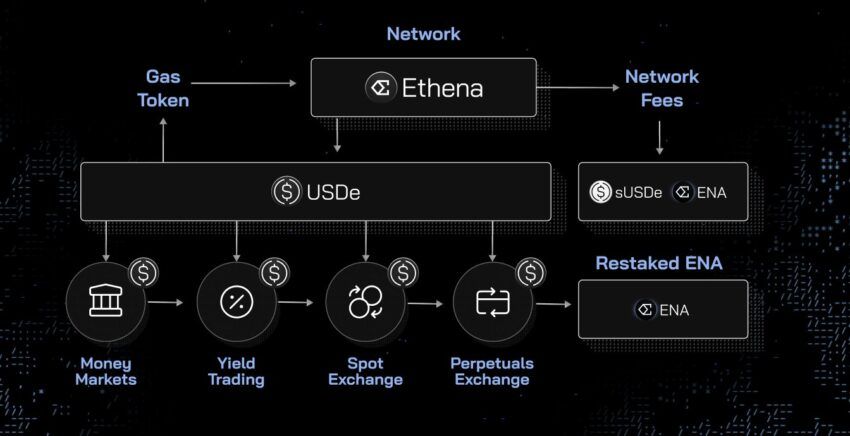

Ethena is also introducing staking capabilities for ENA, enhancing its utility within the ecosystem. These staking options are part of Ethena’s broader strategy to integrate ENA into its financial infrastructure, including the upcoming Ethena Chain.

The restaked ENA will provide security for cross-chain transfers verified through LayerZero’s DVN network. Additionally, ENA and sUSDe will be the first assets available for deposit in Symbiotic’s next epoch, with initial liquid staking tokens (LST) caps already filled.

The new roadmap also highlights its commitment to building a financial infrastructure. The Ethena Chain will host financial applications and infrastructure built upon USDe as the gas token.

“Restaked ENA will provide security across these protocols and, in return, may be eligible for potential future airdrops at their discretion,” the team added.

However, this update has sparked debate within the crypto community. Some members expressed disappointment with Ethena’s latest update. They highlight concerns about the new vesting and locking requirements.

“After delaying our airdrop, they are adding a vesting on our vested airdrop. […] Changing terms already defined to pump their token is shady, but don’t forget that ENA is a ‘governance token.’ Shame on you, Ethena Labs,” a crypto community member criticized.

Since its inception, controversy has surrounded Ethena. Some industry experts have voiced their concerns over USDe’s sustainability. They pointed out that USDe could potentially face a collapse similar to TerraUSD (UST).

Read more: How To Use Ethena Finance To Stake USDe

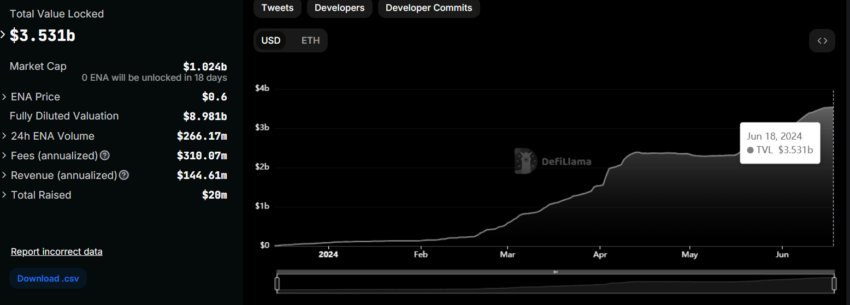

Despite the controversy, Ethena has recently reached a remarkable milestone by surpassing $3.5 billion in its total value locked (TVL). At the time of writing, Ethena’s TVL is $3.53 billion, representing approximately a 47% increase over the last 30 days.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.