While trading activity in crypto has dwindled due to a bearish market, there may still be opportunities for strong profits when the altcoin season rolls around. But what exactly does this buzzword mean?

This guide covers everything you need to know about altcoin season, from appropriate trading strategies to the risks and opportunities.

BeInCrypto Trading Community in Telegram: get the hottest news on crypto, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

Methdology

Our process for selecting the top exchanges to purchase altcoins was exhaustive and conducted over a six month process. Many features were taken into account, such as:

- Selection of altcoins

- Fees

- Availability

- Payment methods offered

MEXC

Mexc leads the pack, offering a diverse selection of trading pairs, over 1,700 to be exact. Additionally, the exchange has 0% spot trading fees, currently. Kucoin uses third-parties to process payments. This allows the exchange to accept a multitude of payment methods.

Because of this level of support, the exchange also accommodates more than 170 countries. Moreover, MEXC also has a robust futures market for traders. With this option, traders will also enjoy 0% trading fees on futures.

Kucoin

Kucoin is one of the most recognizable names in terms of crypto exchanges. Not only does it list over a thousand cryptocurrencies, but users have the option to actually purchase more than 800 cryptos and altcoins.

While the options for altcoins are high, the trading fees are low, coming in at 0.1%. While MEXC offers the most altcoins to purchase, Kucoin supports the most countries, coming at more than 200. Additionally, Kucoin is also an all-in-one exchange. So, it supports a host of crypto activities as well.

Binance

While the former offer a wide selection of cryptos and supported countries, Binance is a trailblazer in terms of liquidity, as it is the largest exchange by trading volume and assets under management.

Similarly to Kucoin, it is also an all-in-one exchange, offering many products, such as:

- A proprietary blockchain and token

- Wallets

- Derivatives trading

- Staking

- NFT marketplace, and more

This methodology was fact-checked and peer-reviewed for accuracy. To learn more about BeInCrypto’s Methodology, navigate here.

Best exchanges to buy altcoins

MEXC

Exchange

Kucoin

Exchange

Binance

Exchange

What is altcoin season?

Derived from the term alternative coin, an altcoin is any cryptocurrency other than bitcoin. In simple terms, altcoin season refers to a period when alternative cryptocurrencies experience significant price surges and outperform bitcoin. For the seasoned investor, the tradeoff is simple.

Markets with a high capitalization (a.k.a. market cap) are more difficult to move. Therefore, markets with low capitalization have the potential to provide higher returns. In other words, it is easier for an asset worth $20 and a market cap of $2 million to go to $100 than it is for an asset worth $20,000 and a market cap of $2 billion to go to $100,000.

In this scenario, altcoins are the proverbial $20 asset, while bitcoin is the $20,000 asset.

As a result, altcoin season is characterized by a flurry of activity as traders seek to diversify their portfolios and capitalize on the potential gains these alternative digital assets offer. Altcoin season is closely intertwined with the broader crypto market cycles, which exhibit alternating periods of bullish and bearish trends.

Crypto market cycles

To understand altcoin season, we must examine the crypto market cycles that govern the ebb and flow of digital asset prices. These cycles typically alternate between periods of bullish sentiment, known as bull markets, and bearish sentiment, referred to as bear markets.

Bull and bear markets

During a bull market, the overall market experiences upward price trends. This is a favorable environment for altcoins to thrive as investors seek opportunities to maximize their returns by diversifying their holdings beyond bitcoin. Altcoin season often coincides with a surge in trading activity as market participants attempt to seize the momentum and ride the wave of the expanding market.

Bitcoin dominance

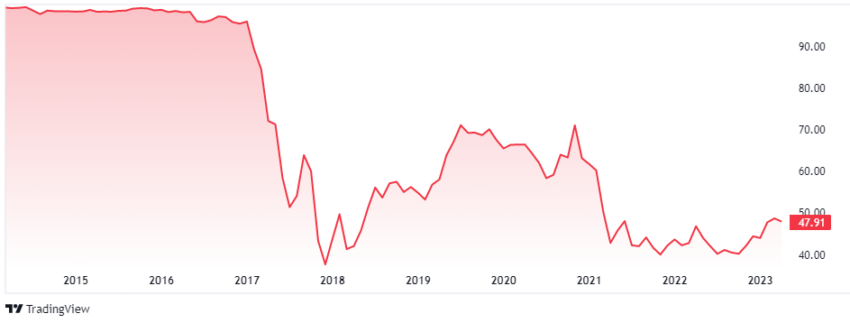

As the most popular cryptocurrency in terms of market capitalization, bitcoin makes up the majority of the cryptocurrency’s market cap. The ratio of bitcoin to altcoins holds significant importance in market analysis and is aptly referred to as bitcoin dominance.

Bitcoin dominance plays a pivotal role in altcoin season. It represents the share of bitcoin’s market cap in relation to the total market cap of all cryptocurrencies. When bitcoin dominance is high, it indicates that Bitcoin is the dominant force in the market.

Although, during altcoin season, the dominance of bitcoin tends to decrease as capital flows into alternative digital assets (e.g., stablecoins or meme coins), enabling them to outperform BTC and capture a larger market share.

Factors influencing altcoin season

Several factors contribute to the arrival of the altcoin season. These factors can influence market sentiment, drive price movements, and shape the overall landscape for altcoin investments.

Market sentiment

Market sentiment, which reflects the collective psychology of traders and investors, plays a crucial role in altcoin season. Traders looking for quick profits may sell their BTC holdings and switch to alternative cryptos if interest in bitcoin declines. Additionally, the high price of Bitcoin may discourage potential cryptocurrency buyers, leading them to choose alternative coins instead.

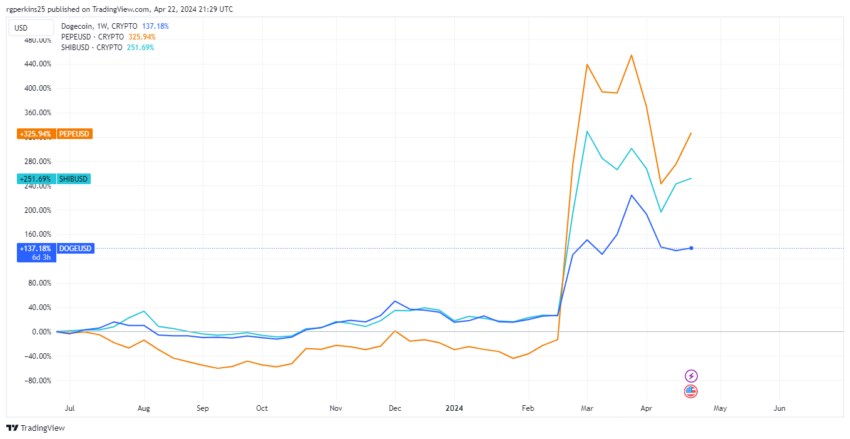

For example, meme coins tend to pump and dump in trends. Cryptocurrencies like dogecoin or shiba inu often experience simultaneous price increases or “pumps.” Meme coins gain popularity and attention primarily through social media platforms, online communities, and word-of-mouth.

When a particular meme coin starts gaining traction and generates hype, it can create positive sentiment and excitement among investors. This collective enthusiasm can lead to coordinated buying activity and simultaneously drive up the prices of multiple meme coins.

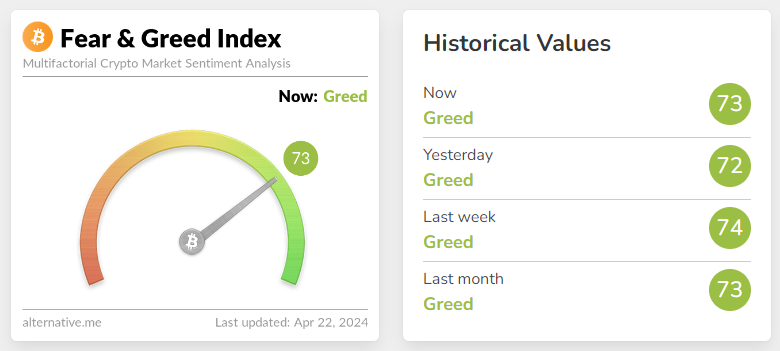

The Crypto Fear and Greed Index is a great way to monitor market sentiment. The index takes into account various factors and data points, such as price volatility, trading volume, social media activity, surveys, and market momentum, to determine the current sentiment in the market.

During altcoin seasons, investors often exhibit a higher risk appetite and allocate their capital to altcoins, aiming to capture potential higher returns compared to bitcoin or other major cryptocurrencies. This increased interest in altcoins may contribute to a shift in the overall sentiment reflected in the Crypto Fear and Greed Index.

News and events

News and events within the crypto space can significantly impact altcoin season. Major announcements, partnerships, regulatory developments, or technological breakthroughs can create a surge of interest and investment in specific altcoins, driving prices higher. Traders and investors should closely monitor news sources and social media channels for such catalysts.

The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has attracted significant attention and investment in specific altcoins associated with these sectors. Positive developments, such as successful DeFi projects or popular NFT sales, can drive up demand for relevant altcoins.

For instance, in 2020 and 2021, the surge of interest in DeFi protocols, such as Uniswap, Compound, and Aave, led to an altcoin season within the DeFi sector. Investors were captivated by the potential of decentralized lending, yield farming, and governance tokens, resulting in significant price rallies for various DeFi-related altcoins.

Technological developments

Technological advancements in the altcoin sector can also drive altcoin season. New projects, blockchain upgrades, or innovative features introduced by altcoins can attract attention and investment. These developments may position certain altcoins as potential game-changers, igniting a rally in their prices.

A great example of this phenomenon is the rollup craze. A rollup, in the context of blockchain technology, is a layer-2 scaling solution that aims to improve the scalability and efficiency of a blockchain network. Essentially, it is a blockchain within a blockchain.

Users tend to want rollups to create blockchain-native tokens. Optimism and Arbitrum are perhaps the most prominent and highly anticipated rollups that have released tokens.

How to identify altcoin season

Identifying altcoin season is crucial for traders looking to capitalize on the market’s potential. While it may not always be easy to identify, several indicators and metrics can help in recognizing this phenomenon.

Altcoin season index

“The Altcoin Season Index is defined as the amount of the top 50 altcoins that have a 90-day return of investment (ROI) greater than Bitcoin, divided by the amount of altcoins used in the index (50 in this case), and multiplying the result by 100.“

Into the Cryptoverse

Some market analysis platforms provide altcoin season Indices that track the performance of a basket of altcoins relative to Bitcoin. These indexes can give traders an overview of the market dynamics and indicate when altcoin season is in full swing.

Market capitalization:

Monitoring the market cap of altcoins can also provide insights into altcoin season. During this period, the total market cap of altcoins increases significantly, indicating a shift in investor sentiment and increased demand for alternative cryptocurrencies. Watching the top altcoins, such as ETH, SOL, DOGE, etc., can indicate a shift in interest from BTC.

How to prepare for altcoin season

1. Create a plan

Creating a plan is the most important thing to consider when preparing for altcoin season. One strategy is to buy in early. Before the season sets in you should already have purchased your “shopping list” while the market is in a downturn. By the time the mania ensues, these assets will be difficult to purchase or at too high a price. Being prepared is key.

2. Research

Remember that research and education are your friends. Not all sectors in crypto behave the same way or perform as well as they did in previous cycles. Trends have a strong influence on cryptocurrency markets. In this way, the best altcoins to hold in your portfolio are solid projects that follow the current trends.

3. Diversify

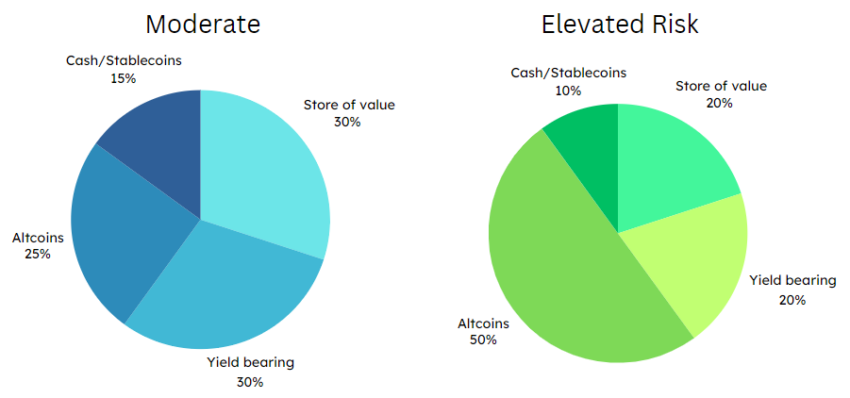

Diversifying your portfolio isn’t generic advice; it is a strategy that allows you to hedge against unforeseen circumstances beforehand. There are many theories on how you should allocate your portfolio, but it primarily depends on your personal risk tolerance.

The above figure represents two different mindsets on portfolio allocation. The left is “Moderate'” meaning that it can withstand market downturns and volatile assets without going underwater. The right is “Elevated Risk,” meaning that it has more risk but can also yield the greatest return.

If two traders allocated the same amount of capital to each portfolio and bought the same assets, the trader on the right would make more profit, but the trader on the left would lose less money if things turned sour.

The general idea is to keep some hard assets that can withstand a market downturn. The following list gives a brief overview of asset classes in order of importance, along with a description of their purpose.

- Store of value: Hard assets like gold and silver tend to hold their value during market downturns — hence the name store of value. In crypto, Bitcoin and Ethereum are considered digital gold and silver.

- Yield bearing: Assets that produce a steady stream of income (bear yield) typically come in two flavors: low-yield low-risk and high-yield high-risk. The greater the risk, the greater the return in general.

- Cash/stablecoins: While stores of value are considered a hedge against inflation, cash or cash equivalents (stablecoins) are considered a hedge against volatility.

- Altcoins: Consist of gems and unicorn projects that could potentially increase in value by orders of magnitude. They may also include riskier and more speculative assets like meme coins or NFTs.

4. Be patient

Markets can start slowly and often test investors’ patience. Maintaining discipline in your investment strategy and not being swayed by short-term market fluctuations is important.

As the old saying goes, “you make money when you buy and you lose money when you sell.” It is extremely difficult to time the market. In other words, traders rarely buy in at the lowest price and sell at the highest price.

It is up to you to determine which assets to buy and sell, how long to hold, and when to adjust your plan. This becomes a lot easier to determine if you remain patient.

In summary, these strategies can help position investors to take advantage of the opportunities that arise during a bull market while managing potential risks effectively. Remember to stay up to date with the latest information. Being well-informed allows you to make timely and educated decisions.

Trading strategies during altcoin season

Navigating altcoin season requires specific trading strategies to mitigate risks and maximize potential gains.

Altcoin season presents an opportunity for traders to diversify their portfolios beyond Bitcoin. By investing in a range of promising altcoins, traders can potentially benefit from the performance of multiple assets and reduce their exposure to the volatility of a single cryptocurrency.

Technical analysis tools, such as chart patterns, indicators, and volume analysis, can assist traders in identifying potential entry and exit points during altcoin season. By studying price charts and identifying key support and resistance levels, traders can make more informed trading decisions.

Whale watching is a great way to predict market volatility. It refers to the practice of monitoring the activities of individuals or institutional investors, often referred to as “whales,” that hold significant amounts of capital. These whales hold significant amounts of cryptocurrencies and have the potential to influence market prices due to the size of their trades.

Whale watching involves tracking the wallets or addresses associated with these prominent investors to gain insights into their buying and selling patterns. By analyzing the transactions and movements of these whales, traders and investors attempt to identify potential market trends, anticipate price movements, and make informed trading decisions.

Whales with substantial resources can influence the order book on exchanges by placing large buy or sell orders. These orders can create artificial supply and demand imbalances, potentially triggering price movements that other market participants may react to.

Risks and opportunities in altcoin season

While altcoin season can present lucrative opportunities, it also carries inherent risks that traders should be aware of. Altcoin season is often characterized by heightened market volatility. Rapid price movements can result in significant gains but can also lead to substantial losses.

Traders should exercise caution, set stop-loss orders, and manage risk effectively to protect their capital. Some altcoins, especially those with smaller market caps, may suffer from low liquidity during altcoin season. This can make entering and exiting positions at desired prices challenging, potentially resulting in slippage or increased trading costs.

Ride the altcoin season wave

Altcoin season represents a period of heightened activity and potential opportunities within the crypto market. Traders and investors can diversify their portfolios, capitalize on price movements, and potentially outperform bitcoin during this phase. Understanding the dynamics of altcoin season, monitoring market sentiment, and employing appropriate trading strategies can help market participants navigate this exciting and dynamic period in the world of cryptocurrencies.

As the market continues to evolve, altcoin season is likely to remain a focal point for traders seeking to maximize their returns and explore the diverse offerings of cryptocurrency.

Frequently asked questions

Altcoin seasons are triggered by a combination of factors. This includes positive news and events surrounding specific altcoins, market trends such as decreasing bitcoin dominance, and the emergence of new technologies or sectors within the cryptocurrency industry. These factors create excitement, generate investor interest, and lead to increased demand for altcoins, resulting in a surge in their prices and overall market sentiment.

The Altcoin Season Index tracks a basket of altcoins. It quantifies the percentage of the top 50 altcoins that outperform bitcoin in terms of their 90-day return on investment (ROI). It is calculated by dividing the number of altcoins with superior ROI by the total number of altcoins in the index (50 in this instance) and then multiplying the result by 100 to obtain a percentage value.

To potentially profit from the altcoin season, consider a few strategies. Conduct thorough research to identify altcoins with strong fundamentals, innovative technology, and promising use cases. Diversify your portfolio by investing in a mix of established altcoins and emerging projects to spread your risk. Stay informed about market trends, news, and events that can impact altcoin prices and adjust your investment strategy accordingly, considering both short-term trading opportunities and long-term investment potential.

Predicting altcoin seasons with absolute accuracy is challenging due to the complexity and volatility of the cryptocurrency market. While certain indicators and factors can provide insights into potential altcoin season trends, there is no guaranteed method for precise predictions. It is crucial to conduct thorough research, analyze market trends, and stay updated with news and events to make informed decisions, but there are inherent uncertainties and risks involved in predicting altcoin seasons.

The duration of an altcoin season can vary significantly and is influenced by market dynamics, investor sentiment, and the overall cryptocurrency landscape. Altcoin seasons can range from a few weeks to several months. In some cases, altcoin seasons have even persisted for a year or longer. However, it’s important to note that there are no fixed timelines or guarantees, and the duration of an altcoin season can be unpredictable and subject to market fluctuations.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.