The altcoin season that the entire crypto market has been waiting for continues to remain delayed despite the launch of spot Ethereum ETFs.

While flows into the ETH ETFs have been decent, the demand for other altcoins has not been great, resulting in the divergence.

Altcoins Continue to Lose

The altcoin market cap, which is the total value of all cryptocurrencies excluding Bitcoin, has dropped below $1 trillion. Currently, at $998 billion, the altcoins’ value was expected to cross the $1.1 trillion barrier but failed to after spot ETH ETFs went live this week.

However, not all hope of recovery is lost since the support of $967 billion is still intact. Furthermore, the market cap is moving within a flag pattern, which suggests a breakout could push the altcoins’ total value to $1.56 trillion.

Read More: 12 Best Altcoin Exchanges for Crypto Trading in July 2024

This, however, would warrant a shift in demand from ETH ETFs to other altcoins as well. The launch did bring a slew of money into Ethereum, but that money failed to flow into other altcoins. According to the President of Bitwise, Teddy Fasuro, ETH ETFs on the second day of trading noted volumes of $852 million.

This was about 75% of the total volume of ETFs traded by Bitcoin ETFs at $1.1 billion on the same day. The comparison shows that FOMO surrounding spot BTC ETFs translates into higher trading for ETH.

However, that does not necessarily boost the total inflows. Grayscale Ethereum Trust (ETHE) is an example of this, as it noted over $800 million in outflows since its launch two days ago.

Thus, as outflows increase, the possibility of an Altcoin Season decreases.

Altcoin Season Goes Far Away

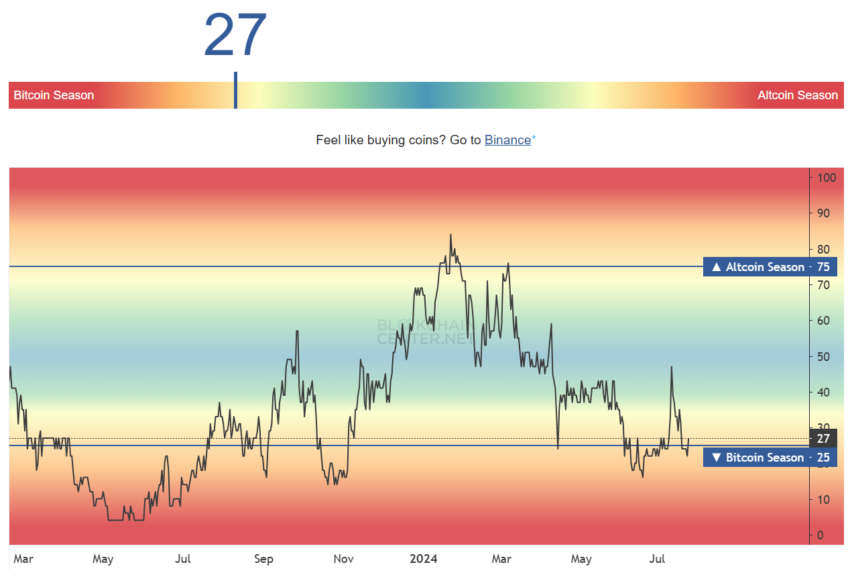

The crypto market did not meet the expectations of investors, and proof of this is visible in the Altcoin Season index. Still stuck around the Bitcoin season’s threshold of 25, the altcoins would need to note massive inflows to outperform BTC.

However, given the market’s condition, this does not seem likely anytime soon. Thus, the possibility of crypto enthusiasts witnessing an altcoin season in Q3 is very low.

Read More: Which Are the Best Altcoins To Invest in July 2024?

The comeback of traders and inflows in October could potentially boost the demand once again triggering the rise of altcoins.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.