In a market that is prone to extreme volatility, interest in stablecoins makes sense. But what is a stablecoin, and are they really trustworthy? This guide covers the various types of stablecoins on the market and the broader role of asset-backed cryptos in blockchain-based ecosystems.

BeInCrypto Trading Community on Telegram: watch Trading Basics course, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

What is a stablecoin?

As its name entails, a stablecoin is a cryptocurrency designed to maintain a set value. These financial instruments are popular options for investors looking to benefit from interacting with digital assets while removing some of the market volatility associated with crypto.

This is because the value of a stablecoin is (most often) pegged to another asset, such as gold, a fiat currency, or another crypto. Or, the supply might be regulated by an algorithm. The intention is that the value of a stablecoin is always equal to the asset it is pegged to.

How do stablecoins work?

Due to crypto volatility, the entire market has been considered speculative at best. Stable cryptocurrencies are an attempt to establish some form of guarantee to the market. Because they are pegged to a real-world asset, they represent real money. Essentially, stablecoins were created to reduce price volatility and produce a reliable environment for cryptocurrency adoption.

Stablecoins are backed up by “reserves,” where the assets backing the stablecoin are securely stored and act as collateral.

One of the main uses for stablecoins is as a reliable means of exchange. These coins can be traded just as any other coin and can be used as an intermediary between sending and receiving payments. This is great for both institutions as well as retail users of crypto since they can be sure the price will not alter between transactions. In bridging TradFi and digital assets, stablecoins have become integral to the crypto ecosystem.

For example, merchants don’t want to risk a loss if the price of crypto plunges after a payment. Furthermore, institutions consider stablecoins to be a universal solution for settling international payments. Stablecoins make cross-border transactions cheaper, faster, and more efficient overall.

Types of stablecoin

Not all stablecoins work the same way. Some are backed by fiat currency, while others are algorithmic in nature.

Fiat-backed

As its name suggests, these coins are backed by fiat currencies and are collateralized by fiat-equivalent reserves equivalent to the coin’s market cap, Thus, assuring the value. In other words, it’s a 1:1 ratio in which one stablecoin can be exchanged for one currency unit. Furthermore, independent entities regularly audit and maintain these reserves to ensure legitimacy. While this type of stablecoin is the simplest, it is also the most centralized.

Commodity-backed

Stablecoins that are backed by commodities derive their value from another tangible asset, such as a precious metal like gold or silver. To illustrate this, Paxos Gold (PAXG) is pegged to real gold reserves held by Paxos.

The token was created to represent the price of one ounce of a gold bar. As such, customers receive the advantage of maintaining fractional ownership of the physical bars. Apart from precious metals, other commodity-backed stablecoins include those which are backed by other commodities like crude oil, for example.

Crypto-backed

Other cryptocurrencies back these types of stablecoins. They are issued in order to launch the underlying crypto asset on other blockchains. Stable cryptocurrencies that are backed by crypto are often over-collateralized. This means that the crypto that is in reserve for backing purposes greatly exceeds the value of the stablecoins issued. This is due to the extreme volatility of the market, which causes the reserve to be prone to volatility as well. For example, MakerDAO’s DAI (DAI) is pegged to the USD but backed by ETH and other cryptocurrencies worth 150% of the DAI in circulation.

Algorithmic

The algorithmic stablecoin may or may not be backed by reserves. These coins are kept stable through a computer program running a preset formula; hence, its name. The algorithm controls the coin’s demand and supply, which are dictated by smart contracts, affecting its value. Since there is no centralized reserve for these stablecoins, they can easily be dubbed decentralized. One well-known algorithmic stablecoin is the TerraUSD (UST) which lost its peg in 2022.

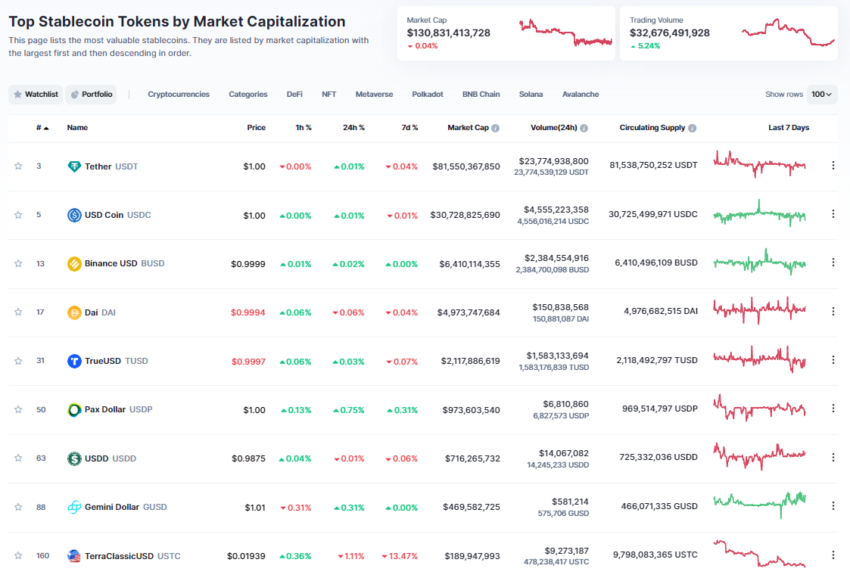

What are the most popular stablecoins?

Tether

Launched in 2014, the largest stablecoin by market capitalization is Tether USDT.

This stable cryptocurrency can be found in most major crypto exchanges. Its primary use case is moving funds between exchanges rapidly. Traders can take advantage of arbitrage when the crypto prices differ on two exchanges.

The currency claims to have a 1:1 ratio to the U.S. dollar. For every USDT, there is one dollar in reserves, according to the crypto giant. While USDT remains the most popular stablecoin, it remains a contentious entity for some.

The company was fined $42.5 million by the U.S. Commodity Futures Trading Commission (CFTC) in October for 2021, charged for lying about its reserves between 2016 and 2019. Whether or not Tether continues to be truthful about its reserves is a subject of controversy. Tether continues to refute “misconceptions” about Tether and USDT amid ongoing regulator scrutiny.

USD Coin

Cryptocurrency firms Circle and Coinbase launched the USD Coin in 2018. Like USDT, this coin is pegged to a 1:1 ratio to the U.S. dollar. It’s an open-source protocol that other companies and individuals can use to create their own products.

USD Coin became very popular since it provided an alternative to USDT as it provided proof of its backing by assets derived from the U.S. dollar.

DAI

Created by The Maker Foundation, DAI is the most popular crypto-backed stablecoin. It was originally created to provide a non-volatile lending asset for businesses, and its governance was later given to MakerDAO.

Notably, DAI is over-collateralized. So, for every Dai that exists, there’s collateral in excess of the value locked in a Maker Vault as a precaution against the impact of market volatility.

DAI is the most widely-used stablecoin when it comes to the integration of DApps, supporting over 400 DApps and wallets.

Binance USD

The stablecoin BUSD is a collaborative project between Paxos and Binance. It is backed by U.S. dollars which are kept in Paxos-owned bank accounts.

It is one of the few stablecoins that Wall Street regulators have approved. Recently, however, there has been a halt of BUSD trading on Coinbase following liquidity concerns. BUSD has since been delisted from the exchange. In addition, increasing SEC scrutiny has caused some trouble with the project, and now Paxos faces a lawsuit over an alleged violation of investor protection laws.

Stablecoins vs. bitcoin

The main difference between bitcoin and stablecoins is that the value of bitcoin is not pegged to another asset. Instead, the price of bitcoin can fluctuate and is generally seen as being quite volatile.

Bitcoin is primarily a store of value and can be used to make purchases. However, stablecoins exist in order to bring stability to the market and allow an easy, cheaper movement of cryptocurrencies between exchanges. In addition, a stablecoin transaction is faster than that of bitcoin. Unlike stablecoins, bitcoin can be used for trading since its volatile market swings allow traders the opportunity to profit.

Are stablecoins safe?

When comparing cryptocurrencies in the market, stablecoins are often considered the safest since they lack other currencies’ volatile nature. This works in theory, but the concept collapses if companies employ shady practices and are unable to show proof of reserves. A stablecoin’s level of safety greatly depends on how it’s backed and its issuer. Moreover, reserves that back the coin can be subject to credit, market, and liquidity risks. Just because they once existed isn’t a guarantee they will always remain safe.

While stablecoins have been touted as an answer to crypto’s volatility and may be considered more regulator-friendly than other coins, the reputation of this asset class took a nose dive following the implosion of Luna (Terra): UST, the algorithmic stablecoin of the Terra ecosystem, depegged in May 2022.

Issuers should be regulated; if they’re not, this can lead to legal problems for the stablecoin project. In fact, the lack of regulation surrounding stablecoins has made it more feasible for issuers to make false claims regarding their backing.

To be on the safe side, it’s best to stick with stable cryptocurrencies that are more well-known and have a high market cap.

What is a stablecoin’s role in the future of crypto?

Stablecoins have greatly impacted our financial lives. This type of crypto can offer cheaper, faster transactions and greater security — in some cases. And while governments are scrambling to accelerate crypto asset regulation, stablecoins may just be a palatable solution to upgrading payment systems and facilitating cross-border remittance.

Frequently asked questions

What is the purpose of a stablecoin?

What is the benefit of a stablecoin?

How many stablecoins are there?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.