In September, it came to the surprise of many when Mr. Goxx, a hamster, managed to outperform professional traders and hedge fund managers. However, the global trading sensation was no surprise to traders who understood the ins and outs of automated crypto trading.

Crypto trading signals, much like those for the traditional stock market, are too numerous for the human mind to fully cover and process. In the end, one has to rely on intuition derived from experience. For newcomers, automated trading removes an additional barrier — emotional volatility.

By the end of this guide on automated crypto trading, you too will understand whether it is worth your while.

In this guide:

- Crypto trading: a part of financial literacy

- Machine learning as the foundation

- Automated crypto trading explained

- The pros and cons of automated crypto trading

- The role of emotional decision-making

- Let AI take care of your crypto trading

- Automated crypto trading makes investment safer

- Frequently asked questions

Crypto trading: a part of financial literacy

As we near the end of 2021, bitcoin is headed toward a massive bull run. It owes this to a continued surge of institutional investors onboarding the crypto train. Almost every week, there is a news item pushing crypto adoption forward. At the beginning of November, Australia’s largest bank serving 6.5 million customers, The Commonwealth Bank of Australia (CBA), announced it will offer crypto trading services to its clients.

This was on the back of El Salvador recognizing bitcoin as legal tender. Twitter using the Lightning Network to offer bitcoin tipping for its 206 million monetizable daily active users also contributed. At the same time, smart contract platforms — Ethereum, Solana, Avalanche, Fantom — are seeing a resurgence of activity thanks to NFTs and blockchain gaming.

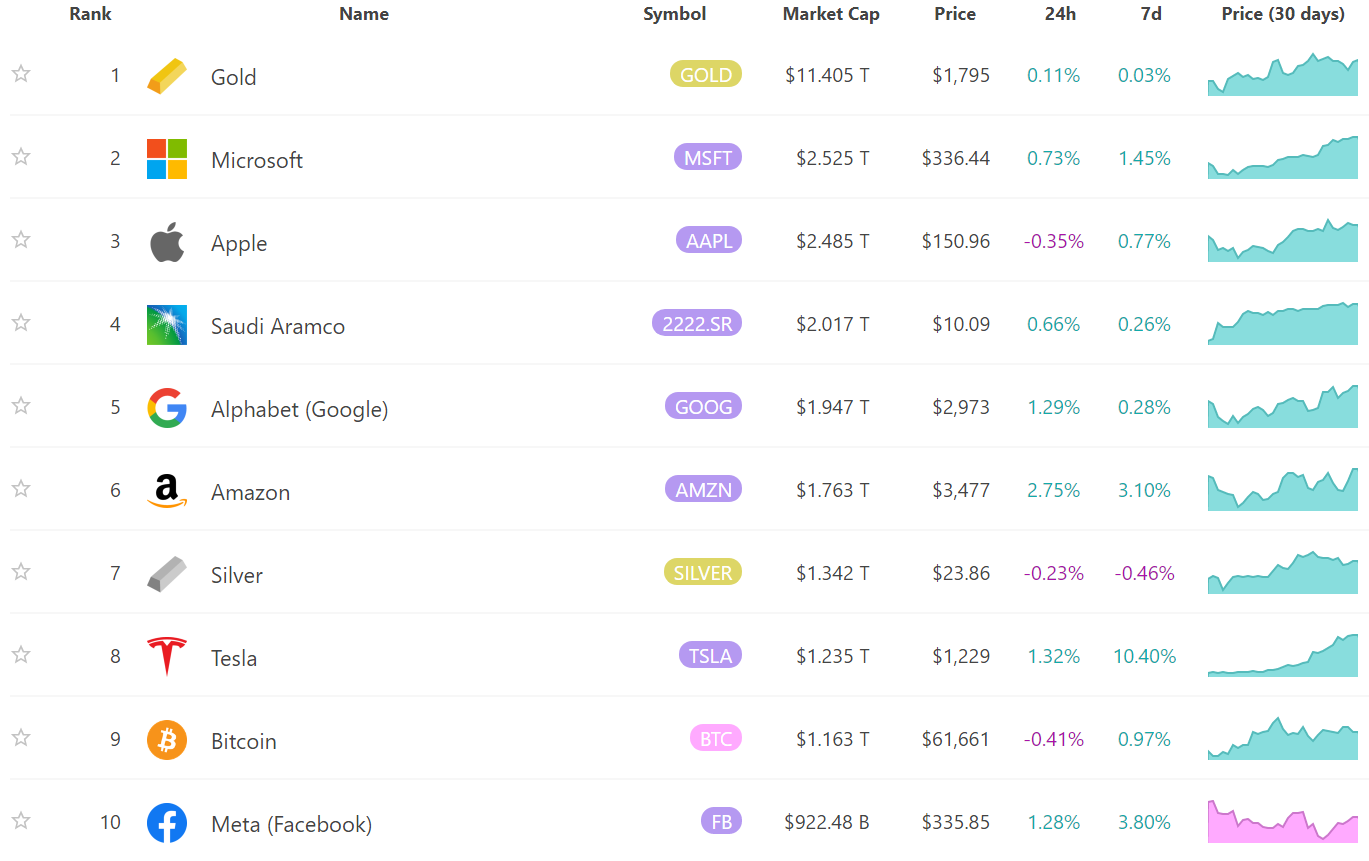

These trends clearly lead to a new era of decentralized finance, deeply embedded into users’ web experience, as Web 3.0. As of mid-October, the total crypto market cap hit an all-time high of $2.6 trillion. Although this is more than the world’s top ten banks combined, it is only the beginning. Bitcoin alone is among the top 10 assets by market cap.

The question is, how can you best take advantage of this crypto wave without suffering too many losses?

Machine learning as the foundation

In the digital age, bots have penetrated all aspects of life, from video games to social media platforms. In the crypto world, we understand bots as software that takes care of automated crypto trading, usually employing AI algorithms or machine learning.

As a subset of AI, machine learning’s core feature is that such a collection of algorithms can improve their performance over time, if enough data is fed to them. The more data they glean from a specific domain, the better such algorithms perform. Specifically, such bots gobble up crypto trading signals in order to conduct quantitative trading, commonly known as quants.

How do quant models help gain market insight?

There are several models quants can employ to gain crypto market insights:

- Generative model — As its name implies, this quant generates synthetic data to fill up the gap left from the lack of historical data. This is especially pertinent in the crypto world, where thousands of altcoins are only a couple of years old. Effectively, this quant model binds real datasets with synthetic ones through deep learning.

For instance, it could be trained to create an altcoin order book based on the existing one. The closer the match between the two is, the better it will perform. - Graph neural networks (GNN) — This type of quant analyzes the hierarchical structure of blockchain data. Because representation can take the form of a graph gleaning data across nodes and addresses, it can also model volatility based on the funds moving across these blockchain nodes. Likewise, these quants can map the inflows and outflows from crypto exchanges, extrapolating their impact on the price of cryptocurrencies.

- Representation learning — This quant model revolves around honing in on the market’s most reliable indicators. Specifically, those that best represent the market. Historical data on the performance of market indicators serves as the basis for a new representation model.

- Semi-supervised learning — A quant that creates models based on labeled small-scale datasets, besides using unlabeled large-scale datasets. Therefore, trading improvement uses the latter datasets, while market models based on its labeled features use the former.

- Neural architecture search (NAS) — A type of meta-quant that relies on machine learning to create the optimal market-predicting model. Correspondingly, NAS goes through countless neural network architectures to find one that produces the best results. This is the most flexible and most promising method, given the diversity of activity present on blockchains, especially in DeFi.

On-chain automated crypto trading also exists

Regardless of the employed quant strategy, most of them work as intermediary software. In other words, through an API (Application Programming Interface) that connects to a particular crypto exchange — Coinbase, Binance, Kraken, Bitmex, etc.

However, in recent months, the native use of automated crypto trading — on-chain within smart contracts — is also possible. Such crypto trading is less user-friendly but more resistant to hacking attempts because the users hold full control of their crypto assets.

Automated crypto trading explained

Now that you understand the broad strokes of what is possible in automated crypto trading, it’s time for a brief overview of how most crypto trading bots work. They consist of three components or stages:

- Signal generator — The crypto bot makes predictions based on price moves, trading volume, past performance, and other data. Then, it decides whether to buy, sell, or hold. Of course, these considerations are generated continuously and executed in microseconds.

- Risk allocation — When the crypto bot enters (buys) or exits (sell) the market, it starts to allocate risk. This translates to selecting the volume of purchases and to the diversification of crypto assets.

- Execution — Making the trades themselves. Crypto trading bots in charge of large asset volumes will place their trades over a series of smaller trades in order to avoid erecting overwhelming buy or sell walls. By avoiding such massive sells or buys, the price is more likely to be optimal. This is commonly called staggered trading.

Lastly, the user deploying crypto trading bots can further tweak them based on technical indicators, portfolio diversification, and asset price.

The pros and cons of automated crypto trading

As you may have inferred from Mr. Goxx, the hamster, the advantages of automated crypto trading far outweigh the disadvantages. The first among them is the ability of quant bots to process the vast amount of crypto market data in real-time and react near-instantaneously. Likewise, they save valuable time and prevent traders from exhaustion and carelessness.

After all, repetitive tasks tend to lull the brain into a dull state that lacks focus. In contrast, crypto trading bots can work 24/7, all year long.

When it comes to disadvantages to automated crypto trading, the bots still need a guiding hand. For instance, market sentiment caused by external news cannot be easily quantified and entered into any quant model. Perhaps, this may never be achieved.

For this reason, it is always a good idea to monitor your crypto bot and understand why it makes the trades it does. However, another aspect of crypto trading is exceedingly important for crypto bots to eliminate.

The role of emotional decision-making

It’s easy to say — buy low and sell high — but it’s another matter altogether when it comes to consistent strategy execution. Bitcoin crashed in May, caused by Elon Musk’s tweet, the Chinese mining ban, among other events. The majority of traders who panic-sold during this time were retail traders.

The problem is, people tend to lose perspective when seeing a short-term trend. Rather than focusing on the long term, they overanalyze a day’s price moves and get cold feet. Likewise, if an asset goes up, hope creeps up. This hope is interchangeable with fear, commonly known as FOMO — Fear of Missing Out.

Of course, when the price goes up, crypto whales usually sell for profits, triggering panic-selling among weak hands. Then, due to selling pressure, the asset depreciates, which represents the perfect buy-the-dip opportunity for whales. All of this transpired during H1 2021 Bitcoin FUD.

To summarize, the emotional disposition of most people is problematic, as they often buy during a price rise, instead of the contrary. This aspect of human nature is difficult to overcome, but automated crypto trading counters it.

Other emotional disruptors also feature. Although Musk is hard to surpass with his 62 million followers, he’s just one of many influencers. There’s an entire ecosystem of influencers across YouTube and TikTok who exploit viewership by making bold proclamations:

- Coin X Will Go Up By X (Urgent!)

- These Top 5 Coins Are Headed to the Moon!

- Don’t Miss an Opportunity of a Lifetime with this Coin X!

With so many documented crypto millionaires, these influencers are tapping into that inexhaustible supply of FOMO and get-rich-quick mentality. Unfortunately, countless other traders see the same headlines, so they often converge into pump-and-dump schemes for massive losses.

Automated crypto trading eliminates clouded and emotionally impaired judgment entirely.

Let AI take care of your crypto trading

Instead of acting on emotion, which most people are not even aware of doing, a performance-oriented trader relies on automated crypto trading. Specifically, on following crypto trading signals, bots comprehensively and assiduously collects.

Case in point, Rocket Wallet Signals, available on free Telegram channel, deploys the Cornix trading bot, usually honed in on the channel’s crypto signals. Working in conjunction with a mobile app and a Telegram account, Cornix can send alerts and notifications to traders on the latest moves it conducts. Cornix employs complex trading actions only reserved for the pros:

- Concurrent take-profit actions combined with stop-loss orders

- It can be connected to all major crypto exchanges: Binance, Coinbase, FTX, BitMex, Bittrex, ByBit, Deribit, and Kucoin, just to name a few.

- Although not a blockchain-based crypto script, it uses the latest security standards to safeguard crypto funds.

- It can also connect to TradingView alerts and Pine scripts to further tweak the tracking of its performance.

- It can unify trades from multiple exchanges into a single crypto portfolio

For the past year, Rocket Wallet Signals’ performance has had a rating of 8/10 — although the historic crypto crash has leveled the score for all crypto trading platforms. With that in mind, Rocket Wallet Signals achieved the following results:

- Ten winning months vs. two losing months

- An average accuracy of 63.35%

- Average Monthly Portfolio Growth: 19.2%

- Average max. PNL (a measure of profit and loss gains): 1156.02%

In fact, Rocket Wallet Signal has been so successful that it is often a target for scams and fake channels, so one should always double-check that your crypto signal Telegram channel is this one. As of press time, the community has grown to nearly 38,000 subscribers, with Adam managing the account.

Automated crypto trading makes investment safer

Predicting valuations in any market is difficult, but especially so in the crypto market. The sensible and seasoned investor will know how to regulate his or her emotion — but AI can remove that burden. With automated crypto trading using bots, not only do you avoid this hassle, but you can also employ sophisticated trading strategies.

Frequently asked questions

Which crypto signal is the best?

Are crypto signals worth it?

What are crypto trading signals?

Do crypto trading bots actually work?

Can you automate crypto trading?

Are auto trading bots legal?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.