The Open Network (TON) is rapidly gaining attention: its deep integration with Telegram sets the stage for 900 million monthly active users to be seamlessly onboarded into crypto. Driven by the enthusiasm of developers and the community, the TON ecosystem has evolved into a diverse blockchain platform encompassing dozens of projects.

DeDust.io is a leading decentralized exchange (DEX) built natively on the TON blockchain. It allows users to swap tokens and provide liquidity, similar in functionality and features to other DEXs like Uniswap. Since its inception, DeDust.io has become a crucial component of TON’s DeFi landscape.

In May 2024, the DeDust.io team announced the launch of staking for its native SCALE token. This staking rewards program aims to distribute the protocol’s fees among stakers, offering an opportunity for users to earn passive income. This guide will help you navigate DeDust.io and its features, providing essential steps to stake SCALE tokens and start earning rewards.

What is DeDust.io?

DeDust.io is a decentralized automated market maker exchange on TON. It uses an AMM mechanism, eliminating the need for order books: by utilizing liquidity pools, the platform ensures high liquidity and efficient price discovery, making it an attractive option for traders. The exchange’s user-friendly interface and security measures also contribute to its user base growth.

As one of the leading exchanges on the TON blockchain, DeDust.io reflects the increasing interest in this ecosystem. DefiLama data shows the platform’s TVL soared from $5.58 million in January 2024 to an impressive $76.62 million as of late May.

DeDust.io is continuously integrating new features and expanding its list of supported tokens and trading pairs. According to DexScreener, DeDust.io supports 721 pairs. The 24-hour trading volume on the platform sits at $6.7 million.

Scaleton (SCALE), the native token of DeDust.io, is designed to benefit from the protocol’s growth.

How does it work?

DeDust.io offers several key elements that allow it to give its users the best experience. Let’s look at each of them separately. But first, you have to connect to DeDust.io. Here’s how to do it: the steps are the same for both desktop and mobile versions.

DeDust.io can be accessed directly in Telegram through Telegram Mini App!

1. Open DeDust.io website and press Connect Wallet.

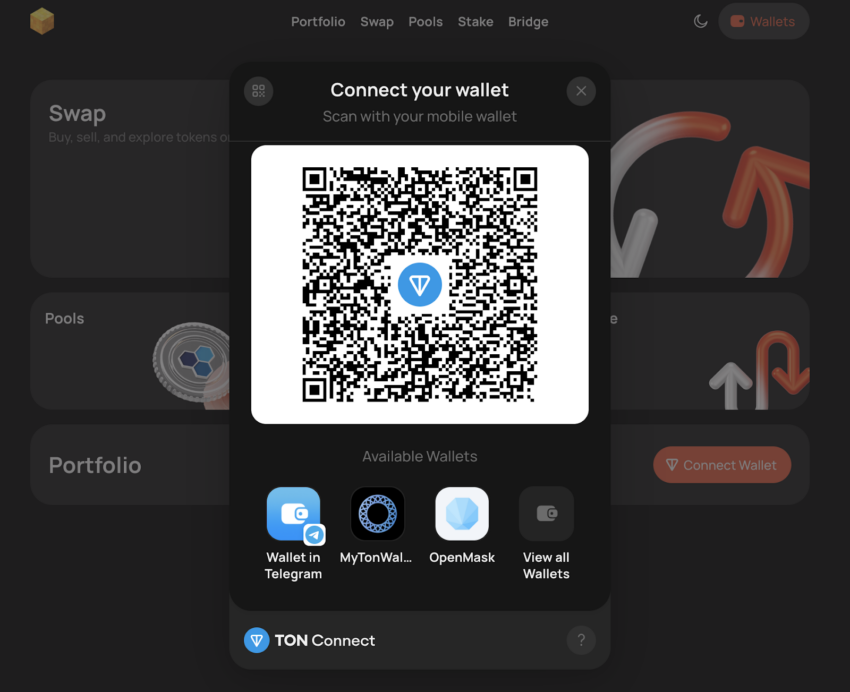

2. Choose the TON wallet or scan the QR code with the mobile application of your wallet and confirm the connection. If you don’t have a TON wallet, you’ll need to create one. The most popular options include Tonkeeper, MyTonWallet, and the built-in Telegram wallet.

Once connected, you can explore the DeDust.io interface.

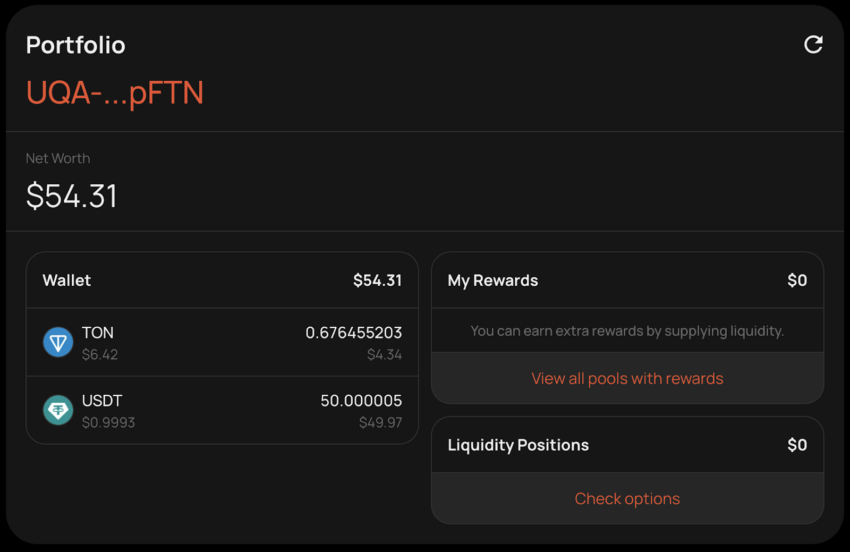

Portfolio

Shows all available assets in the connected wallet.

Swap

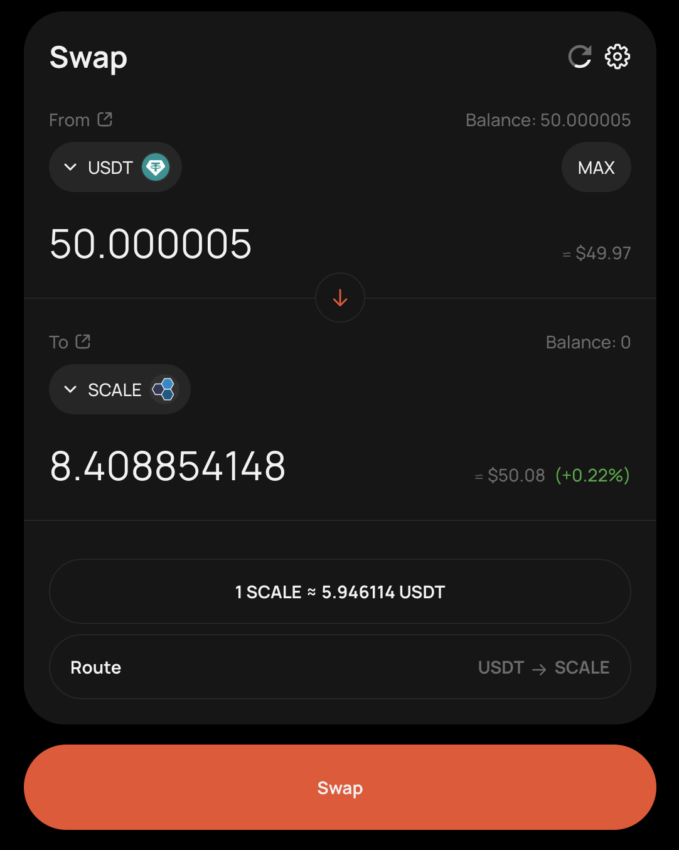

Here you can exchange one token for another: choose the assets, specify the amount you want to swap and don’t forget you’ll need some TON to cover network fees.

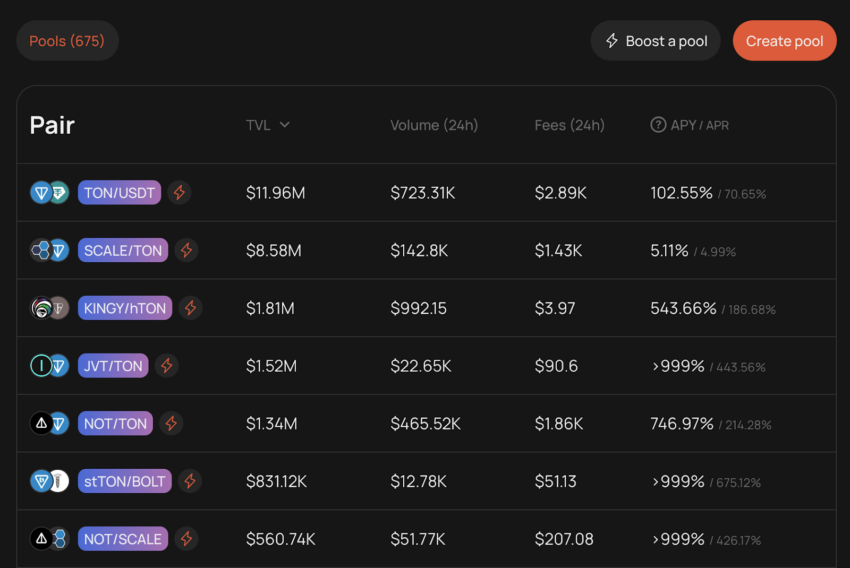

Pools

A liquidity pool is a group of funds stored in a smart contract that helps with decentralized trading and other financial services on a blockchain. DeDust.io has over 600 pools in the default list on the website and lets users create their own, making it easier for more people to join in with decentralized finance.

Stake

The staking interface allows you to stake/unstake SCALE tokens in a few simple steps. No rush, we’ll come back here later.

What is SCALE?

As we already mentioned, SCALE is DeDust.io’s native token. Before we move on to discussing how to stake it to earn passive income, let’s take a look at its tokenomics and utility.

Initial supply: 21,000,000 SCALE

Allocation breakdown:

- Ecosystem fund: 4 313 384,9 (25%)

- Core team: 4 200 000 (20%)

- Development: 1 225 000 (5.83%)

- Marketing: 548 000 (2.61%)

- Burned: 4 313 3384.9 (20.54%)

- On the market: 546 3615,1 (26.02%)

Ownership is revoked, so no new tokens will be issued. This usually results in a price increase for the token, driven by higher demand and reduced supply.

As of May 31, 2024, SCALE’s price on CoinGecko is $5.46, while daily trading volume sits at $340,903.

How to stake SCALE?

As you may know, staking involves locking up funds in a decentralized protocol. In return, stakers earn rewards, either as additional tokens or through an increase in the value of their staked tokens. In May 2024, DeDust.io team launched SCALE staking, allowing users to receive daily rewards, coming from the protocol’s trading fees.

“DeDust.io became the first product in the Scaleton ecosystem to introduce such mechanics. Moving forward, we plan to expand our offerings with more DeFi products to continue this approach.”

Nick Nekilov, DeDust.io founder

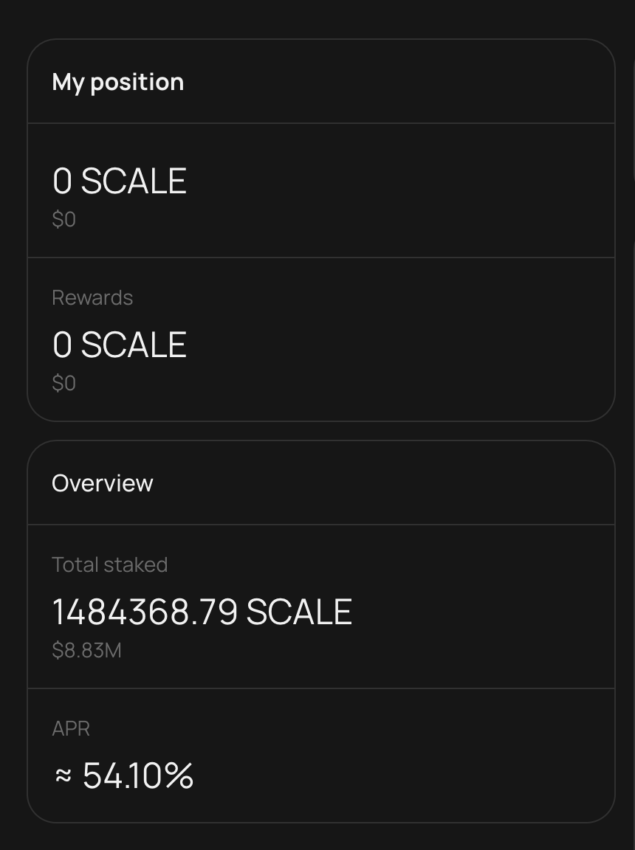

As of May 2024, users can stake SCALE with ≈ 54.10% APR. Just three weeks after the tool’s launch, the number of staked tokens has surpassed 1484373.79 SCALE, worth about $8.8 million.

The process of staking SCALE involves several key steps:

- Buying Toncoin (TON) or USDT

- Exchanging TON for SCALE

- Staking SCALE

- Earning rewards

- Managing staked coins

Let’s look at each of these step-by-step.

Buying TON/USDT

Before staking, you must have USDT or TON in your wallet to swap it. Both assets can be purchased on popular centralized exchanges, such as OKX, Bybit, and MEXC.

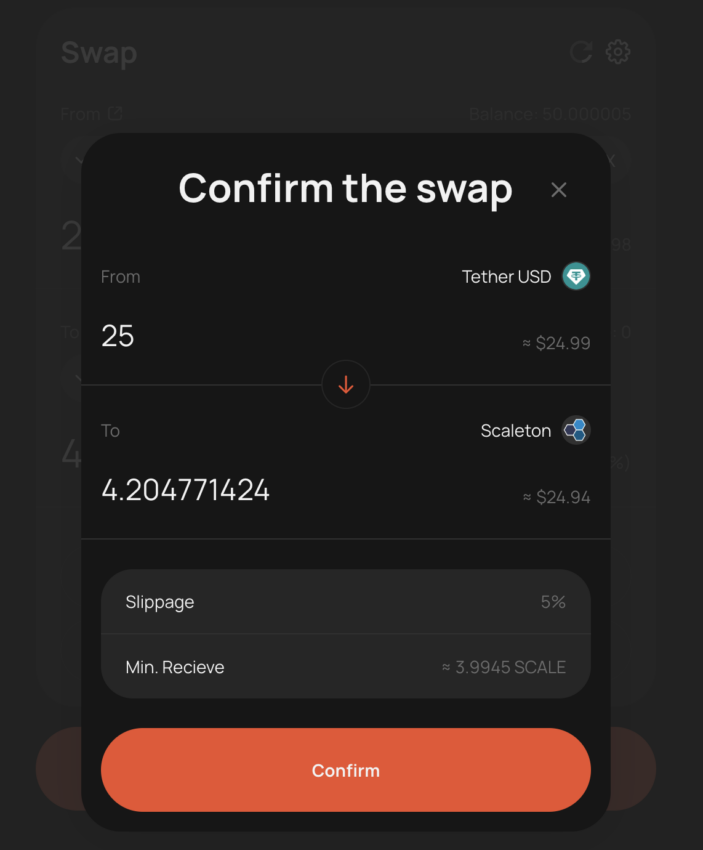

Swapping USDT/TON for SCALE

Swap the desired amount of USDT or TON in the DeDust.io itself, in the SWAP section. Tap the “Confirm” button to verify your purchase and proceed with buying the specified number of SCALE. Your wallet will then request confirmation to finalize the transaction on the blockchain.

One more time: don’t forget about extra TON to cover the network fees.

Open the Portfolio section to make sure everything went smoothly. SCALE tokens should appear among your assets.

Staking SCALE

Now, when you have your SCALE ready, go to the Stake tab and specify the amount of SCALE you want to stake.

After this, your wallet will prompt you to confirm the transaction. Staked tokens will show up in a few minutes.

Earning rewards

After staking SCALE, you’ll start receiving daily rewards. The amount depends on the share of tokens you stake and the commissions earned by DeDust.io.

Managing staked SCALE

If you want to unstake your SCALE, click the Unstake button and choose how to withdraw your funds. You can either unstake immediately with a 5% penalty or wait 72 hours to unstake without a service fee. A network fee will be charged in either case, as it is required to process your transaction on the blockchain.

The unstaked tokens and collected rewards will show up in your wallet in a few minutes.

SCALE staking: A user-friendly way to get involved in DeFi

In this guide, we walked you through how to stake SCALE on DeDust.io, a great option for those looking to explore the TON ecosystem, dive into DeFi tools, and earn passive income. We covered everything from connecting your wallet to buying and staking SCALE. By following these steps, you were able to start staking and enjoy daily rewards based on your share and DeDust.io’s earnings. Overall, staking on DeDust.io offers a user-friendly way to get more involved in the exciting world of DeFi and make your crypto work for you.

Frequently asked questions

The Scale (SCALE) token is the native crypto of the Scaleton platform. Scaleton developed the DeDust.io decentralized exchange. On DeDust.io users can stake SCALE to earn rewards.

DeDust.io is a decentralized exchange (DEX) on the TON blockchain. It offers features like portfolio management, asset swaps, liquidity pools, staking, and bridging between blockchains. DeDust.io supports the native TON coin, as well as other assets like the TEP-74.

Trading fees on DeDust.io range from 0.4% to 1.0%, depending on the specific pool and asset types involved. 20% of the trading fees go to users that stake SCALE. You can also become a liquidity provider on DeDust.io to earn trading fees.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.