XRP soared 8% on Wednesday, with the Ripple community tentatively discussing a possible settlement in its lawsuit against the US Securities and Exchange Commission (SEC).

The crypto community is at the edge of its seats, watching every Ripple SEC development with care in a longstanding case that could affect the industry.

XRP Community Athirst Over Possible Ripple SEC Settlement

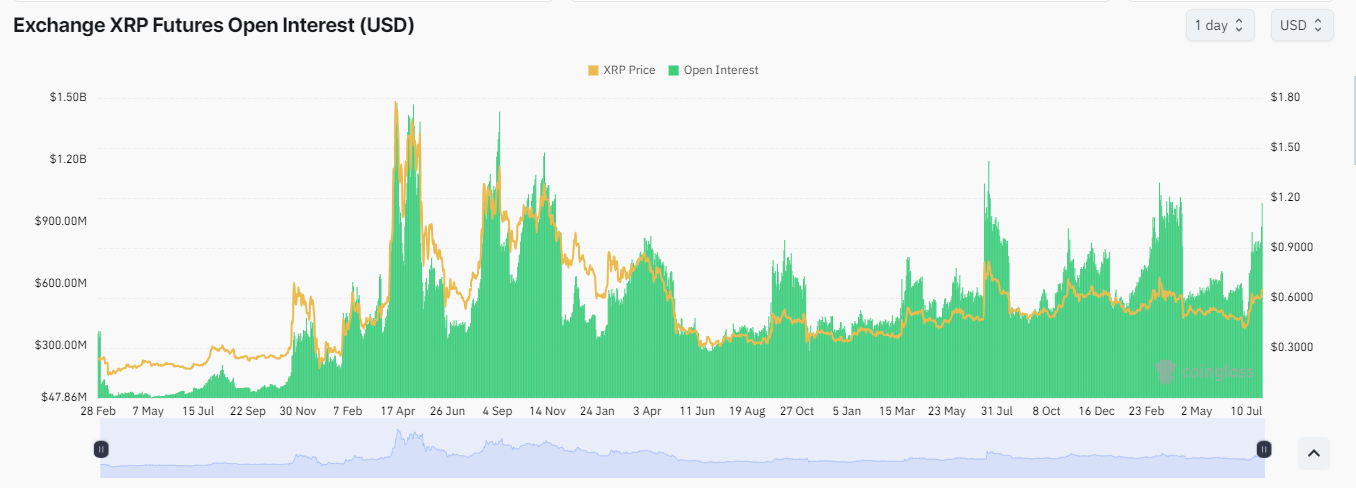

XRP price soared 8% on Wednesday to $0.6586, liquidating over $1.3 million in total positions. Meanwhile, trading volume surged 112%, with open interest approaching $1 billion. Open interest shows the sum of all open or unsettled long and short positions for an asset.

The soaring trading volume and bloated open interest come as July remains an important month for the XRP community. This is after Ripple’s victory against the US SEC in a landmark decision by Judge Analisa Torres on July 13, 2023.

As the month climaxes, the Ripple community anticipates a possible settlement soon. As BeInCrypto reported, XRP advocate, attorney Fred Rispoli, speculated the case would poetically end on July 13 or July 31. In a follow-up post on X (formerly Twitter), Rispoli expressed nervousness as the window was closing fast.

“I’m running out of time to hit my 7/31 prediction for the remedies ruling,” Rispoli wrote.

The XRP community may have to wait until August 1 or later in the month for a development. Based on the SEC’s Sunshine Act Notices calendar, there is a closed-door meeting on Thursday.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The closed meeting’s agenda includes instituting and settling injunctive actions. The regulator will also discuss initiating and settling administrative proceedings and resolving litigation claims. Additionally, other issues related to examinations and enforcement proceedings may be addressed.

Notably, the previous meeting was canceled, which negatively affected the XRP price. Ryan Lee, Chief Analyst at Bitget Research, observes the potential influence of Thursday’s meeting. He says it could drive the Ripple token’s price in August.

“This meeting will discuss potential settlement options for the Ripple lawsuit. The founder of Ripple Labs mentioned that a legal settlement might be announced soon. If they release an official settlement plan, it could positively affect XRP’s price movement. Stimulated by positive news, XRP’s token performance might outshine Bitcoin,” Lee told BeInCrypto.

Lee also observed the potential for US election campaigns to influence XRP price. He cited developments between Ripple and the Democratic Party’s campaigns, noting that close ties could influence decisions.

“US Democratic candidate Harris has close ties with industry participants like Coinbase, Circle, and Ripple. During the campaign, there might be announcements of favorable news for the industry, such as a comprehensive regulatory framework and legal protection for crypto companies operating in the US,” Lee added.

Read more: How To Buy XRP and Everything You Need To Know

The SEC’s recent decision to amend its complaint against Binance has heightened market interest. The regulator’s partial withdrawal from the case suggests a possible shift in its stance. These developments highlight the dynamic nature of the industry and demonstrate how regulatory actions can impact asset prices.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.