NEAR’s price has not recovered strength over the last 24 hours. Today, it is up by only 2%.

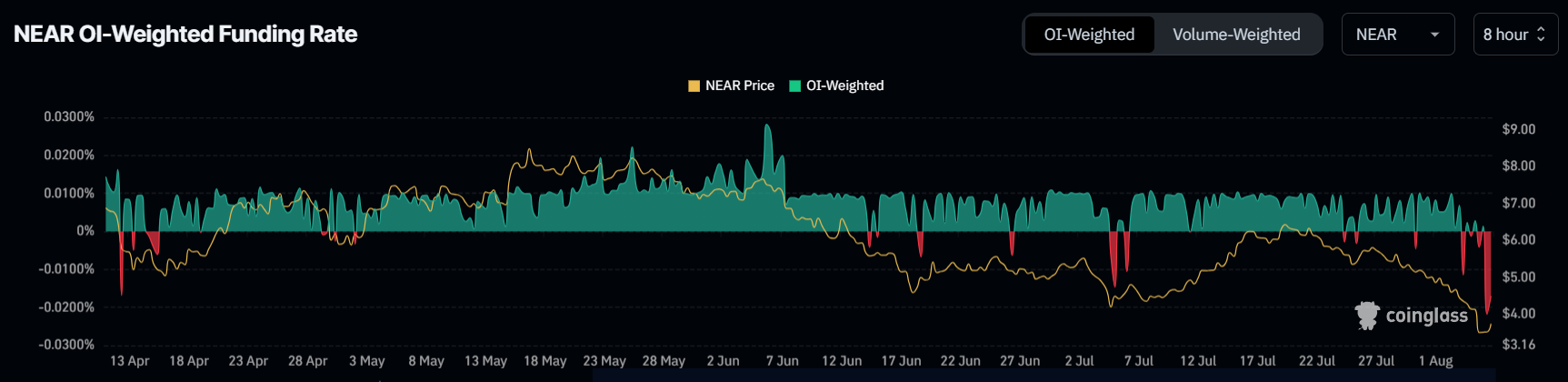

This is largely because the price action is responding to the investors’ bearish actions, which are evident in the funding rate.

Near Protocol Investors Seek a Drawdown

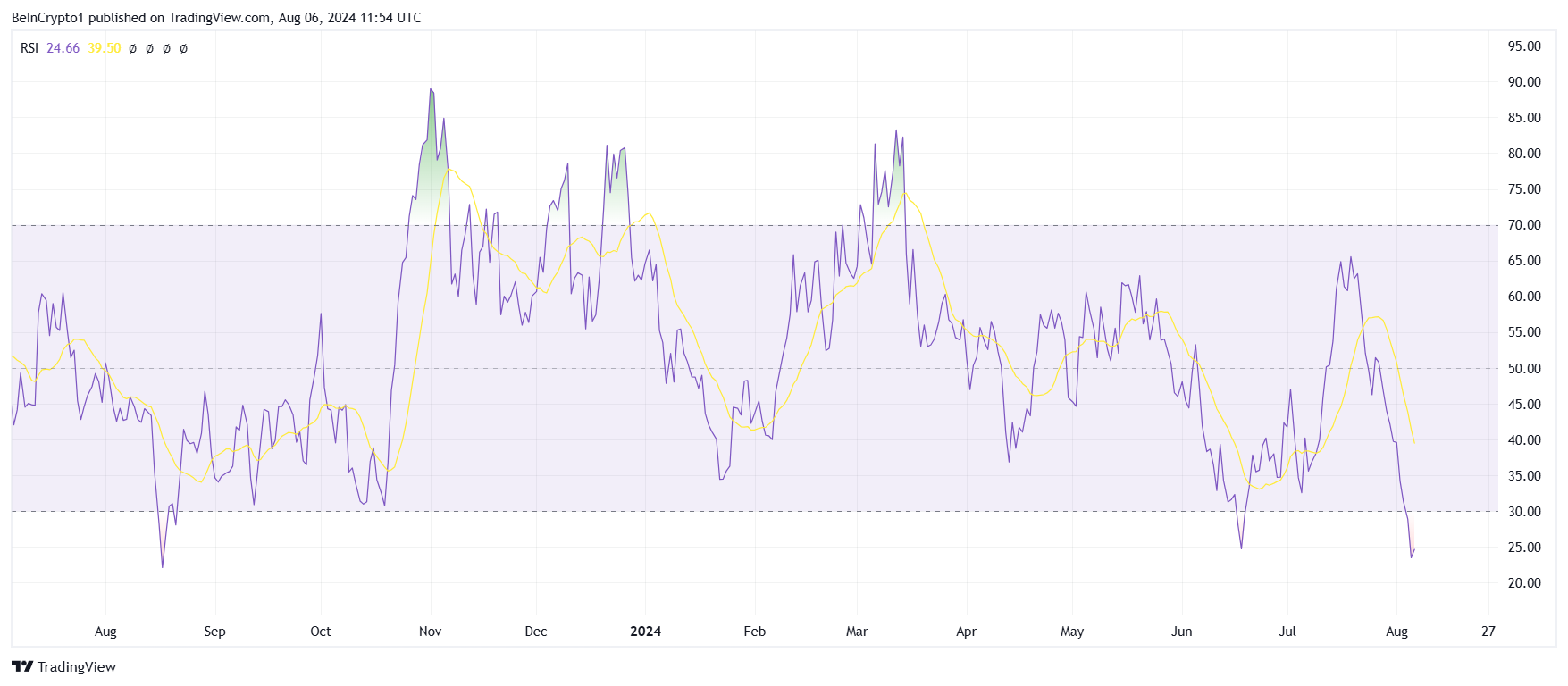

Along with the effect of the broader market’s sell-off, NEAR’s price drawdown has also been due to its own investors. The Relative Strength Index (RSI) is deep in the overbought zone, indicating that selling pressure dominates the altcoin.

The Relative Strength Index (RSI) measures the speed and change of price movements to identify overbought or oversold conditions. It ranges from 0 to 100, with values above 70 indicating overbought conditions and below 30 suggesting oversold conditions.

Read More: What Is NEAR Protocol (NEAR)?

Interestingly, this overbought condition is not necessarily detrimental for NEAR investors.

In line with the selling pressure, the negative funding rate reflects that investors are positioned for a potential downward move. However, the record-high negative funding rate implies that investors still haven’t adjusted their sentiment to recover from the correction.

This could result in the altcoin struggling to make back the profits it has lost in the last couple of days.

Near Price Prediction: Slow Recovery Ahead

NEAR’s price is trading at $3.57 at the time of writing, attempting to secure the resistance of $3.58 as support. Doing so would help the altcoin climb the daily chart and flip $4.39 into support again.

This would enable further recovery for the altcoin, as this level has been tested as a support floor multiple times. Pushing past the $5.00 resistance would help NEAR holders reclaim 50% of the losses noted recently.

Read More: Near Protocol (NEAR) Price Prediction for 2024

However, if the breach of $4.39 fails, NEAR price could linger under it and above the $3.58 support level. This consolidation could continue for a while, invalidating the bullish thesis.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.