Hamilton, a startup specializing in real-world asset (RWA) tokenization, has announced the tokenization of the first US Treasury bills on Bitcoin layer-2 (L2) solutions, including Stacks, Core, and BoB.

This milestone signifies a major step towards integrating traditional finance with the Bitcoin ecosystem, enhancing the accessibility and tradability of stable, government-backed assets within decentralized finance (DeFi) networks.

Bridging Finance: Treasury Bills on Bitcoin Layer 2 Solutions

According to the official statement, Hamilton conducted the inaugural transaction on America’s Independence Day. Hamilton’s initiative seeks to make financial instruments like Treasury bills more accessible and tradable within Bitcoin’s DeFi ecosystems.

“Combining US Treasury bills with Bitcoin’s security and transparency marks a historic step towards financial independence, providing crucial exposure to emerging markets,” Kasstawi, CEO & Co-founder of Hamilton, said.

Read more: What is Tokenization on Blockchain?

Hamilton’s tokenized Treasury bills will be available on three prominent Bitcoin L2 solutions: Stacks, Core, and BoB. These platforms are well-known for making Bitcoin more scalable and functional.

Therefore, they will allow Hamilton to easily and affordably create digital tokens representing real-world assets—all while ensuring the security that Bitcoin is famous for. The tokenized Treasury bills are expected to be available soon on Hamilton’s platform.

Additionally, Elkasstawi told BeInCrypto that the company plans to expand its offering to include other types of RWAs. These include commodities and corporate bonds.

“This diversification will allow us to cater to a broader range of institutional investors,” he said.

Hamilton’s move matches the increasing interest in RWA tokenization from both crypto firms and traditional financial institutions. Boston Consulting Group’s (BCG) projection of the RWA market to reach $16 trillion by 2030 highlights the potential of such innovations.

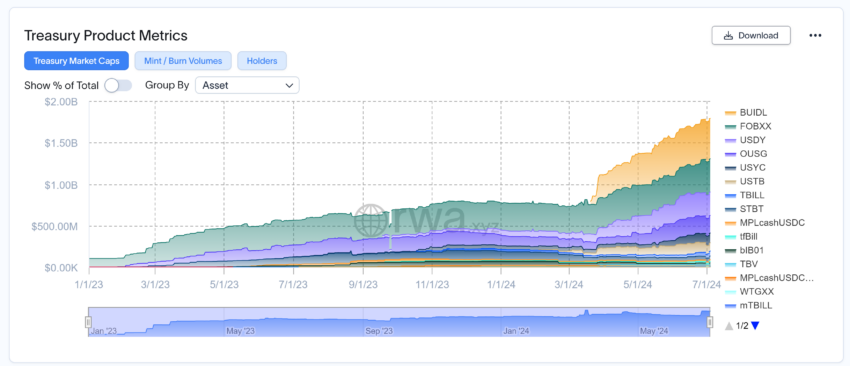

Additionally, the latest data from RWA.xyz indicates that the total value of tokenized treasuries as of July 4 is $1.79 billion. The figure represents a 215.88% year-on-year increase from $566.67 million. This surge highlights the growing demand and potential for RWA tokenization in the financial sector.

RWA tokenization involves creating digital representations of tangible assets like bonds, real estate, and debt on blockchain networks. Once tokenized, these assets can be swapped, transferred, and leveraged in DeFi ecosystems.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

“We anticipate that tokenized assets will bring increased transparency, liquidity, and accessibility to traditional financial markets. We believe that enabling fractional ownership and 24/7 liquidity will democratize access to high-quality investment opportunities,” Kassawi explained.

This method creates new opportunities and liquidity between traditional and crypto assets. Furthermore, it enhances transparency, liquidity, security, and accessibility while reducing costs and transaction times.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.