JUP, the native token of the Solana-based decentralized exchange Jupiter, has maintained a downtrend since July 29.

The altcoin’s decline was worsened by Monday’s market downturn, causing its price to plunge to a five-month low, a level it now risks revisiting.

Jupiter Bears Have the Upper Hand

At press time, JUP trades at $0.88. The broad market recovery since Tuesday has driven JUP’s price up nearly 10% in the past 24 hours. However, the 44% decline in its trading volume indicates a negative divergence.

When this divergence emerges, it indicates that the buying momentum backing the price surge is weak. Therefore, JUP’s rally might be said to have mirrored the general market rebound and not been due to significant demand from its holders.

Moreover, key momentum indicators observed on a daily chart confirm that JUP’s downtrend is strong. For example, its Aroon Down Line is 85.71% as of this writing. An asset’s Aroon indicator measures its trend strength and identifies potential price reversal points.

When the Down Line is at or close to 100%, the downtrend is very strong. It signals that the asset’s price has consistently made new lows, showing a clear downward momentum.

Further, according to readings from JUP’s Directional Movement Index (DMI), its negative directional indicator (-DI) (red) currently rests above its positive directional indicator (+DI) (blue), confirming the strong bearish bias against the altcoin.

Read More: Top 9 Safest Crypto Exchanges in 2024

This indicator measures an asset’s trend strength. When the -DI lies above the +DI, it signals that selling pressure outweighs the demand for an asset.

JUP Price Prediction: Short Traders Ravage Market

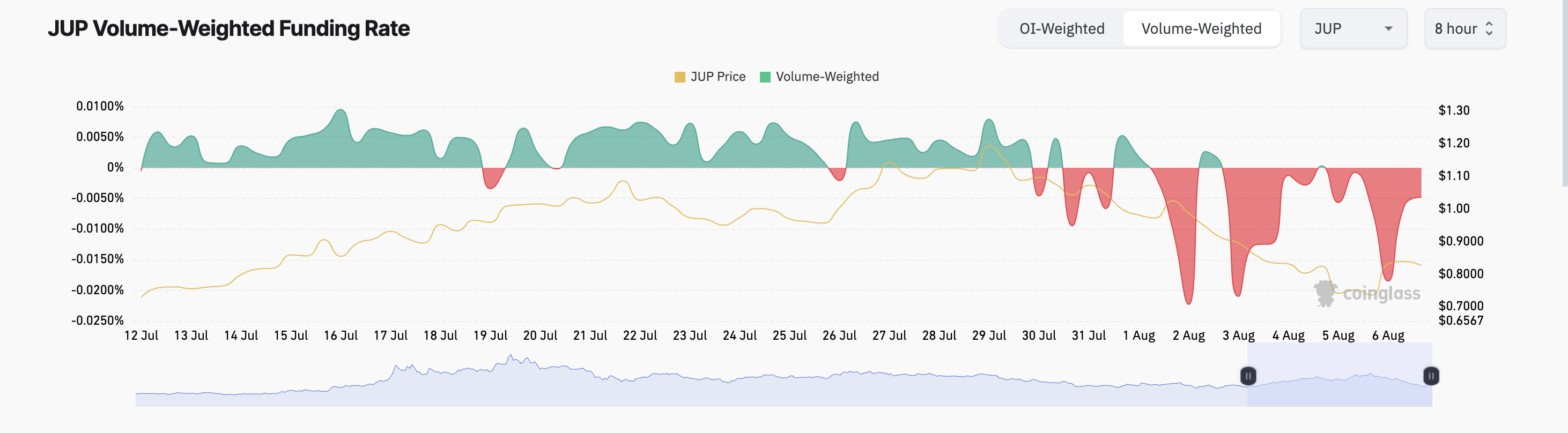

In its futures market, JUP traders have primarily demanded short positions since the beginning of August, as evidenced by its negative funding rates. At press time, the token’s funding rate is -0.0048%.

When an asset’s aggregated funding rate across cryptocurrency exchanges is negative, it means more traders are buying the asset, expecting a decline, than those buying in anticipation of a rally.

This is a bearish signal because it reflects traders’ expectation that prices will decrease as they are willing to pay to maintain their short positions.

If JUP maintains its downtrend, its next price target is $0.65, a 26% fall from its current value.

Read More: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

However, if market sentiment shifts and an uptrend ensues, the altcoin may rally to $0.93.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.