BNB is crucial fuel for the mammoth Binance ecosystem. But what does BNB do, and how does the flagship Binance blockchain work? This guide demonstrates buying BNB and everything else you need to know.

- How to buy BNB

- What is BNB?

- How does BNB work?

- What is Binance Smart Chain (BSC)?

- Yield farms on Binance Smart Chain

- Why is BNB popular?

- BNB vs. Other cryptocurrencies

- Binance vs. Binance.US

- BNB ecosystem

- BNB wallets

- BNB staking

- Where to buy BNB

- 1. Binance

- 2. YouHodler

- 3. Bybit

- 4. KuCoin

- Zhao’s big exit and its impact on BNB price

- BNB: Should you buy into the hype?

- BNB price prediction 2024/2025/2030

- Buy BNB with caution

- Frequently asked questions

How to buy BNB

Numerous top centralized and decentralized cryptocurrency exchanges support BNB purchasing and even trading. Although the methods to purchase BNB largely align across these exchanges, some nuances may exist. In this guide, we’ll highlight the process of buying crypto on YouHodler, which is notable for its user-friendly interface and significant presence in the DeFi lending arena.

Step 1: Create an account

To start with YouHodler, you must sign up on their platform. Once you’ve entered the required details, they’ll prompt you to undergo the Know Your Customer (KYC) verification. This step enhances trading security and compliance. After getting verified, you can dive in and kick off your BNB purchases.

Step 2: Choose a currency and payment method

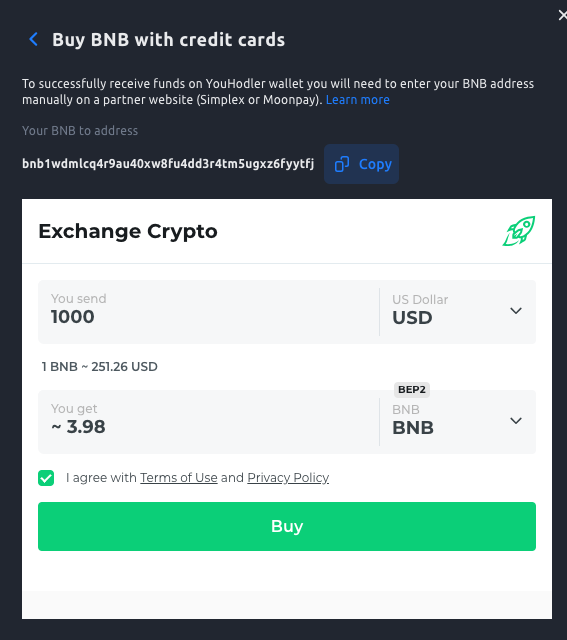

Click on “Buy Crypto” on YouHodler to see available options for buying BNB.

Step 3: Pick your payment method to buy BNB

Keep in mind that rates on YouHodler might fluctuate in real-time. Make sure you select the payment method that best fits your requirements, and double-check the preview on YouHodler before finalizing your purchase.

Step 4: Store BNB

Once bought, store BNB in your personal crypto wallet or use it for trading. Before making any purchasing decisions, always check the official YouHodler website for announcements regarding its most recent services and updates.

What is BNB?

Binance Chain (BNB) was created in April 2019. It is the flagship blockchain of the Binance exchange (founded by ex-CEO Changpeng Zhao) and was primarily designed for fast and low-cost crypto trading.

Just as Binance (global) is different from Binance U.S., Binance Smart Chain (BSC) is also a separate blockchain that was launched in September 2020. It was created to support smart contracts and decentralized applications (DApps).

BNB was built using the Cosmos SDK, while BSC is a fork of the Go Ethereum client. In February 2022, BNB and BSC merged to form the BNB chain that we know today.

How does BNB work?

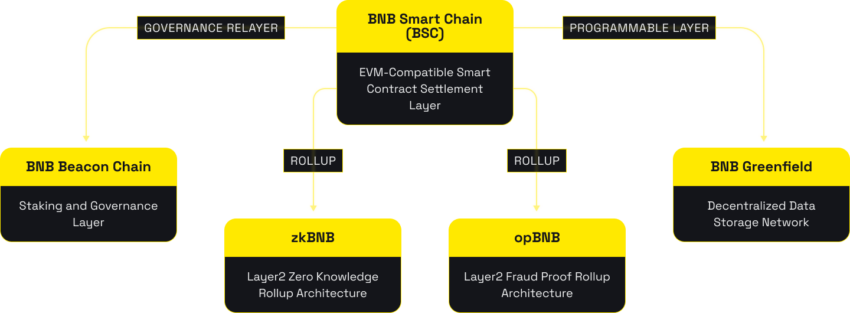

After its merge, the BNB chain became the beacon chain that runs parallel to BSC (BNB Smart Chain) while also serving as the governance or consensus layer. BSC is the smart contract or execution layer.

BNB is an abbreviation for “Build and Build.” The BNB coin serves as a governance token and fuels transactions on the BNB Chain (much like gas on Ethereum).

It is important to note that Binance is sunsetting the BNB Beacon Chain. All governance tasks will now be conducted on the BNB Smart Chain.

What is Binance Smart Chain (BSC)?

Binance launched Binance Smart Chain (BSC) in September 2020 as a solution to the limitations of Binance Chain, which it had originally deployed in April 2019. While Binance Chain prioritized ultra-fast trading, it lacked smart contract functionality due to the high computational power required for these contracts. In contrast, BSC was designed as a sidechain to Binance Chain, specifically to support smart contract programmability while maintaining high transaction speed.

This development came in response to congestion issues seen in other networks, such as Ethereum, which were particularly highlighted during events like the December 2017 CryptoKitties phenomenon.

Yield farms on Binance Smart Chain

There are a number of leading yield farms on the Binance Smart Chain. These include:

- PancakeSwap: #1 AMM and leading yield farm on Binance Smart Chain; forked from UniSwap. It offers token exchange, liquidity farming, high yields, and rewards; it is noted for its user-friendly interface with themes like bunnies and pancakes.

- Venus Protocol: Allows collateral use for borrowing assets and minting synthetic stablecoins, enhancing investment opportunities in their financial products.

- Pancake Bunny: A yield aggregator and optimizer specifically for Binance Smart Chain, often paired with PancakeSwap.

- Autofarm: Features products like Vaults for strategic yield optimization and AutoSwap for best DEX trade prices.

- BakerySwap: An all-in-one DeFi platform offering AMM, DEX, and NFT Marketplace.

Why is BNB popular?

BNB is popular, largely due to the weight that the name Binance carries in the industry. However, the blockchain also offers low gas and transaction fees compared to Ethereum, which is attractive for developers and decentralized application (DApp) users.

BNB vs. Other cryptocurrencies

As of July 15, 2024, the price of BNB is $571, with a 24-hour trading volume of $1,806,626,296. It has a market cap of $84,344,136,005 and a circulating supply of 147,582,218 BNB tokens. Out of all cryptocurrencies, BNB ranks number four according to market cap.

BNB vs. Ethereum: An ultimate comparison

Ethereum and BNB are very similar in many aspects. For example, BSC is an Ethereum fork. Moreover, Eth 2.0 has a beacon chain and a smart contract layer, and BNB also has a beacon chain and a smart contract layer.

In other words, both had a merge event and have somewhat similar architectures. However, the difference lies in the architecture of the beacon chains. Lastly, BNB uses a proof-of-stake authority (PoSA) mechanism, while Ethereum uses proof-of-stake. Simply put, BNB uses a centralized governing mechanism, and Ethereum’s governance is more decentralized.

Binance vs. Binance.US

Despite a history of facing several outages, Binance, the original platform, continues to distinguish itself from its U.S. counterpart. Offering a vast array of cryptocurrencies and user-friendly features, it surpasses Binance.US in functionality and ease of use. As a result, many users are optimistic about a future reduction in Binance’s technical issues.

Conversely, Binance.US faces unique challenges, notably the varying services available across different states, which limits its user base. However, as Binance.US aims for expansion, it’s worth noting that Binance currently caters more effectively to a diverse range of traders, from beginners to experts. This situation highlights the ongoing “Binance vs. Binance.US” discussion, a topic gaining traction amidst evolving regulatory landscapes and SEC enforcement.

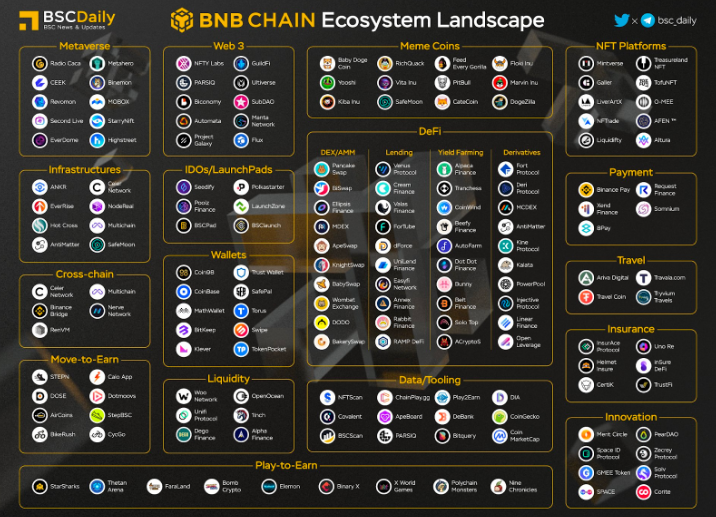

BNB ecosystem

Contrary to many other alt L1s, BNB actually has a powerful ecosystem. This includes decentralized cryptocurrency exchanges, yield farms, NFTs, and more. Here is a list of just a few of the DApps on the BNB chain.

- PancakeSwap – DEX

- DODO – DEX

- Travala – Hotel

- OpenOcean – DeFi

- BlockGames – GameFi

BNB wallets

Because the coin runs on a popular blockchain, BNB is widely supported by many digital wallets. Here is a list of several of the best BNB wallets.

- Binance Wallet: As the official wallet of Binance, it offers seamless integration for managing and trading BNB directly on the Binance platform.

- Trust Wallet: A user-friendly mobile wallet with powerful security features for storing BNB and other cryptocurrencies.

- SafePal: Known for its hardware and digital wallet solutions, SafePal offers secure and convenient options for storing BNB.

- MetaMask: Primarily known for ethereum, MetaMask also supports BNB, allowing users to manage their assets within a familiar interface.

- Ledger: A hardware wallet, which provides high-level security for BNB, making it ideal for those prioritizing asset safety.

BNB staking

Because the BNB chain is a proof-of-stake blockchain, it is possible to stake BNB. However, although you can stake, it is more accurate to say that you are delegating BNB, as only a privileged validator set can actually validate the private blockchain.

Where to buy BNB

As stated previously, BNB is a very popular blockchain and coin. As such, many exchanges offer the popular crypto. Here are our top choices based on experience:

1. Binance

We found buying BNB on Binance to be an easy and hassle-free experience, mainly due to its intuitive interface and unmatched liquidity. The platform’s wide array of products, ranging from NFTs to the Bluebird Index and various derivatives like futures and options, provided us with diverse trading and investment opportunities. We particularly appreciated the flexibility and breadth of options available on Binance, making it a one-stop shop for our BNB-related activities.

2. YouHodler

Our experience with YouHodler while buying (and trading) BNB was relatively flawless. The platform not only allowed us to purchase BNB within the metaphorical blink of an eye, but it also offered an attractive interest rate of up to 5.5% on our holdings. These crypto loan facilities and interest-earning opportunities added significant value to our investment strategy, enabling us to leverage our assets effectively.

3. Bybit

Bybit was just as good a platform for buying and trading BNB as the others in this list. We liked the added benefits of token discounts through its IDO launchpad. This feature provided us with unique investment opportunities, adding a layer of excitement to our experience on the platform. Bybit’s interface and overall trading environment were conducive to both our standard transactions as well as while exploring and evaluating new token offerings.

4. KuCoin

KuCoin proved to be an excellent choice for purchasing BNB for our team members spread across the globe. The platform’s offerings, including fractional NFTs, peer-to-peer trading, and derivatives, catered well to our trading needs. We also liked KuCoin’s peer-to-peer trading and derivatives, which expanded our trading strategies significantly.

*In 2024, KuCoin is facing charges from the Department of Justice following allegations that the platform knowingly flouted AML rules in the U.S. The company’s legal woes have dramatically dropped its market share, with many concerned users withdrawing funds from the platform. For a detailed overview of the current situation, please check our explanation of KuCoin’s legal status. If you are considering alternatives to KuCoin, explore our recommended exchanges here.

Zhao’s big exit and its impact on BNB price

In November 2023, the crypto sector was shaken up by some major news — Changpeng Zhao (CZ) stepped down from his CEO role at Binance. Now, this was no small move, given that Binance is the biggest crypto exchange globally in terms of trading volume. The departure was part of a $4.3 billion settlement deal with the SEC after Binance admitted to letting some sketchy Hamas-linked payments flow through the exchange.

Richard Teng took over for Zhao. He came from regulating financial markets in Abu Dhabi. Between his work in Singapore and the UAE, Teng brought a strong compliance background, which was crucial for Binance as regulatory pressure mounted.

Understandably, the crypto community, especially traders, did not take Zhao’s exit well when it happened in November 2023. Binance coin, which powers the exchange ecosystem, tanked 10% to $240. Data shows over $3 million of bullish BNB bets were liquidated within an hour. That’s one of the highest numbers observed in just 90 days in 2023, so skepticism was running high at the time. Some are worried things could snowball into a long squeeze, where folks continue to sell and drive the price down further.

So uncertainty rules the roost for now in crypto-land! While some see BNB’s drop as a buying chance, others are shying away until the dust settles. Regulatory woes and the leadership change continue to steer market sentiment. So, if you’re still looking to buy Binance Coin, be sure to monitor how this volatile story unfolds closely.

BNB: Should you buy into the hype?

Now that you know what BNB is and how it works, is it worth buying? Here’s a quick list of pros and cons

Pros

- Low fees and high transaction throughput

- Diverse ecosystem of DApps

- Active developer community

- Uses the best parts of Cosmos and Ethereum blockchains

- Allows you to purchase crypto at a discount on Binance

Cons

- Uses of PoSA mechanism

- Accusations of blockchain manipulation

- Binance’s regulatory woes can impact prices

Is BNB a good investment for you?

Whether or not BNB is a good investment for you largely depends on your personal financial goals. However, there are a few things that you should keep in mind before investing. Mainly, BNB is a proof-of-authority blockchain operated by Binance-approved validators. This carries counterparty risk for every DApp, smart contract, and user on BNB.

Moreover, the BNB chain is also accused of not being a “blockchain” at all. While the BNB coin does have impressive price performance, the Binance name attached to the crypto is not enough to overlook the high-risk concerns of the blockchain.

BNB price prediction 2024/2025/2030

If you are still interested in the Binance coin, you may want to know how the price will perform in the future. Refer to our BNB price prediction for a more in-depth analysis. In brief, our experts predict that the BNB coin will be $298.30 in 2024, $347.20 in 2025, and $1352.20 in 2030. Note that no prediction is 100% accurate, and in the volatile crypto space, circumstances can change quickly. Always DYOR as opposed to relying on a single price prediction.

Buy BNB with caution

BNB is one of the few EVM-compatible, layer-1, Ethereum alternatives that has actually secured a significant amount of adoption. It has stood the test of time. But, as is commonly noted in finance, past performance does not indicate future results. If you are keen to buy BNB, choose a reputable exchange, practice good crypto wallet security, and never invest more than you can afford to lose.

Frequently asked questions

What is BNB crypto?

What’s the difference between BNB and Bitcoin?

How can I buy BNB crypto?

Where can I buy $1 worth of BNB?

How can I buy BNB in the U.S.?

Is BNB legal in the U.S.?

What is the cheapest way to buy BNB?

Is BNB cheaper than Ethereum?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.