The Telegram app, traditionally a messaging platform, is shaking up the crypto space with its innovative bot tokens. But what are they, and how do they work? This guide covers everything you need to know about the top Telegram bot coins and their impact on crypto trading.

Buy & trade UNIBOT and other Telegram bot tokens on BeInCrypto’s most loved exchanges

BingX

Up to 150x leveraged trading, copy trading and over 600 spot coins

MEXC

No spot trading fees, great liquidity for futures with 0 maker fees

GateIO

Over over 1,700 cryptocurrencies available for trading

What are Telegram bot coins?

One of the flagship features of Telegram, the popular cloud-based messaging app, is its Telegram bots — or just bots for short. Telegram bots are like virtual assistants. They allow you to automate a multitude of tasks depending on your personal needs. Recently, these bots have found a unique product market fit in decentralized finance (DeFi).

Thanks to a few, mostly anonymous devs, users can now conveniently access essential DeFi services from their Telegram accounts. These bots alleviate certain challenges associated with trading on DEXs and facilitate fast and cost-effective transactions.

You can use them for a variety of specific DeFi purposes, such as trading on decentralized exchanges (DEXs), wallet management, yield farming, token sniping, and more. Telegram bot coins are the native tokens of these unique Telegram bots.

Telegram bot coins vs. meme coins

The increasing popularity and remarkable performance of Telegram bot coins have led some people to compare this phenomenon with that of meme coins. Like meme coins, Telegram bot coins possess mostly extrinsic value. In other words, they aren’t necessary for the performance of the bots. However, a few tokens allow holders to take advantage of lower trading fees, revenue sharing, or other exclusive benefits.

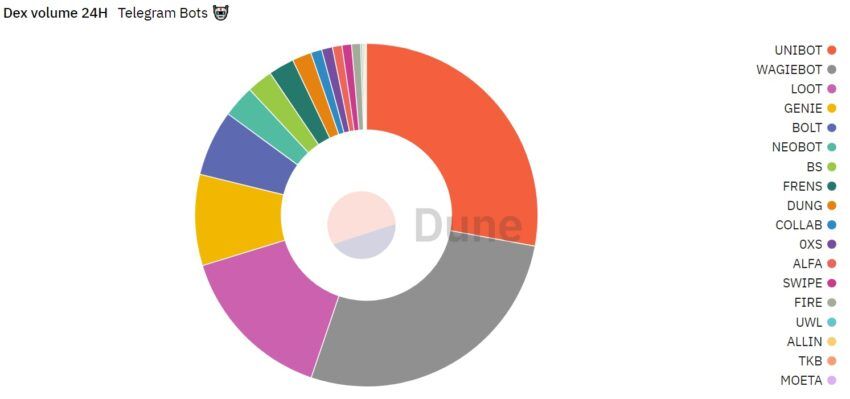

In contrast to meme coins, Telegram Bot Coins have demonstrated a better-than-average performance than the global market, indicating a potential bullish trend. The daily volume surged from $10.4 million to $15.1 million between July 19, 2023, and July 20, 2023, as per data from Dune Analytics. Furthermore, as of Aug. 5, 2023, the total market cap of Telegram bot coins has surged to $192 million.

One example is Unibot, a top-ranked Telegram bot coin that allows fast trading on Uniswap. This combination of speed and convenience has made UniBot rapidly popular.

And it’s not just UniBot. Other bot coins like Bolt Bot, Genie Bot, OxSniper, and Wagie Bot have all experienced significant growth in Q2 2023. This success, although dependent on market conditions and potentially unsustainable, has attracted considerable attention from traders and investors.

Top 5 Telegram bot coins

1. UNIBOT

UniBot is a high-speed Telegram bot that allows swift trading or ‘sniping’ on the Uniswap platform with a minimal transaction fee of 1%. It is distinguished from similar platforms due to its remarkable speed. UniBot is powered by advanced algorithms and a robust infrastructure that includes private nodes, transaction options for buying/selling tokens, and a token tracker.

Holding the UNIBOT token presents several benefits, such as reduced fees, access to premium nodes for faster transactions, and advanced features like Miner Extractable Value (MEV) protection and private transactions. Some of the tools provided by UNIBOT include a quick Buy/Sell platform, a ‘Mirror Sniper’ for copying trades, a token launch channel for updates on new tokens, ‘Method Sniper’ for specifying up to 3 tokens for sniping at launch, and wallet management for tracking profit/loss and token values.

- Supports order types

- Private transactions

- Revenue sharing

- Variable fee

2. IMGNAI

Image Generation AI is a Telegram bot that employs artificial intelligence to transform text into anime, 3D, or hyper-realistic images through its primary product, Nai. While Nai is free to use as of August 2023, there are plans to launch a premium version (Nai Premium) that would allow users access to exclusive art styles and models, remove watermarks, upscale and render images in 4K, and even mint them into NFTs.

What sets ImgnAI apart is its unique stake-to-earn model that promises a share of its revenue to $imgnAI token holders who choose to lock up their tokens. This revenue can be generated from multiple sources, including paid advertisements on the Nai bot, the web app, NFT sales, and paid partnerships.

ImgnAI Telegram bot coin serves mainly as a utility token, allowing holders to unlock premium features on the web app, such as HD & 4K resolution, upscaling, remixing, and exclusive models. It can also be used to directly mint images as NFTs. The $imgnAI team also offers access to unreleased beta models to community members holding at least 100,000 $imgnAI tokens.

- Tokens unlock exclusive features

- Also available on Discord

- High threshold to gain exclusive features

3. CGPT

ChainGPT is an advanced AI model explicitly built for blockchain technology. ChainGPT offers features such as a no-code smart contract generator, smart contract auditor, code debugger, code-to-words, documentation creator, chart analysis & technical analysis, AML features, blockchain analytics, live on-chain data, and crypto news.

The ChainGPT (CGPT) token is the lifeblood of the ChainGPT ecosystem. It offers numerous benefits to its holders, such as access to the ChainGPT AI Model and all the utilities and tools powered by this model. Holders can also use it for staking and farming opportunities, including access to the AI model and earning rewards in $CGPT for providing liquidity to certain pools.

Half of all the fees and profits collected by the ChainGPT tools & utilities are burned, increasing the value of $CGPT for holders. The other half is used for the growth and sustainability of the ChainGPT organization, ensuring continued user benefits.

- Token burning mechanism

- Smart contract generation and auditing

- Can use token for staking and farming

- Using AI to audit and create smart contracts carries risks

4. DCK

DexCheck is a platform developed to analyze DEXs. It offers a comprehensive suite of tools designed to enhance users’ crypto and NFT trading experience. You can use it to get an overview of the crypto market, including crypto trading volume, market cap, top tokens, and crypto news, while the AI-driven GPTBoard presents an easily readable dashboard with diverse data.

The PRO features offer insights from top crypto and NFT traders, smart money leaderboard, and the AI-powered InsightsGPT for real-time DEXs insights. The platform also includes trackers for crypto and NFT whales and the “Address Analyzer” for understanding successful trading strategies. Additionally, DexCheck provides a “Token Unlocks Dashboard” for upcoming token events and Telegram bots for efficient wallet monitoring and swift token swaps.

Its utility token DexCheck (DCK), grants access to access to DexCheck PRO platform, gives holders rights to vote in the DAO, and can be used for staking.

- Wallet tracking

- Token scanning and sniping

- Free to use

- Multiple wallet management

- Using Telegram token bots to trade carries risks

5. TKB

TokenBot is an automated copy-trading platform for social trading groups on messaging apps like Discord, Telegram, and Slack. It monitors an admin’s exchange account and notifies group members of their crypto trading activities in real time.

TokenBot supports major spot and futures exchanges, with plans to expand further. You connect your API key in the TokenBot dashboard and add the bot to your group chat, where it shares trades without a fee. Users who want to copy trades can do so at a price you set, with TokenBot taking 10%-30% of the subscription price. Trades are shared in near real-time thanks to its direct connection to the exchange WebSockets API. For security, the platform uses hardware encryption and IP-restricted API keys. TokenBot currently supports centralized exchanges but plans to support DEXs like dYdX.

- Social trading

- Supports major spot and futures exchanges

- Does not currently support DEX trading

Does Telegram have a token?

The Open Network, originally the Telegram Open Network, was first developed partly to create a crypto token. Gram was intended as a utility coin to facilitate transactions within the Telegram messaging platform. However, legal issues quickly abounded after Telegram raised almost $1.7 billion for the TON platform in two private token sale ICO rounds in February and March 2018.

The SEC’s legal case led to the separation of the renamed “The Open Network” from the Telegram team. Now, the TON Foundation oversees Toncoin (TON). It is entirely separate from Telegram, which does not have a native token.

In June 2020, Telegram reached an $18.5 million civil settlement with the U.S. Securities and Exchange Commission and pledged to return the cash investors had put into the TON token. The messaging app’s founder Dural Pav criticized the regulator’s ruling heavily, writing on his Telegram channel:

Unfortunately, a U.S. court stopped TON from happening. How? Imagine that several people put their money together to build a gold mine — and to later split the gold that comes out of it. Then a judge comes and says: “These people invested in the gold mine because they were looking for profits. And they didn’t want that gold for themselves, they wanted to sell it to other people. Because of this, they are not allowed to get the gold.”

Dural Pav via Telegram

Did you know? The SEC uses the Howey Test as a framework to check if a specific investment contract adheres to federal securities law and if it qualifies as a security.

In the case of Gram, the court did not find the tokens themselves or the purchase agreements standing alone to be securities. However, the court concluded that the entire presale scheme as a whole could be considered securities and thus must be regulated as such.

So what is The Open Network?

The Open Network (TON) is a decentralized layer-1 blockchain that aims for scalability to draw billions of users. It uses a bridge system to connect different networks. TON, its native cryptocurrency, handles fees and governance. The network features blockchain sharding for efficiency, a proof-of-stake system for transaction validation, and smart contracts for managing participants. TON accepts tokens as payment for services and applications within its blockchain. Its design aims to make blockchain technology accessible to everyone.

While The Open Network is not affiliated with Telegram, users can buy and send TON through the Wallet Bot on the decentralized messaging app. Users employ the token to cover fees associated with executing smart contracts, operating decentralized applications (DApps), participating in governance, and staking in the network’s consensus mechanism.

What is the Telegram token used for?

After Telegram was forced to abandon Gram by the SEC, Toncoin (TON) has effectively (yet crucially not officially) taken its place. Toncoin primarily serves to expedite payments and transactions within the Telegram messaging app, other networks, and apps and services built on the TON network but it is not a “native” coin, as per Telegram’s press office.

TON’s system allows users to make instant payments within chats and transfer crypto to friends simply by typing their nicknames instead of lengthy wallet addresses. Moreover, the initial distribution of TON employed a “fair” method that enabled all community members to mine the tokens. It then switched to a more efficient proof-of-stake system.

How useful are Telegram bot coins?

Telegram bot coins offer a range of useful features, such as trading on the best-decentralized exchanges, managing digital wallets, and yield farming, all from within the decentralized messaging platform.

Unlike some cryptocurrencies that are driven by hype (e.g., meme coins), Telegram bot coins offer tangible uses that give investors confidence. However, like all investments, they come with potential risks. Investors must thoroughly research, understand the technology, and evaluate the team behind these assets before investing.

Frequently asked questions

Which is the best Telegram bot coin?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.