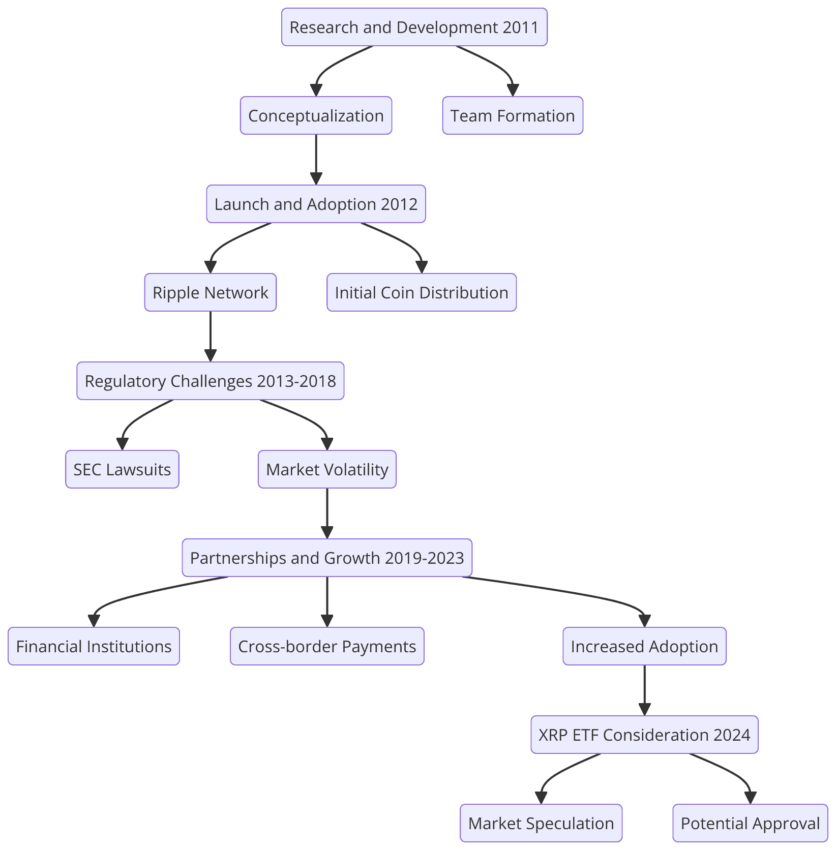

XRP ETFs are yet to be officially available in the U.S. However, with Bitcoin and Ethereum ETFs already approved, the focus is shifting to the potential of Solana and XRP ETFs in 2024. This XRP ETF guide explains everything about XRP-specific exchange-traded funds (ETFs). We cover their global availability, benefits, and risks, plus the relevance of SEC regulations in the U.S. and the investment process.

KEY TAKEAWAYS

• XRP ETFs offer indirect ownership of the asset via shares of the ETF

• There has been no approval of XRP ETFs in the U.S. as yet, but many commentators increasingly point to the likelihood

• XRP ETF approval would further legitimize the crypto space, signaling maturity to institutional investors

What is an XRP ETF?

An XRP ETF or exchange-traded fund tracks the value of the Ripple Labs’ cryptocurrency, XRP. By purchasing shares in an XRP ETF, investors can gain exposure to XRP’s performance without having to directly buy, store, or manage the digital currency themselves.

Think of an XRP ETF as a financial product that holds XRP as its underlying asset. The fund’s management issues shares to investors. These shares can then be traded on financial markets, just like stocks. The primary goal of an XRP ETF is to track the asset’s price, providing investors with a way to profit from the price movements of XRP without directly holding the crypto.

“XRP ETF will change the XRP supply available and cause higher XRP prices.”

Will Fix, crypto analyst: Written on X

How does an XRP ETF compare with a direct XRP investment?

Investing directly in XRP involves purchasing the asset and storing it in a crypto wallet. This method can still be somewhat complex for non-web3 natives and carries some security risks.

In comparison, investing in an XRP ETF offers a more simple, secure way to gain exposure to XRP, as the fund handles the storage and management of digital assets.

XRP ETF price: How is it determined?

A number of factors are behind the price determination and standardization of XRP ETFs. Let’s take a look.

Creation and redemption

This process involves authorized participants who purchase large quantities of XRP when the demand for the ETF increases. The APs then deliver the XRP units to the ETF provider. In exchange, the ETF provider issues new shares of the XRP ETF to the APs. This process increases the supply of ETF shares, ensuring that the ETF price does not deviate significantly from the XRP price.

The redemption part happens when the demand for the XRP ETF decreases. The APs return ETF shares to the ETF provider. The ETF provider then returns the corresponding amount of XRP to the APs. This arc lowers the supply of ETF shares, aligning the XRP ETF price with the underlying asset.

Other factors

Besides the creation-redemption cycle, other factors influencing the price of the XRP ETF include market liquidity, the participation of institutional investors or lack thereof, regulatory challenges, and more.

How will an XRP ETF work?

While the value of XRP mostly determines the market price of an XRP ETF, several elements are involved, including the Net Asset Value (NAV). The NAV is calculated by dividing the total value of the XRP held by the fund by the number of outstanding ETF shares. This provides a benchmark for the ETF’s market price.

Another approach to understanding how XRP ETFs work is to look at the arbitrage opportunities in play. APs exploit arbitrage opportunities to keep the ETF price in line with the NAV. If the ETF shares trade at a premium (above NAV), APs can sell them and buy XRP, then redeem them for XRP. If the ETF shares trade at a discount (below NAV), APs can buy them and sell XRP, then create new ETF shares with the XRP.

This cycle, which is also part of the creation-redemption arc, keeps the price of an XRP ETF steady amid market volatility.

Did you know? Funds employ various methods to ensure their share prices closely follow the market price of the underlying crypto asset, including XRP for XRP ETFs. This includes using real-time pricing algorithms and making periodic adjustments to the asset pool.

What is the structure of an XRP ETF?

Any XRP ETF guide would be incomplete without us discussing the product’s structure. Here is a simplified explanation.

- Underlying asset: The core asset is XRP

- Management: Work done by professional fund managers, who are assigned the responsibility of tracking the XRP ETF price.

- Trading platforms: Once regulatory approval is obtained in compliance with SEC regulations, XRP ETFs are expected to be listed on major stock exchanges.

Understanding the risks of an XRP ETF

Like any other investment, an XRP ETF has risks. Here’s a quick list of a few.

- Market volatility

- Regulatory risks

- High management fees

- Counterparty risks involving the entities managing the ETFs

- Liquidity risks, mostly during periods of market stress

- Price tracking errors

- Technological risks related to technological failures, hacking, and more.

- Changing market sentiments and adoption

Global availability of XRP ETFs

In the U.S., XRP ETFs have not yet been approved. The Securities and Exchange Commission (SEC) remains cautious about approving crypto ETFs, with XRP being no exception. However, some bullish optimism is brewing for XRP holders and ETF seekers, particularly around the election and the potential of a second Trump presidency.

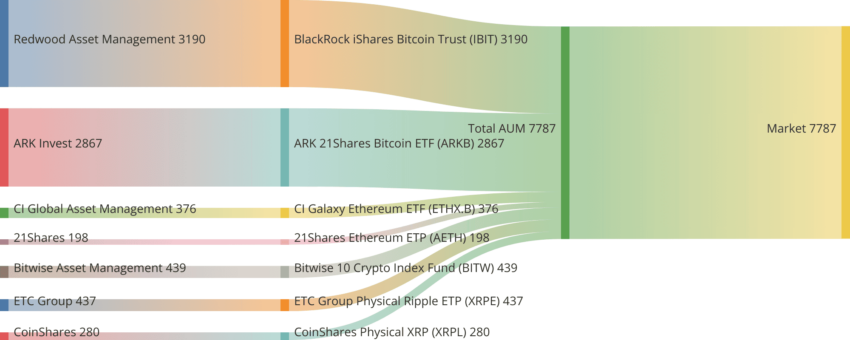

As for global availability, Europe leads the charge in adopting crypto-specific products. Several European countries have approved exchange-traded products (ETPs) that track the price of XRP.

Switzerland, known for its favorable financial markets regulations, has listed several crypto ETPs, including those tracking XRP. The SIX Swiss Exchange has been a leader in this space.

Germany has also welcomed crypto investment products. Deutsche Börse’s Xetra platform is leading the charge, listing a variety of crypto ETPs, including those specific to XRP.

Besides Europe, Singapore is known for its progressive stance on cryptocurrencies and blockchain technology. The Monetary Authority of Singapore (MAS) has established a regulatory framework that could support the introduction of XRP ETFs in the future. However, any potential here is speculative.

Here are three of the top XRP-specific crypto products trading globally that could drive further widespread adoption.

1. 21Shares Ripple XRP ETP (AXRP)

- Type: ETP

- Exchange: SIX Swiss Exchange, Switzerland

- Utility: Tracks the performance of XRP and is 100% physically backed by XRP

2. CoinShares Physical XRP (A3GRUE)

- Type: ETN

- Exchange: Xetra, Germany

- Utility: Provides exposure to the value of XRP with a collateralized debt obligation backed by physical XRP.

3. Fidelity Investments Platform XRP ETP

- Type: ETP

- Exchange: Available on Fidelity Investments’ platform, managed by 21Shares

- Utility: This ETP allows investors to gain exposure to XRP through a regulated financial product. Although initially launched by Amun AG, it now trades under the 21Shares brand.

XRP vs. XRP ETF

While we have already considered the differences between investing in an XRP ETF and the standalone XRP crypto, here are some other insights into the two options:

| Feature | XRP | XRP ETF |

| Ownership | Direct ownership of XRP | Indirect ownership via shares of the ETF |

| Management | Self-managed | Professionally managed by fund managers |

| Liquidity | Dependent on crypto exchanges | High liquidity on major stock exchanges upon approval |

| Fees | Exchange fees, wallet costs | Management fees, trading fees |

| Regulatory oversight | Varies by country | Subject to SEC regulations and other regulatory bodies |

| Accessibility | Requires understanding of crypto | Accessible via traditional brokerage accounts |

| Market volatility | High volatility | Volatility managed through diversification |

| Risk management | Self-managed risk | Professional risk management |

Notably, investing in an XRP ETF offers a more structured and regulated pathway. This makes for a more attractive option for those who prefer professional management and high liquidity despite additional fees.

XRP ETF vs. BTC ETF

Bitcoin ETFs were the first big dial change, with approval in the U.S. marking a turning point and a gateway for approval of other crypto ETFs. Here’s how a Bitcoin ETF compares against an XRP ETF.

| Feature | XRP ETF | Bitcoin ETF |

| Regulatory status | More scrutiny due to ongoing legal issues surrounding XRP | Generally more accepted and established regulatory framework for Bitcoin ETFs |

| Market maturity | Emerging, fewer products available | Mature, with several well-established products |

| Management fees, when approved | Typically higher due to niche market | Often lower due to economies of scale |

| Liquidity | High liquidity but less than Bitcoin ETFs | Very high liquidity due to broader market acceptance |

| Trading volume | Generally lower trading volumes | Higher trading volumes reflecting greater adoption |

| ETF issuers | Fewer issuers due to regulatory complexities | Multiple issuers with a wide variety of products (presently 11 issuers) |

| Market perception | Seen as more speculative | Seen as a more stable and established investment |

| Historical performance data | Limited historical data | Extensive historical data available for analysis |

| Investment use case | Often used for diversification into alternative crypto assets | Frequently used as a primary investment in digital assets |

XRP ETF vs. ETH ETF

Ethereum ETFs are the newest kids on the block. Here’s how they compare against XRP ETFs.

| Feature | XRP ETF | Ethereum ETF |

| Number of issuers | Fewer issuers, with 21Shares being one, offering services as XRP ETP | More issuers with the more prominent ones, including Fidelity, VanEck, and more. |

| Regulatory environment | XRP ETFs face more regulatory hurdles, especially in the U.S. | Ethereum ETFs have seen more favorable regulatory conditions, with several spot Ethereum ETFs approved |

| Management fees (when approved for trading) | Typically higher due to specialized market. For example, 21Shares Ripple XRP ETP has a TER of about 2.50% p.a. | Often lower due to a larger market and broader acceptance |

| Investment focus | Primarily for diversification in the crypto market | Often used for both primary investment and diversification |

Are XRP ETFs beneficial?

XRP ETFs offer a new form of portfolio diversification. While Bitcoin and ETH ETFs have become mainstream, this XRP ETF guide reveals how ETF-specific exposure to the Ripple-backed asset can offer the flavor of more volatile crypto — packaged within a regulated financial product. Overall, XRP approval would add further legitimacy to the crypto space, encouraging more institutional investors to consider decentralized assets.

Notably, you can buy XRP ETFs from traditional trading platforms, provided they are listed in your region. While this allows for a level of security, remember that all investment products carry risk, and profits are never guaranteed. With legal proceedings ongoing, note that XRP as an asset also isn’t an SEC favorite. This counts against the likelihood of an incoming or quick XRP ETF approval in the U.S.

Frequently asked questions

What does an XRP ETF mean?

Is there an ETF for XRP?

What is an ETF in crypto?

How to buy XRP ETF?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.