BlackRock CEO Larry Fink recently addressed the Group of Seven (G7) leaders. He highlighted a significant shift in the global financial system.

Fink emphasized the growing role of capital markets as the primary source of private-sector financing. This change signals a pressing need for new strategies to unlock financial potential.

Larry Fink: The “Growth Dilemma”

In a keynote address, Fink highlighted a pressing “growth dilemma” impacting emerging economies and established economic powers.

“The International Monetary Fund and the World Bank were created 80 years ago when banks, not markets, financed most things. Today, the financial world is flipped. The capital markets are the biggest source of private sector financing,” Fink noted.

Recent reforms have already yielded significant results, with billions of dollars funneled into infrastructure in developing countries. However, he emphasized the necessity for a new approach to unlocking capital, which differs from traditional bank balance sheet models.

As a result, Fink announced the formation of the Investor Coalition, including BlackRock, GIP, and KKR, which will commit $25 billion to Asia’s emerging economies. This initiative mirrors efforts in Africa, aiming to stimulate economic growth through infrastructure investments.

Fink stressed that the need for growth extends beyond emerging economies.

“Great economic powers, including the G7, are in fact on the list. Indeed, growth going forward. All of us are staring down a growth dilemma, whether we solve it or not. It’s a significant economic fork in the road for our countries,” he stated.

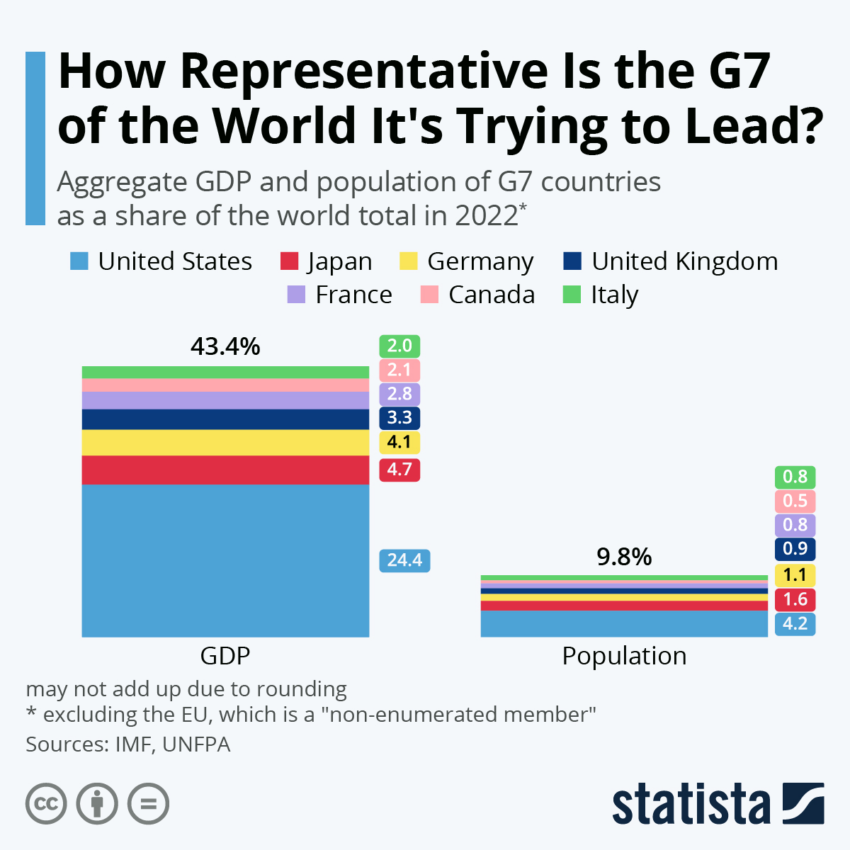

With G7 countries averaging a debt-to-GDP ratio of 129%, traditional methods of taxation and spending cuts are insufficient. Fink argued that genuine growth is essential to overcoming this economic hurdle, though achieving it is increasingly challenging due to demographic shifts and declining working-age populations.

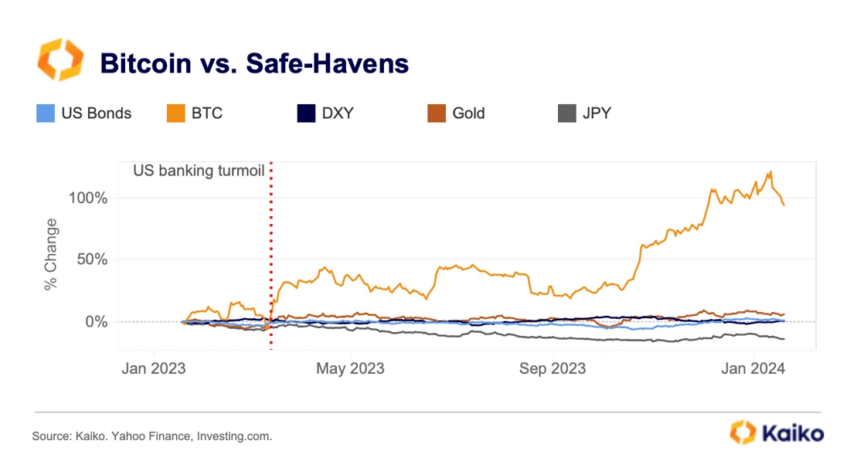

Amid these economic concerns, Bitcoin has garnered attention as a potential safe haven. Analysts at blockchain analytics firm Kaiko have observed large institutional players, such as Franklin Templeton, Fidelity, and even BlackRock, lauding Bitcoin’s safe-haven characteristics.

Unlike traditional safe havens, Bitcoin offers higher returns and a low correlation with equities, particularly during market turmoil.

Kaiko’s analysis reveals that Bitcoin’s 60-day correlation with the Nasdaq 100 has significantly decreased over the past year, averaging close to zero since June 2023. This low correlation enhances its appeal as a safe haven, especially during financial crises, such as last year’s US banking crisis, where Bitcoin outperformed traditional assets like gold and US bonds.

The introduction of spot Bitcoin exchange-traded funds (ETFs) in the US has also seen strong demand, with more than $15 billion in net inflow since its launch in January 2024. These ETFs benefit from Bitcoin’s asymmetric returns and its reputation as a reliable asset during economic instability. However, Matteo Greco, Research Analyst at Fineqia, told BeInCrypto about the challenges these new financial products bring.

“I believe the role of Bitcoin and the digital assets space will become increasingly significant each year. However, I also expect its correlation with traditional finance markets to grow as traditional finance investor adoption increases. For example, we are already seeing this pattern with Bitcoin now being traded mainly from Monday to Friday during US market hours, aligning with the trading hours of spot Bitcoin ETFs,” Greco said.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

As the global economy faces unprecedented challenges, Bitcoin’s role as a safe haven becomes increasingly significant. With institutional endorsements, Bitcoin stands out as a viable option for investors seeking stability amid economic uncertainty.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.