In recent years, DeFi has emerged as an alternative to traditional banking, offering everything a commercial bank offers, thereby eliminating the need for third parties. As a result, the rate of people investing in the frenzy is increasing at a reeling rate. As of March 2020, thousands of DeFi projects have emerged offering different services, including lending and borrowing, yield farming, APY earn and many other benefits globally. This has led to the birth of Aave. So, what is Aave?

This guide provides a simplified explanation of what it entails. Let’s explore.

In this guide:

What is Aave?

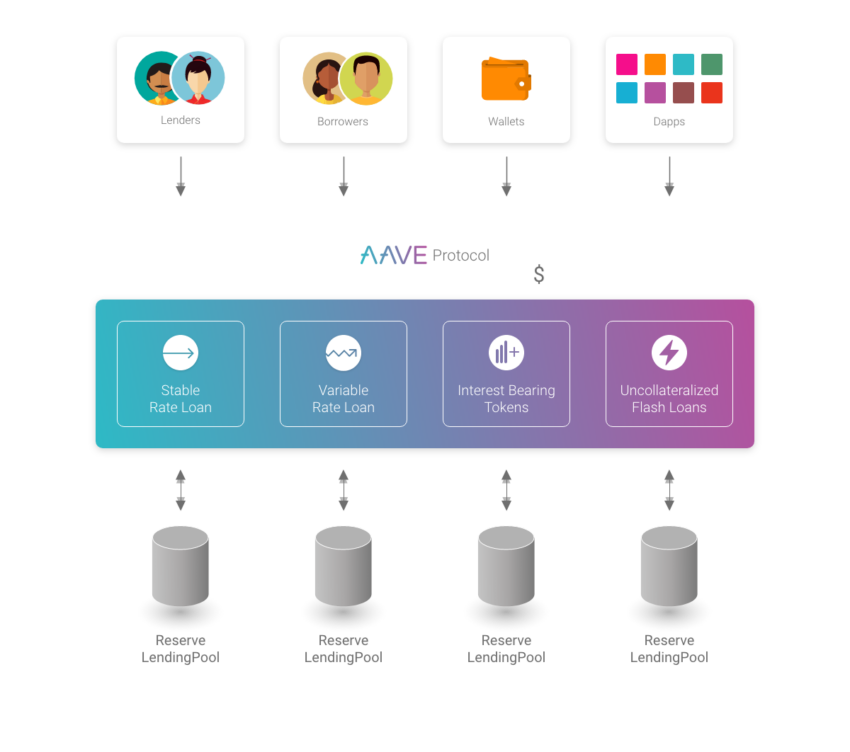

Aave is a non-custodial, completely decentralized, community-governed protocol that allows people to earn interest, borrow assets, and build applications within its ecosystem. The platform is known to be the world’s largest peer-to-peer loan provider.

It allows users to earn rewards by putting funds into the protocol or borrowing funds deposited by another user. Essentially, it does this in a trustless manner by eliminating the need for intermediaries, like banks.

Aave protocol implements peer-to-peer lending. Meaning, it doesn’t interfere with the cryptocurrencies deposited by users. As a result, Aave’s mode of operation is quite different from the conventional and centralized financial service providers.

Aave runs on Ethereum, Polygon, Arbitrum and other Ethereum scaling blockchains. Users can borrow and lend stablecoins, altcoins, and other available crypto assets. The project is governed by the AAVE token, and thr token holders can vote on the ecosystem’s overall development.

To fully understand what the project entails, let’s look at its background.

History of Aave

The whole concept of Aave was started in 2017 by Stani Kulechov and a team of other developers to build what is called EtherLoan. An idea that revolves around connecting lenders to borrowers. This was based on a peer-to-peer model, all going smoothly until it encountered a few problems. These issues involved linking borrowers to lenders and liquidity.

Solving these issues, in early 2020, the platform changed its model from peer-to-peer to peer-to-contract, causing a total rebrand from ETHLend to Aave.

ETHLend

ETHLend, founded in 2017 by Stani Kulechov and a team of developers, is a peer-to-peer lending protocol. It features the basic functionalities of decentralized finance. The development was sustained via an initial coin offering (ICO) at the end of 2017, raising about $16.2 million.

The first version of ETHLend ran on the Ethereum blockchain in early 2017, which brought about several exciting activities in the Ethereum system.

The platform offers crypto asset-based loans that allow users to spend funds without selling their crypto holdings. As a result, borrowers can apply for loans by using their cryptocurrency assets as collateral to receive spendable funds.

ETHLend utilized the peer-to-peer model, which matches users with other users via smart contracts. However, the team realized it was pretty inefficient as there are sometimes difficulties in matching lenders and borrowers. So they came up with a total rebrand.

Rebranding

In Sep. 2018, ETHLend transitioned into a peer-to-contract model. This model offers swift transactions within the system, allowing instant access to funds in the liquidity pool. This solves the challenge of the user’s waiting time and fastens the whole process of accessing the decentralized protocol.

The platform changed the name from ETHLend to Aave.

Aave is a Finnish word for ghost. This means all transactions are done transparently and anonymously.

Aave

In Jan. 2020, the Aave protocol started fully on the Ethereum network and acquired a U.K. Financial Conduct Authority license. Aave is among the popular founders of DeFi protocols, and it performs the basic functionalities of Defi.

How does Aave work?

Following the rebranding of ETHLend, Aave allows users to request loans and earn rewards by lending. A user can identify as a borrower or as a lender.

Its working principle involves users supplying assets into the liquidity protocol and starting earning interest in proportion to the asset supply interest rate.

For example, a user can choose to supply USDT and start earning interest in USDT.

Once USDT has been supplied by the lenders, it gives borrowers access to the USDT. On one condition, borrowers have to pledge an asset as collateral.

The interest rate for lenders and those requesting loans is decided automatically:

- For borrowers, it depends on the availability of funds — the total amount of funds present in the pool at a specific time. So, naturally, as funds are borrowed from the liquidity, the amount of funds available decreases, which increases the interest rate.

- For lenders, the interest rate is equivalent to the earn rate, with a set of codes securing the pool reserve to ensure steady withdrawals at any given time.

Distinctively, even with the varying interest rate, Aave provides its users stable borrow rates.

Overcollateralization

Notably, just as on other platforms such as Compound and Uniswap, all loans on Aave are overcollateralized. This means the provided collateral is pretty higher than the amount that can be borrowed. So, for example, if you want to borrow $150 USDT, you have to provide more of that as collateral.

This concept balances the network and protects users from the risks that come with not being able to repay depositors.

Lenders/depositors who supply liquidity to the protocol receive aTokens. The value of aTokens is equivalent to the value of the base token at a balanced ratio.

What is aToken? It is the deposit amount plus the interest earned. Its value increases with the present protocol’s interest borrowed rate.

aTokens are ERC20 tokens, and they are quite flexible in the sense that you can send the token to friends, and it keeps accruing interest in their wallet.

In addition, Aave is open-ended. It allows users to receive loans in another asset than they deposited. For example, a user can provide Ethereum (ETH) into the pool, then receive USDT to earn a standard yield.

Features of Aave

Aave has several catchy features that make it different from its competitors. Asides from features like overcollateralization, there are features like FlashLoans, creating a leveraged position, and so on.

Flash Loans

This is a type of loan Aave offers that allows users to borrow any amount of funds without providing any collateral. Flash Loans can only be paid back into the same block that they borrowed.

Aave is the first platform to utilize the use of flash loans. The loans can be used to trade (buy and sell) assets and then repay the original amount plus an additional 0.09% of the borrowed amount.

Flash loans offer lesser risk to users since it has to be repaid within the same block. The only associated risk can be platform and smart contract risks. Currently, users have borrowed assets worth up to $19 million on the Aave platform, with about $5 billion total flash loans.

The idea of flash loans can be useful in maximizing profit while trading arbitrage. For example, say there is a price discrepancy in the USDT/DAI pools between Compound and Uniswap. You can trade 1 USDT for 1 DAI on Uniswap, but you only need 0.99 USDT to buy 1 DAI on Compound. Here’s the best strategy.

- Borrow 50,000 USDT from Aave via flash loan

- Swap 50,000 USDT for DAI on Compound and receive 50,505 DAI

- Swap 50,505 DAI for 50,505 USDT on Uniswap

- Repay original 50,000 DAI + 0.09% fee = 50,045

- Profit 460 USDT

Collateral trading

The Aave protocol allows users to swap deposited assets, whether used as collateral or not. This is done by creating a leveraged position, which involves using what is called a Flash Loan contract and receiver contract to swap assets to the preferred asset.

To better understand this, let’s imagine a user has 200 ETH and 40 UNI deposited in the protocol, with a loan of 100 DAI. He wants to swap both his deposited ETH and UNI to AAVE, without going through the stress of paying back the loan within one transaction.

He can do this by sending the assets to a receiver contract which then swaps the amount of ETH and UNI to AAVE via a decentralized exchange. Finally, the contract will supply the equivalent amount in AAVE into the Aave Protocol.

Paying back with collateral

The latest version of the Aave protocol also allows users with one of many assets deposited as collateral in the protocol to use them to pay back part or full of their loans.

Unlike the conventional loan providers, you don’t have to pay your loans all back at once or on a fixed date.

Credit delegation

Credit delegation gives users access to the liquidity pool without pledging any collateral. This feature is essential when there is a need to give credit to a platform, crypto exchange, or any DeFi protocol under given conditions.

The AAVE token

AAVE is the innate token of the Aave protocol, and it runs all the basic transactions within the system. Its holders can decide on possible updates to the protocol, including market parameters and funds reverse management.

This protocol features another token called aToken. This is what lenders get when they deposit their assets into the pool.

Background

ETHLend, an initial token of Aave protocol, had its ICO in late 2017 and raised about $16.2 million. The price debuted at $0.016 a token. Since the protocol is based on Ethereum, these tokens were ERC-20 with a non-inflationary structure.

In mid-2020, Aave launched its token swap. The total circulating of 1.3 billion LEND tokens could be swapped for the newly introduced token, AAVE tokens, at the rate of 100 LEND for 1 AAVE. This created a circulating supply of about 13 million AAVE.

AAVE tokenomics

AAVE utilizes the decentralization and autonomy of the Aave Protocol. It offers governance and financial rewards. The token shares the power between stakeholders within the Aave ecosystem to secure the Aave Protocol.

The allocation and distribution of tokens include:

- Core development 30%

- User experience development 20%

- Management and legal 20%

- Promotions and marketing 20%

- Miscellaneous costs 10%

Token supply: The token was launched via a crowd sale with an initial of 1.3billion LEND tokens. The initial supply distribution of AAVE accounted for 23% for founders and project and 77% for investors.

Market Capitalization: The total market cap of AAVE is about $2.7 billion with a maximum supply of $16 million. Aave currently has over $21 billion of liquidity locked in AAVE across 7 networks and 13 markets.

Token usage: AAVE is a deflationary token, and asides from governance and other primary, the platform aims to use locked AAVE tokens as a mitigation tool in case of any liquidity slippage in the Aave protocol.

Where to buy AAVE?

Aave is a popular DeFi protocol making it available on virtually all the popular crypto exchanges, including Binance, Coinbase, Kraken, and many others.

In terms of compatible wallets, since the protocol is built for Ethereum, it only supports EVM-compatible wallets. The supported wallets include Ledger, Portis, Ethereum, Coinbase Wallet, MEW wallet, MetaMask, Torus, Fortmatic, imToken, and Wallet Connect.

What’s the AAVE token used for?

AAVE is used for multiple functions, including governance, staking, and trading. Basically, the token provides governance to the platform’s protocol. It also allows users to lock up their AAVE token to contribute to the subsequent updates of the network.

Is Aave really worth it?

Aave seems to be a great protocol for all levels of crypto enthusiasts, offering some unique features and benefits for all users. Just as other DeFi lending protocols, it offers creative tools to allow users to implement the basic functionalities of the Aave protocol into their own DeFi projects.

The platform just announced the launch of its V3, which features a better interface, reduced gas fees, and other fascinating features. However, just as with Compound and other DeFi lending protocols, it is important to know that users can be exposed to smart contract, market, and liquidity risks.

Frequently asked questions

What is Aave?

Is Aave crypto a good investment?

How do you use AAVE?

Why is the Aave coin popular?

Is Aave safe?

How does Aave make money?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.