If you are a cryptocurrency trader and you wish to start using a broker, you should know that there are a lot of different order types that can really help you out.

These different order types are given to the broker by the trader in order to specify when and how the broker is supposed to act on your behalf. Basically, these are specific instructions that you can use to your advantage to make gains or control losses, at least to an extent.

Today, our focus is a specific type of order, known as stop-limit. We will discuss what it is, how it works, and how it differs from other, similar orders in the trading industry.

What is a Stop-Limit Order?

A stop-limit order is a conditional trade, which takes place over a certain timeframe. The timeframe combines the features of two order types — stop order and limit order, essentially using them to make a new order, which is a stop-limit order.

In order to understand how stop-limit order works, let’s take a look at what stop and limit orders do, first.

When you place a limit order or stop order, you essentially tell your broker that you want your order to be executed under specific conditions. That means that the broker should not do it right away, under the current market price, but should instead wait for the price to reach a certain high or low, depending on what you want to do.

So, what is the difference between them?

- A limit order can be seen by the market. Meanwhile, a stop order remains invisible until the targeted price is reached, and the order gets triggered.

In other words, a limit order can be seen by the market and sellers can fill it when they are willing to meet the price. On the other hand, a stop order acts as a two-part order, which first needs to be met, and it then turns into a limit order, as it becomes visible to the market.

How Does a Stop-Limit Order Work?

To start off, we should note that stop-limit orders require the setting of two different price points. The first one is ‘Stop’, which is the start of the specified target price, while the other is a ‘Limit’, which is outside of the price that you target for the trade.

In addition to that, a broker will also need you to decide on the timeframe, during which the order should be considered executable.

The ability to decide on these conditions gives you, the trader, very precise control over when the order is to be filled. However, there is also a potential downside to this, which is the lack of a guarantee that your trade will ever be executed.

You see, if your instructions say that the trade should be executed only when the price reaches a certain high or low, and the price never goes that high up or down, the trade will not take place. However, more than that, you need the price to reach the desired levels during the set timeframe, too.

So, you see, while you can be rather precise with your instructions, the price needs to behave in a very specific way to meet your conditions, and do it within a selected timeframe.

Stop-Loss vs Stop-Limit

Another thing to note is that stop-limit orders are not the same as stop-loss orders. While both can be used for the same purpose of limiting your loss and preventing it from growing too big, there are differences that separate them.

Stop-loss orders, for example, can be split into two different types — ‘sell stop orders’ and ‘buy stop orders’.

Sell-stop orders are there to protect long positions, and they do so by triggering a sell order should the price fall below the level you are comfortable with. In other words, if you believe that the price will grow, you would enter a long position. However, just in case your assumption is wrong, you should secure the value of your investment by requesting a sale if the price starts falling.

Buy-stop orders are the same in theory, except they are there to protect short positions. In other words, if you bet that the price will go down, and it starts rising, you could lose your money. You can prevent this by setting a stop or triggering a sale order instantly as soon as the price reaches a certain limit, thus protecting your losses.

That is how it differs from the stop-limit order which, as mentioned above, contains a stop price and a limit price, and it executes once the asset’s price is either at the limit price or better.

Trailing Stop

One more thing to note here is the existence of the so-called trailing stops, which can be combined with the stop-loss. This works in such a way that it allows trade orders where the stop-loss price is not fixed at a specific amount.

Instead, it is tied to a certain percentage or amount, which can be found below the market price. That way, when the price goes up, the trailing stop will trail after it. In other words, it won’t remain fixed in place, but it will move up in regard to the price itself. As soon as the price stops growing, the trailing stop will stay in place as well.

In a way, it is automatic protection of an investor’s downside, which will keep moving alongside the price as long as the price itself moves in the desired direction. If, on the other hand, the price goes towards the trailing stop, it will trigger it and the investor will be saved from experiencing heavy losses.

Why are Stop-Limit and Other Orders Helpful?

Stop-loss, limit, trailing stop, and stop-limit orders are a great tool for protecting your investment from major losses, as they allow you to remove emotions from the picture.

Any asset that you can trade suffers from certain price volatility, that is what allows people to trade and earn a profit in the first place. However, when it comes to crypto, specifically, such volatility is quite large.

Bitcoin is known for sinking or surging by hundreds, or even thousands of dollars within hours, or even minutes. This often leads to an emotional response from the trader, who is willing to risk more in order to earn a bit more. If the price suddenly starts going down, most traders would refuse to complete the trade, hoping that this is just a minor step back before the surge continues.

However, in most cases, this is not true, and they lose the opportunity to earn a decent amount because greed forces them to hope for an even bigger one than that.

With these orders set into place while you are able to think with a cool head, you can prevent yourself from damaging your own trade. Give the instructions, and stick to them. Even if the price does end up taking a step back and then continuing the surge, it is better to exit when the conditions are met,

Losing profit is better than seeing losses. New opportunities will come in due time, and you will still have some money to exploit them. But, if you lose everything, you are left with nothing, and no matter how many opportunities arrive, you won’t be able to make use of them.

This is why platforms such as StormGain offer all kinds of different orders that would let you be as precise with your trade as you wish.

How to Start Trading on StormGain

StormGain is a very user-friendly platform for buying cryptocurrencies. You can buy Bitcoin with ease, and do it with your credit card directly. Not only that, but you can even get 10% interest on your crypto deposits if you already own some coins.

The platform has low fees and great benefits, such as the possibility of using a demo account for testing trades without any risk. It also lets you trade futures contracts on 6 major coins with a multiplier up to 200x, which is a lot more than what you will get on most other platforms.

Best of all, it is really easy to start using it. All you need to do is register and start earning.

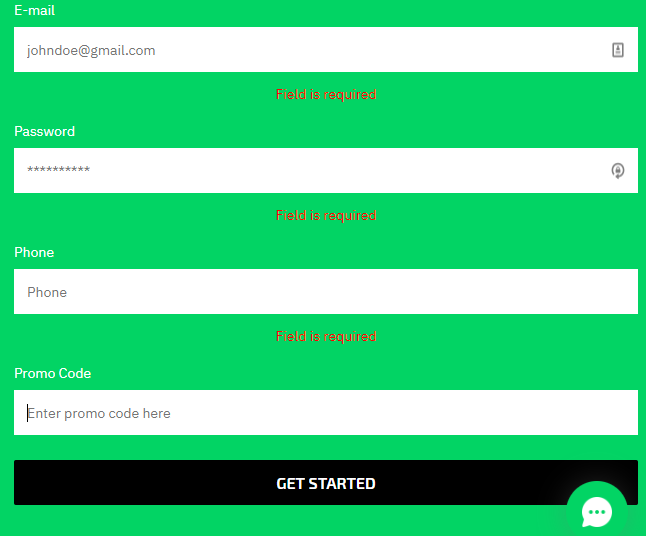

To start, get a free StormGain account. This is as simple as it sounds. Just go to StormGain’s website and enter your email, password, and phone number.

After that, hit ‘Get Started,’ and you will do just that.

You will receive an email that will notify you of your account creation, and another that will welcome you, share some tips and possibilities, and help you get funds to your account.

From this point on:

- You can deposit funds into your account:

- Withdraw them if you already have them

- See all kinds of available instruments

- How their price had changed in the last 24 hours

- As well as what you have in your wallet, which is conveniently displayed on the right side of your screen.

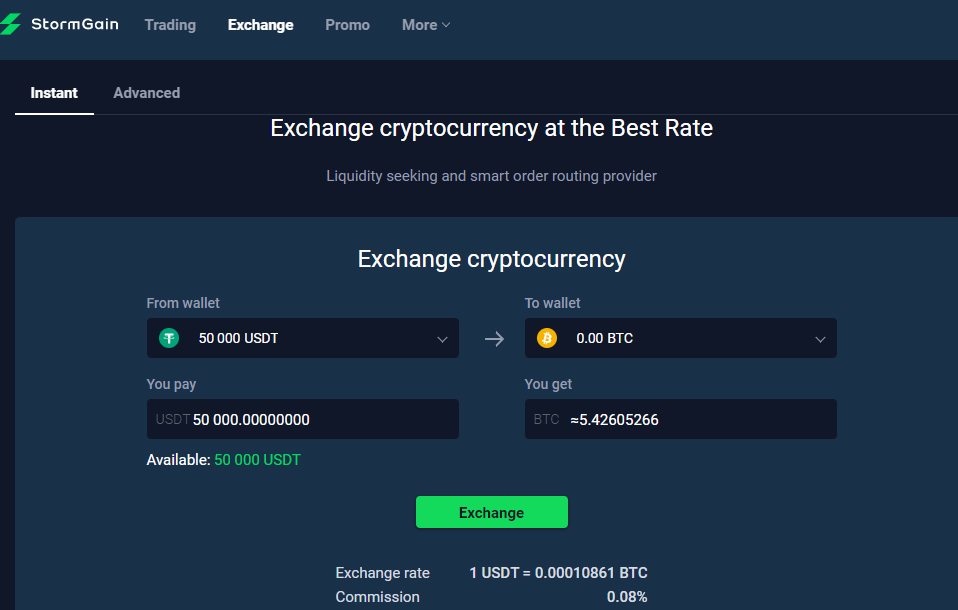

You can also go to the exchange section and quickly and easily exchange your funds for another cryptocurrency.

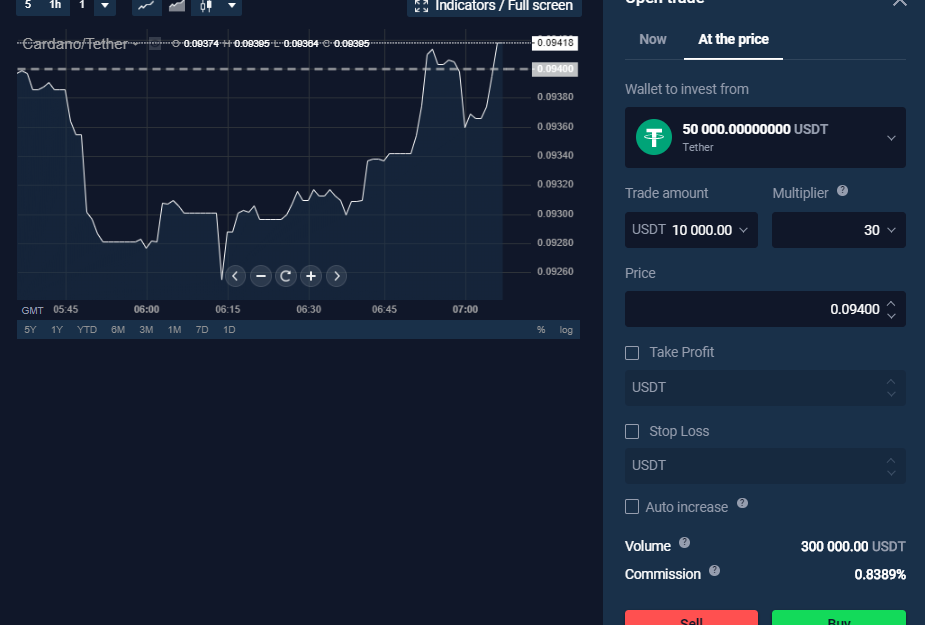

And, when you are finally ready to open trade, you will see this screen, where you can enter specific instructions for trading right now, or when the price moves to a specific way.

And, that’s it, really. The rest of it all revolves around trading strategies and nuances that you will pick up along the way, learn from other traders, and by educating yourself through guides, tutorials, strategy explanations, news tracking, and alike.

Conclusion

The trading world can be rather ruthless at times, and to survive it, you have to get a specific mindset. The most important thing is to remember to leave your emotions out of it. This is a game that you need to approach with your cool, calculated side.

Even then, using any and all tools at your disposal is advised, as you might hesitate or rush ahead and make an error. A system that you instructed can do things with more precision and not risk it.

Stop-limit and other orders that we spoke about can help you do just that, and always come out on top. If things go downhill at any point, your investment will be saved with minimal losses; and when things are going well, you can secure higher profits.

So, if you are getting into investing in cryptocurrency and trading; learn how to use these orders, and let the system do the rest.

Frequently asked questions

What are order types?

What is a limit order?

What is a market order?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.