The cryptocurrency industry aims to democratize financial services, and decentralized exchanges (DEXs) play a pivotal role in this revolution. Anyone with an internet connection and a crypto wallet can engage in trading digital assets through DEXs. This article explores the essence of decentralized exchanges and highlights the leading DEXs available today.

Want to get reviews on the best crypto platforms & exchanges? Join BeInCrypto Trading Community on Telegram: read reviews, discuss crypto projects, ask for technical analysis on coins and get answers to all your questions from PRO traders & experts! Join now

- Understanding Decentralized Exchanges

- Top Decentralized Exchanges of 2024?

- Stormgain

- dYdX

- ApeX Pro

- OKX DEX

- Curve

- Balancer

- Changelly

- PancakeSwap

- SushiSwap

- Bancor

- Dodo

- Uniswap

- Exploring Different Types of Decentralized Exchanges

- What are the top decentralized exchanges (DEX)?

- Is the Future Decentralized?

- The Enduring Presence of Decentralized Exchanges

- Frequently asked questions

Understanding Decentralized Exchanges

Decentralized exchanges are digital platforms that facilitate cryptocurrency trading on blockchain technology without intermediaries such as banks.

These exchanges contrast sharply with traditional stock exchanges or centralized cryptocurrency exchanges. On a DEX, the control lies with the users, spreading out the decision-making power instead of centralizing it. This decentralization ethos is at the heart of cryptocurrency’s vision, fostering financial autonomy and independence.

Additionally, DEXs offer greater robustness and privacy than their traditional counterparts. Users are not required to undergo identity verification via a Know Your Customer (KYC) process; instead, they simply connect their crypto wallets, select their desired crypto, and initiate transactions.

Decentralized exchanges utilize various blockchain technologies, including smart contracts, tokens, and layers, although each DEX has its unique characteristics depending on its construction and user interface.

The Significance of DEXs

DEXs are crucial for financial inclusion in our digital era. Many globally lack access to traditional banking services and could benefit from the accessibility DEXs offer.

Moreover, as the world gradually moves away from dollar-centric trade and finance, DEXs provide necessary alternatives for transactions, particularly in regions facing economic instability or currency volatility.

In times of financial instability, DEXs offer a reliable avenue for accessing cryptocurrencies anytime and from anywhere, ensuring equitable financial access regardless of one’s economic status or geographic location.

DEXs not only facilitate trading but also address broader economic issues such as currency shortages and trade limitations, offering decentralized solutions that empower individuals and businesses alike.

Top Decentralized Exchanges of 2024?

How to exchange DeFi tokens on Changelly and get $10 bonus:

To get the bonus you need to create a blockchain wallet on ZenGo use THIS LINK, invite friends to ZenGo using your personal promo code that can be found in Settings in ZenGo mobile app. Once your friend buys $500+ worth of crypto both of you will get $10 bonus.

Stormgain

StormGain has introduced its DEX, StormGain DEX, where users can now directly trade assets on the Ethereum blockchain. Future support for Binance Smart Chain and Tron Coin has been announced. The flagship DEX offers user-friendly DeFi technology without any additional commissions for deposits or withdrawals, with users only responsible for the blockchain network fee.

Using Stormgain DEX, users need only pay the blockchain network fee. There are no commissions or withdrawal fees for using Stormgain DEX.

- Quick registration: just connect your blockchain wallet

- No first deposit required.

- No verification needed.

- Keep complete control over your crypto funds

- Trade with leverage of up to 500x

- No support for BSC

- Fully functional but in Beta phase

1. Create a blockchain wallet (e.g. Metamask)

2. Go to StormGain DEX website and click on Connect wallet button.

3. Connect your wallet via Metamask or WalletConnect (if you use another web3 wallet).

4. Enjoy your anonymous trading directly from your blockchain wallet.

dYdX

On dYdX, participants can engage in margin and perpetual trading. This exchange is built on StarkEx, an Ethereum layer-2 solution, employing zero-knowledge-proof technology to ensure decentralization, privacy, and security. dYdX has announced its upcoming transition to its own blockchain within the Cosmos Ecosystem, although it will continue to use order books and matching models for trading, alongside its native token and Hedgies, the platform’s NFTs.

A decentralized, non-custodial margin product, the dYdX Perpetual, provides synthetic exposure to various assets. The Starkware Perpetual smart contracts have been independently audited by PeckShield. Trades settle on an L2 system, which periodically publishes ZK proofs to an Ethereum smart contract to validate the legitimacy of state transitions within L2.

-No deposit fees

-Maker fees: 0%-0.02%

-Taker fees: 0%-0.05%

- Clear interface

- Quick transactions

- Large selection of popular types of trading orders

- A limited selection of margin trading pairs

- A limited selection of swaps

1. Sign in to your web3 wallet, like MetaMask.

2. Connect your wallet to dYdX.

3. Deposit at least $500 or more.

ApeX Pro

ApeX Pro offers a non-custodial, multichain crypto exchange that provides access to derivatives crypto trading, specifically perpetual futures contracts, utilizing the platform’s scalability engine, StarkEx. Apex users benefit from a no-KYC registration process, maintaining a high level of privacy. The platform also offers zero gas fees for trading, provides leverage, and minimal slippage through its order book mechanism.

Additionally, Apex Pro incorporates a Buy & Burn Pool (BBP) into its infrastructure, engaging in a routine buyback and burn strategy to stabilize and enhance the value of $BANA. A portion of the fees collected is allocated to staking programs and pools in USDC.

-Maker fee: 0.02%

-Taker fee: 0.05%

- Leverage up to 20x.

- Mobile App iOS/Android: ApeX Pro

- Testnet – demo trading account with no risk

- The possibility of decentralized trading in perpetual contracts for top cryptocurrencies

- Limited choice of trading instruments

- Smart contract risk

1. Connect a web3 wallet, such as MetaMask.

2. Confirm the terms and conditions agreement.

3. Register username and email (not available for U.S. users).

4. Deposit crypto.

OKX DEX

Trading on OKX DEX offers a seamless experience and lower costs. Unlike open blockchains like Ethereum, OKC focuses on a specialized infrastructure for trading DApps and DEXs. If users lack native tokens for transactions, they can utilize the OKX DEX Gas Station to swiftly exchange popular tokens like USDT, USDC, DAI, WETH, and others to cover fees.

OKX’s X Routing algorithm optimizes price discovery across all DEXs, reducing costs for developers setting up trading DApps and indirectly for traders by lowering fees. OKX DEX operates on OKX’s enterprise blockchain, OKC.

Only blockchain network gas fees.

- Low trading fees

- Aggregates the best price across multiple chains and DEXs

- Available worldwide

- Low trading volume

1. Sign up for OKX account (you will need an email).

2. Make a deposit into your OKX account on the OKX app (at least $50).

3. Or buy $50 worth of crypto.

4. Claim Mystery Box reward.

Curve

Specializing in stablecoin trading, Curve allows users to employ their investments on other DeFi ecosystem apps, a feature known as DeFi composability. The platform uses CRV, its native token, for governance and as an incentive for its users.

Users can acquire or earn CRV through yield farming. When assets are deposited into a liquidity pool, users are rewarded with CRV tokens. The pool adjusts its internal prices according to the area with most liquidity, ensuring the pool does not incur losses as trades occur. Additionally, crypto pools charge variable fees ranging from 0.04% to 0.40%, with users who have vote-locked their CRVs receiving 50% of the trading fee.

0.04% on all liquidity pools.

- Low fees

- Non-custodial

- Many liquidity pools

- Not very beginner friendly

- If there is an issue with a linked DeFi pool, Curve pools might be affected

1. Sign in to your web3 wallet.

2. Go to the curve.fi website.

3. Connect your wallet.

4. Select a pool.

5. Deposit or Swap.

Balancer

Balancer acts both as a DEX and a liquidity provider platform, doubling as an automated portfolio manager. Originally established on the Ethereum blockchain, it utilizes an automated market-making mechanism to set prices. The platform serves dual purposes: an exchange for traders and an investment fund for liquidity providers to own part of the platform, should they choose. Like other AMM-based DEXs, Balancer has liquidity pools.

Participants deposit crypto assets into these pools to support the ecosystem, particularly in price management. 100% of all BAL fees collected are shared with holders of veBALs, with the price for all other tokens being USDC, of which 35% goes to the DAO. A boosted USD balancer pool known as bb-a-USD distributes 65% to BAL holders.

The minimum swap fee is 0.0001%, while the maximum swap fee is 10%.

- Custom automated market makers

- Multi-asset pools

- High risk of scam tokens

- Not very user friendly

1. Sign into MetaMask or a web3 wallet equivalent.

2. Go to balancer.fi website.

3. Select Explore Pools.

4. Connect wallet.

5. Select Swap.

Changelly

Changelly stands out with its DeFi swap product, featuring direct user interaction with a smart contract that sets the rules of exchange. No intermediaries are involved, promoting transparency, trust, and decentralization. The Smart Router technology provides the best market rates for crypto-to-crypto exchanges. Changelly also supplies its own private liquidity to maximize benefits from the DeFi sector.

Changelly DeFi Swap is a decentralized exchange aggregator connecting over 100 different decentralized exchanges, enabling 3600+ token swaps across various networks like Ethereum, Binance Smart Chain, Avalanche, Polygon, Fantom, and Optimism.

0.25% commission

- Low fees

- Live support

- Non-custodial

- Fast transaction execution

- Unavailable in many countries (including the U.S.)

- Fiat fees

1. Go to Changelly.com

2. Select the crypto asset that you want to exchange and click on Exchange now button

3. Click on Connect wallet button on the top right corner

4. Enter the wallet address or scan the QR code

5. Swap crypto, invite friends and get bonus of $10 for each friend invited

PancakeSwap

Utilizing the AMM model, PancakeSwap facilitates decentralized cryptocurrency trading, while liquidity providers can deposit their crypto assets into pools, thus creating liquidity for the DEX. Beyond traditional trading and buying, Panc

akeSwap offers additional services such as yield farming, staking, and trading NFTs.

Each transaction on PancakeSwap incurs a fixed 0.25% fee per hop (swap) in each Exchange V2 liquidity pool, with 0.17% reinvested into the Liquidity Pool as trading fees.

0.25% for all liquidity pools.

- Low slippage

- Low transaction costs

- High transaction volume

- Network congestion

- High-risk for scam tokens

1. Sign in to your Metamask or web3 wallet.

2. Go to Pancakeswap website.

3. Connect wallet.

4. Select Trade, Earn, or NFT.

SushiSwap

Originating as a clone of UniSwap, SushiSwap has distinguished itself with features like liquidity mining that attract its own liquidity providers. It also enables users to participate in governance decisions via the platform’s native token, SUSHI. Initially launched on the Ethereum blockchain, SushiSwap now operates across 14 other chains including Polygon, Arbitrium, Moonbeam, Optimism, and Avalanche.

On this exchange, a 0.3% trade fee is charged per transaction, with liquidity providers receiving 0.25% of this fee. The remaining fee revenue is contributed to a pool called SushiBar, which purchases all collected fees from all pools and converts them into SUSHI when the reward distribution command is executed.

0.3% fee on trades.

- Simple user interface

- Platform revenue sharing

- Technology not up-to-date when compared to competitors

- Smart contract risk

1. Sign in to a web3 wallet.

2. Select a blockchain.

3. Go to sushi.com.

4. Connect wallet.

5. Choose an asset.

Bancor

Operating on the Ethereum blockchain, the Bancor protocol is a decentralized exchange that facilitates the instant conversion of crypto assets using the AMM model. It aims to offer returns to liquidity providers, including those holding small and micro-cap coins, providing access to a broader range of cryptocurrencies that may be inaccessible through other decentralized exchanges.

Each trade deposited into a liquidity pool’s reserves is subject to a percentage fee. By depositing tokens into a pool and holding its Pool Token, any user can act as a liquidity provider and earn a share of its trading fees. These “pool tokens,” either ERC20 or EOS tokens, represent ownership interests in a liquidity pool, with the value of a Pool Token increasing as fees accumulate. Liquidity can be added to a Bancor pool without permission.

Fees on Bancor are set by liquidity providers, and therefore, varies between liquidity pools.

- Impermanent loss protection

- Supports numerous tokens

- Single-sided deposits

- Third-party centralized trading platforms

- Not very user-friendly

1. Sign in to Web3 wallet, like Metamask,

2. Go to bancor.network website.

3. Connect wallet.

4. Select Trade or Pools.

Dodo

DODO, a cryptocurrency exchange built on Ethereum and BNB Chain, employs a unique ‘Proactive Market Maker Algorithm’ to offer superior price finding and liquidity compared to other AMMs. It features SmartTrade, a decentralized liquidity aggregation service that routes to and compares liquidity sources to quote the optimal swap rate for trading tokens.

0.3% transaction fee per trade.

- Low transaction fees

- Highly accurate pricing

- No minimum deposit for liquidity providers

- Impermanent loss protection

- Adoption and TVL continue to drop

1. Choose a Web3 wallet like Metamask.

2. Go to dodowx.io website.

3. Connect to the app.

4. Select Exchange or Bridge.

Uniswap

As the largest decentralized exchange by trading volume, Uniswap supports crypto trading through the power of automated market-making in its trade functions and price determination. Originally based on the Ethereum blockchain, it has expanded to other blockchain ecosystems and layer-2s, compatible with ERC-20 tokens. Uniswap operates using two smart contracts: the exchange contract, which facilitates token swaps, and the factory contract, used for adding new tokens to the platform.

This DEX charges a 0.3% trading fee on all trades, with swapping fees being deposited into liquidity reserves. This increases the value of liquidity tokens, acting as a dividend to all liquidity providers proportionate to their share of the pool. Fees are collected by removing a proportional share of the underlying reserves by burning liquidity tokens.

0.30% trading fees.

- Adequate liquidity

- No registrations

- Friendly UX

- Gas fees

- High-risk of scam tokens

1. Select a Web3 wallet like Metamask.

2. Go to the Uniswap website.

3. Connect your wallet.

4. Trade.

Exploring Different Types of Decentralized Exchanges

There are several types of DEXs, each catering to different needs in terms of functionality and pricing:

- Automated Market Makers (AMMs) stand out as the most prevalent type of DEX. They use algorithms to set prices for crypto assets in real-time without relying on traditional order books.

- On-chain order book DEXs maintain a ledger of all potential trades for a crypto asset on a blockchain. Market prices are determined by the matching of buyers and sellers on this order book, while assets are held in user wallets.

- Off-chain order book DEXs take a different approach by processing transactions through a centralized mechanism, though final settlements occur on-chain. This structure allows for efficient trade clearing but relies partly on centralized elements.

- DEX aggregators enhance liquidity and trading by pooling data from multiple DEXs, providing traders with optimal pricing and improved trade execution across various platforms.

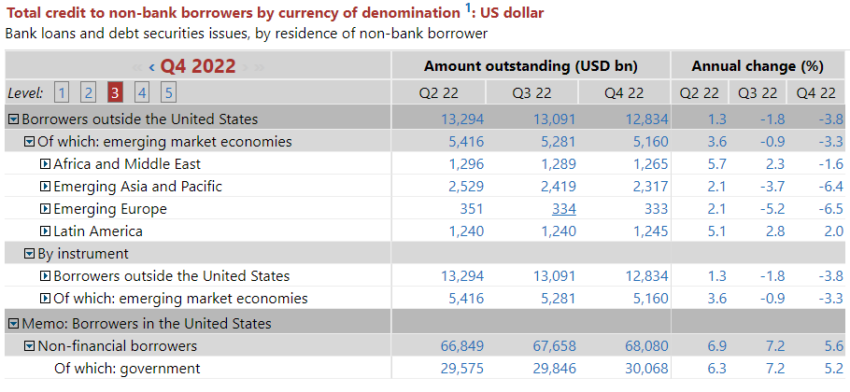

What are the top decentralized exchanges (DEX)?

Platform |

Best Feature |

Fees |

Coins |

Bonuses |

|---|---|---|---|---|

StormGain DEX | Sign Up |

No verification needed |

No additional commissions for depositing or withdrawing funds |

BTC, ETH, LTC, XRP, ERC-20, multi-asset support including POW and POS coins and tokens |

No |

dYdX | Sign-up |

Free monthly trading option |

No fees for deposits or withdrawals. Perpetual trades are free for everyone, up to $100,000 every month. |

ETH, BTC, SUSHI, ATOM, YFI, CRV, AVAX, MATIC, MKR, SOL, ZRX, FIL, UMA, AAVE, UNI, COMP, SNX, 1INCH, ALGO, LINK, DOT, XMR, ZEC, DOGE, ADA, BCH, EOS, LTC |

No bonus for new users |

APEX Pro | Sign-up |

Trade-to-earn activity |

Transaction fee: 0.1% |

BANA, USDC, BTC, ETH, XRP, CATOM, and DOGE |

Regular activities with airdrops, bonuses and rewards for users |

Uniswap | Sign-up |

Adequate liquidity on many trading pairs |

0.3% fee for swapping tokens |

ERC-20 tokens |

No |

Curve | Sign-up |

Yield farming |

0.04% trading fee |

ERC-20 stablecoins, WBTC, ETH, FRAX, AVAX, multiple asset support |

No |

Balancer | Sign-up |

Versatile automated market maker |

Pool fees are between 0.0001% to 10% |

ERC-20 tokens |

No |

PancakeSwap | Sign-up |

Low transactions cost |

0.25% trading fees |

BEP-20 tokens |

No |

Sushiswap | Sign-up |

Staking and farming |

0.3% trading fees |

ERC-20 |

No |

Bancor | Sign-up |

Impermanent loss protection |

No trading or withdrawal fees from the Bancor protocol itself, each pool is set with a specific trading fee paid to the liquidity provider |

ERC-20 |

No |

DODO | Sign-up |

Smart trade |

0.3% transaction fee |

ERC-20 and EVM compatible chain tokens |

No |

OKX DEX | Sign-Up |

Aggregates orders across multiple exchanges and chains. |

N/A |

10+ chains, 100+ DEX and 100,000+ coins |

No |

Is the Future Decentralized?

Decentralized exchanges offer enhanced autonomy and security compared to centralized exchanges. Recent events have underscored the vulnerabilities of centralized platforms, making the case for the increasing relevance of DEXs.

Since the collapse of major centralized exchanges, there has been a significant shift towards decentralized platforms. Users are increasingly recognizing the benefits of DEXs, where they are not exposed to the risks of central authority failures.

The ftx collapse is a direct double indictment of the regulatory apparatus. first, users were pushed onto offshore jurisdictions because of the complete lack of operational clarity. second, sam was deep in bed with the “protectors”, and they didn’t do a thing. Resounding failure.

Foobar, DeFi and NFT founder: Twitter

The comparison between the risk and reward of using DEXs versus centralized exchanges has become clearer, especially in light of recent events (the FTX collapse in November 2022). As decentralized platforms continue to mature, their adoption is expected to rise.

The Enduring Presence of Decentralized Exchanges

As with any innovation in the cryptocurrency space, it’s essential to thoroughly vet any DEX before engaging in trades. A good practice is to only invest what you can afford to lose and to trade on platforms where the code has been verified by independent smart contract auditors.

DEXs offer significant security advantages over centralized exchanges and are poised to grow in popularity as more people learn about and adopt cryptocurrency.

Frequently asked questions

How are DEXs genuinely decentralized?

What distinguishes DEX platforms from DeFi platforms?

Are DEX sites secure?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.