For decades, we’ve heard about the smartness of objects, from smart bombs to smart cars and homes. Once you finish reading this article, you will understand how smart contracts overshadow them all.

The Fight Against Evil Tolls

It is no overstatement to say that contracts form the foundation of human civilization. No ancient empire could have thrived without trading treaties and contract law.

The founding document of the modern Western civilization, the Magna Carta, was the first formalized contract in the 13th century to bind both kings and merchants.

“All merchants shall have safe and secure exit from England, and entry to England, with the right to tarry there and to move about as well by land as by water, for buying and selling by the ancient and right customs, quit from all evil tolls, except (in time of war) such merchants as are of the land at war with us.”

The phrase “evil tolls” refers to the age immemorial problem of trading — mediation costs to conduct a trade and relying on the impartiality of mediators to resolve disputes.

This was the pivotal year when an American computer scientist and cryptographer, Nick Szabo, digitized the contract recording process by using digital ledger technology (DLT).

Within this new form, as a computer code, a contract could be automatically executed if proper conditions are triggered. Fast-forward to 2008, and the first step in the mass adoption of smart contracts was taken. Under the pseudonym Satoshi Nakamoto, he/they published a whitepaper titled Bitcoin: A Peer-to-Peer Electronic Cash System.

Putting DLT into practice by implementing blockchain technology, Bitcoin launched in 2009. Inevitably, building upon the promise of blockchain, a more programmable one had launched in 2015 — Ethereum.

Building a New Future Without Third Parties

Developed by Vitalik Buterin, Ethereum, with its native token ETH, birthed an entire financial, social, artistic, and gaming ecosystem, all thanks to smart contracts.

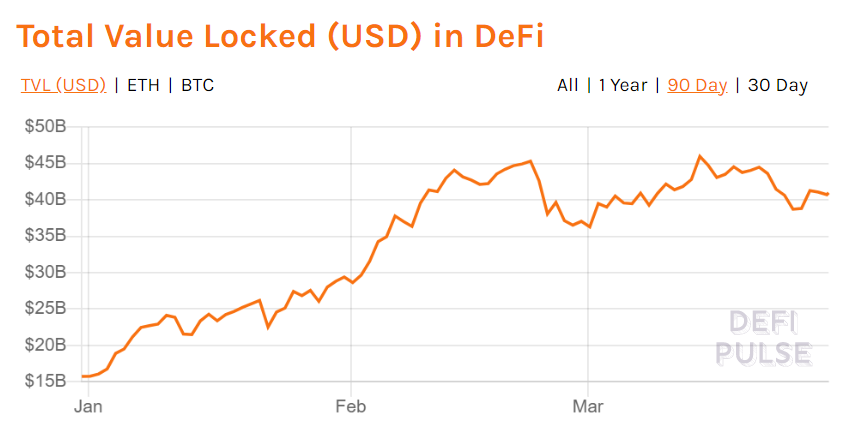

One area where smart contracts have been utilized has been with DeFi — Decentralized Finance. This space has gone into overdrive since last summer, going from $1 billion to more than $40 billion of total value locked.

Out of over 5000 altcoins emerging on the scene since Bitcoin’s launch, the bulk of them are ERC-20 tokens, issued from the Ethereum network.

Accordingly, Ethereum’s smart contract programmability brought into being virtual banks in the form of yield farming, gamified yield farming, decentralized exchanges (DEXes), and NFT marketplaces, to just name the few applications of smart contracts.

Smart Contracts Simplified

First, let’s examine what Vitalik Buterin, the pioneer of Ethereum’s smart contracts, has to say about the nature of smart contracts.

“A smart contract is a mechanism involving digital assets and two or more parties, where some or all of the parties put assets in, and assets are automatically redistributed among those parties according to a formula based on certain data that is not known at the time the contract is initiated.”

Sounds a bit thick with jargon for the uninitiated, doesn’t it?

Don’t worry, by the end of the following example, you will see exactly how this definition applies to real-world dealings.

Let’s say that you are a small indie game developer, struggling to get funding for your project.

You could go to GoFundMe or Kickstarter to realize your dream, but then you encounter a problem. Those two crowdsourcing platforms only support a fraction of countries, and you don’t live in one of them.

Moreover, if you find a crowdfunding platform that does support your country, let’s say Indiegogo, it takes 5% of all raised funds.

For an indie developer, 5% out of $100,000 would mean losing $5,000!

With a small game budget, this would have a big impact, enough to cut out a feature, just to pay for the fee of mediation!

To make things worse, what if someone doesn’t like what you said at some point in history? In an increasingly shrinking space of allowable speech, even the most benign statements can kick you off third-party platforms.

To recap, this is what you have to deal with when using centralized, mediated finance:

- Availability of the service based on your geo-location

- Hefty fees

- Ideological volatility of current culture that can deplatform you at any moment for any reason

- Trusting the third-party to take care of the money of all the investors and give it to you in a timely manner

Now, let’s see how a smart contract-powered blockchain would handle the task of crowdsourcing by eliminating the need for this mediation.

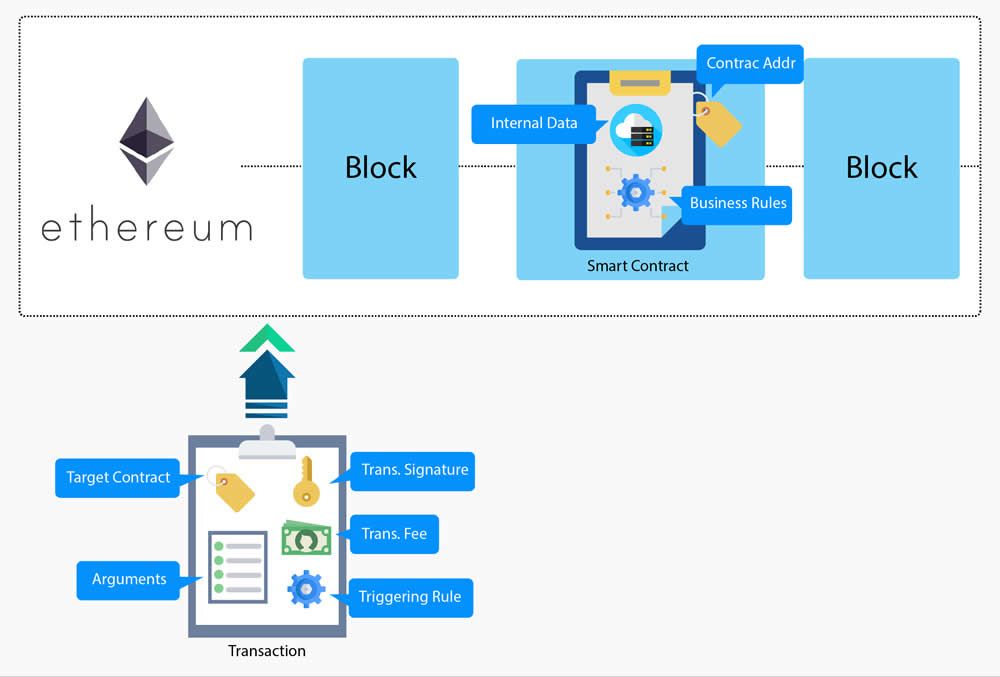

In other words, how would a smart contract — a program inside a blockchain — kick out a third-party?

Tokens + Smart Contracts + Blockchain = Secure Decentralization

When investors fund a project, it means that it has a quantifiable goal. In turn, this means that reached goals can be coded as digital contracts.

In a crowdsourcing model, this would further entail that a smart contract could be programmed to hold the funds until predetermined funding thresholds are reached.

Investors would use tokens — digital cryptocurrency — to fund their projects.

These tokens are also digital code (ERC-20 compliant), which means it would be accepted by smart contracts, running on the Ethereum blockchain that created them.

Any gamer would immediately understand this. After all, countless games, RPGs in particular, have some internal economy with their own currencies.

You use those currencies inside a game without anyone looking over your shoulder, based on in-game code and math.

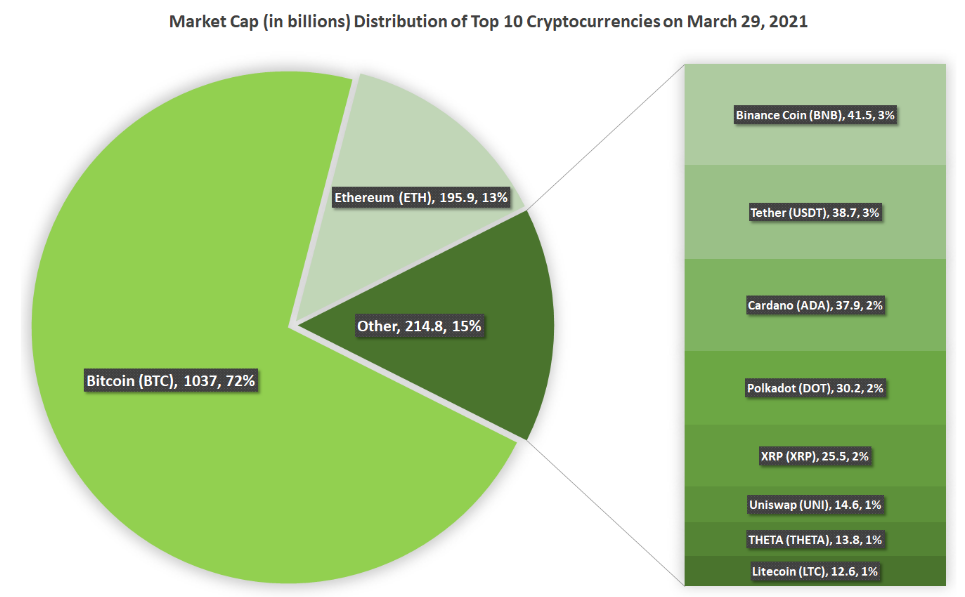

In the real world, blockchain makes such tokens formidable assets, enough for Bitcoin to have exceeded one trillion dollars in market capitalization, with ETH being the second largest one.

Moreover, in many games, when you earn a certain amount of money, you unlock a new achievement or open up new dialog options. In other words, you reach a threshold.

When the smart contract calculates that the incoming inflow of tokens has reached such a threshold, it unlocks them and transfers them into the crypto wallets of indie game devs.

Likewise, if the proposed game failed to reach the funding threshold in an allotted time frame, all the tokens would automatically return to the investors’ crypto wallets.

In both cases, there would have been no need for any kind of mediation. Of course, because smart contracts are a part of the blockchain, that also means they share blockchain’s key feature — distributed immutability.

Smart Contract Flexibility and Fees

Based on the quantifiability of thresholds for a specific project, any endeavor can be locked into a smart contract:

- Insurance claims

- Passive income via lending

- Mortgages

- Social media platforms

- Decentralized exchanges

- Record keeping

- Property ownerships

- Voting

- Decentralized Autonomous Organizations (DAOs)

In short, no more lawyers, bureaucrats, and brokers to extract a toll!

If something is quantifiable like it would be in a regular contract, it can be coded into a smart contract stored on a blockchain.

However, that doesn’t mean there are no fees involved. After all, those nodes that verify all the transactions on the blockchain have to be compensated to make it worth their while.

On the Ethereum blockchain, these fees to conduct a transaction or execute a smart contract are called ETH gas. Such fee is measured in Ethereum’s native token, ETH, but in its 9-decimal denomination called Gwei.

Just like cent is a 2-decimal denomination of USD.

The highs and lows of ETH fees depend on the network congestion. Fortunately, this should improve drastically with the ongoing upgrade to Ethereum 2.0, going from 15 tps (transactions per second) to 1000s tps.

Smart Contracts on Other Blockchains

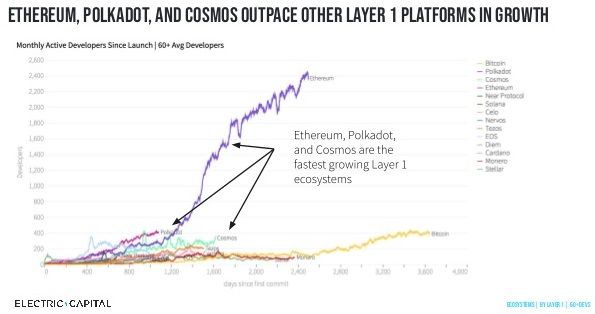

As Bitcoin demonstrated, being first often counts the most. While Ethereum holds the majority of dApps and developers, other programmable blockchains have popped up as viable smart contract solutions.

However, as you can see from the above graphs, all of them have minuscule developer representation and market capitalization compared to Ethereum.

Meaning, multiple dev teams working on the ETH 2.0 upgrade would have to seriously screw up the transition from the blockchain’s proof-of-work to proof-of-stake by 2022.

Polkadot, Cosmos, and HyperLedger are top alternatives to Ethereum’s smart contract infrastructure.

More interesting development also comes in the form of off-chain functionality.

Chainlink (LINK) was built on the Ethereum blockchain for this specific purpose. For ETH to not remain isolated in its own ecosystem, it is vital that off-chain data can be in-loaded into smart contracts.

As its name implies, Chainlink makes this possible through network oracles that safely transfer external data into blockchains.

As a consequence of this interoperability, we have seen an emergence of a new type of asset last month — synthetic derivatives.

Are Smart Contracts the Future of Finance?

It is clear that the future is digital, and smart contracts are harbingers of that future.

Mediation brings costs, moral hazards, and deplatforming risks, all of which can be eliminated by smart contracts.

While it will take time for people to be familiarized and trusting of dApps, the only real question is which smart contract blockchain will cement its dominance?

In the end, this too might not matter much as cross-chain development continues apace. More likely, we will see many blockchain domains, each offering its own unique advantages and drawbacks. Most importantly, they will all have to compete to serve the only relevant entity — you.

Frequently asked questions

What are smart contracts?

How do smart contracts work?

What are the benefits and limitations of smart contracts?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.