Crypto wallet terminology can be confusing. But no fear; we’re here to break down the jargon. This guide covers the benefits of hot wallets vs. cold wallets, the differences between the two types, and some examples. As wallets store your crypto, it’s important to have an understanding of which type you are using. Here’s what you need to know.

Choose your free crypto wallet

Paybis Wallet

Best for beginners

Wirex Wallet

Best for EU&UK

OKX Wallet

Best for traders- Benefits of using crypto wallets

- Different types of crypto wallets

- What is a hot wallet?

- Examples of popular hot wallets

- What is a cold wallet?

- Examples of popular cold wallets

- Hot wallet vs. cold wallet

- Importance of wallet security

- Should you switch to a hot or cold wallet immediately?

- Frequently asked questions

Benefits of using crypto wallets

A crypto wallet differs from a wallet in the traditional sense. A physical wallet holds your ID, debit or credit cards, and most importantly — your money, whereas a crypto wallet doesn’t hold anything.

In actuality, a crypto wallet is simply a client or an application that stores your private keys to your crypto and allows you to interface with the blockchain. With them, you can send, receive, and spend crypto. These are the primitives of every wallet.

Some wallets allow you even more functionality, such as:

- In-app browsers

- Integration with decentralized applications (DApps) and DEXs

- In-app staking

- Multi-chain support

- Third-party payment providers to purchase crypto from CEX

Wallets are a safer option for long-term investors. Cryptocurrency was created in part for users to have custody of their assets. Therefore, wallets are an essential component of this process.

It is advisable not to have crypto sitting on an exchange, especially if you have sizable funds. Exchanges often go bankrupt, which puts users’ funds in legal limbo. Meaning if you leave your crypto on an exchange, there is a possibility that you will lose it.

According to Adam Levitin, a professor who specializes in bankruptcy, commercial law, and financial regulation, if you are an unsecured creditor to an exchange, you could lose your crypto in the event of bankruptcy.

Some exchanges are safe. However, instances of technical malfunction or hacking have occurred in the past — as was the case with Mt. Gox, an exchange that was the target of one of the largest crypto hacks in history.

Crypto wallets are improving every day. Modern variations allow for the storage of a huge variety of coins. Not every coin is listed on every major exchange. You can easily manage your investment portfolio using a good crypto wallet.

Different types of crypto wallets

“Hot” and “cold” wallets refer to different solutions for storing cryptocurrency private keys. The names infer the wallet’s connectivity status to the internet.

Hot wallets are digital crypto wallets that need an internet connection to function. Cold wallets are not connected to the Internet. The private keys are stored offline or off the internet. Some people also refer to keys stored offline as stored in cold storage.

Keys stored in this way are less prone to hacker attacks or technical malfunctions. In addition, cold wallets must be connected to a device before they can send or sign transactions. They are typically used in conjunction with an app to send transactions as well.

Hot wallets are always connected to the internet and the blockchain. Therefore, there is no need for further connections. You can send and sign transactions instantaneously.

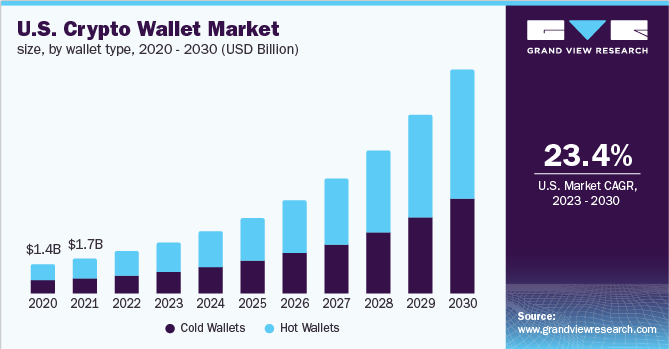

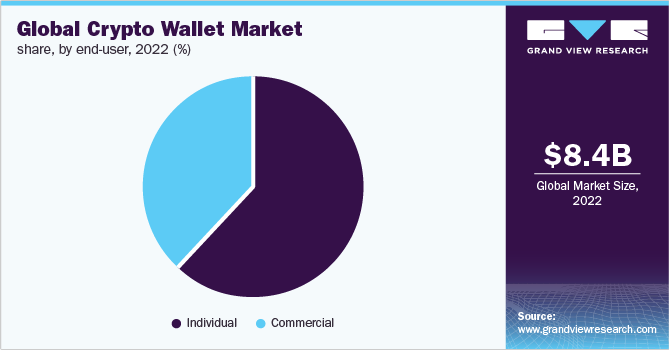

Because of the convenience, hot wallets tend to be more popular. In 2022, they dominated the market and accounted for more than 55% of total revenue.

The image below shows the size of the global crypto wallet market was estimated at $8.42 billion in 2022, and it is anticipated to grow at a compound annual growth rate (CAGR) of 23.4% from 2023 to 2030.

Custodial wallets

Ownership in blockchain technology differs from its traditional definition. In today’s world, if you own something, you can physically hold it, or you have rights to it enforced by the law. This is not the case in the digital world.

Custody on the blockchain is simple. It is ownership or, rather, knowledge of one’s private keys. If you and someone else have knowledge of your private keys, you both own them. Not your keys, not your crypto, as the saying goes!

When someone has knowledge of your private keys, they can steal your crypto. A custodial wallet is where the wallet manufacturer (often a centralized exchange) stores your private keys on their server.

If the wallet provider even so much as holds a share of your private keys (e.g., multi-party computation), or uses multiple keys to a single wallet (e.g., multi-sig or multi-signature), then the wallet is custodial. Multi-sig means that there are multiple keys to a wallet. They are notorious for hacks because they introduce counterparty risk.

Non-custodial wallets

The opposite of a custodial wallet is naturally a non-custodial wallet, which means that you alone hold your private keys. Or, more specifically, your private keys are not sitting on a company’s servers. Both hot and cold wallets can be non-custodial.

Hardware wallets

A hardware wallet is a physical device that stores your crypto’s private keys offline, typically the size of a USB drive. These types of wallets are synonymous with cold wallets. The terms hardware and cold wallets are often used interchangeably. It is an industry-standard that hardware wallets are both cold wallets and non-custodial.

In need of a reliable hardware wallet? Get the GridPlus wallet today!

What is a hot wallet?

Hot wallets are connected to the internet. From a technical standpoint, this means that the private keys are stored locally in a web browser (e.g., MetaMask) or stored in an application that maintains a constant internet connection.

It’s easy to understand the appeal of hot crypto wallets. For one thing, they are usually free and can be downloaded from the Internet. They are also easy to use and are favored by those that need to send multiple transactions.

Someone conducting numerous trades throughout the day might not wish to move funds in and out of cold storage.

The downside of hot wallets is that they aren’t as safe as cold wallets. Risks involving software errors are enough to keep some crypto users away from them. However, if you use a DApp like Uniswap daily, a hot wallet is your best bet.

Because they maintain a constant connection with the internet, this makes it more likely that a user can expose their private keys by:

- Downloading malware

- Signing a malicious smart contract that drains the user’s wallet

- Keylogging

Hot wallets differ based on their characteristics. There are basically three types: desktop, web, and mobile wallets.

Desktop wallets

Desktop crypto wallets have higher security capabilities than web-based wallets. However, technically, they are less secure than physical wallets. A desktop crypto wallet is downloaded to your computer or laptop.

Web wallets

Web wallets run directly through a webpage browser. They are typically browser extensions or progressive web applications. Generally, they do not include additional software that runs on your desktop or on your computer. Still, hybrid types do exist.

For example, crypto games or NFT marketplaces using Ethereum tokens will require a connection to a web wallet such as MetaMask.

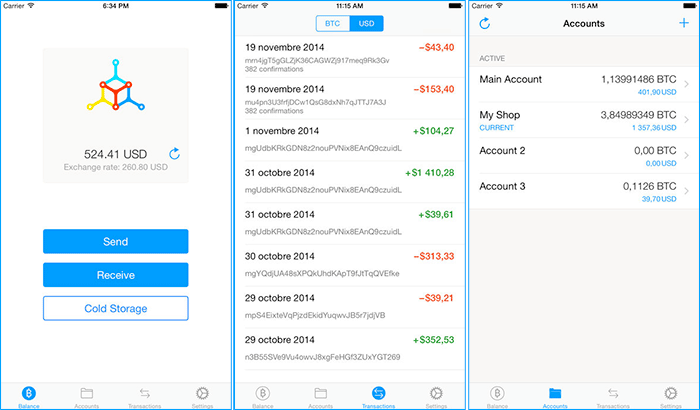

Mobile wallets

Mobile crypto wallets work in the same way as desktop wallets. They can be used with either iOS or Android operating systems. The greatest benefit is that a mobile wallet is more portable than a desktop crypto wallet. Your mobile crypto wallet is always with you.

Examples of popular hot wallets

1. ZenGo

The Zengo wallet offers a mobile app, and the company operates in the U.S., U.K., AU, and CAN markets. One unique feature of ZenGo’s wallet is that it has a very strong security feature in the form of biometrics. Besides this, it functions in the same way that major wallets do, and also has a very intuitive interface that connects to multiple blockchains.

Act now and get the popular ZenGo wallet today!

2. Coinbase Wallet

The uniqueness of the Coinbase Wallet is that it functions as a standalone application, and you don’t need to register for an account with the Coinbase crypto exchange. Although it was originally designed to support Ethereum and ERC-20 tokens, it has since expanded to include other cryptocurrencies.

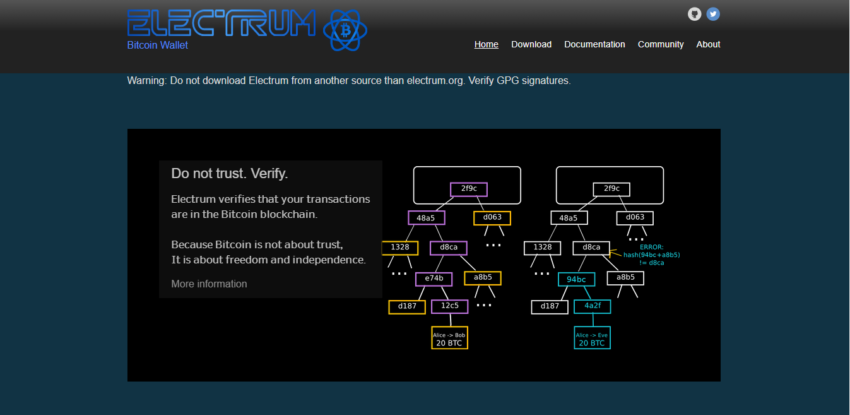

3. Electrum

The Electrum wallet is a popular crypto hot wallet that excels in its core function. It is a versatile wallet that is suitable for most users.

4. Mycelium

The Mycelium wallet is another popular option that works on iOS and Android devices. But the wallet’s features may be intimidating for novices. This wallet is ideal for crypto enthusiasts who are looking for features such as QR-code-based payment, cold storage, and control of their private keys.

What is a cold wallet?

Cold wallets are the preferred choice for many security-conscious crypto users. A cold wallet has no connection to the internet. Any piece of hardware specifically designed to store cryptocurrency can be a crypto wallet. Many of them are variations of USB sticks.

Cold wallets are a better solution if you are a long-term holder and do not need to move your funds immediately. Note that cold storage wallets are generally very secure. A cold wallet is usually not accessible to anyone without the necessary security information. Furthermore, these devices are usually quite small. Crypto users should have no trouble carrying them around in a pocket.

Cold storage wallet options include paper wallets and offline computers that store crypto. Reputable exchanges try to compete with these by offering cold storage options, as well as hardware devices.

Paper wallets

A paper wallet is a piece of paper that contains private keys or QR codes that facilitate cryptocurrency transactions. Paper wallets are inaccessible via the internet. This is why some consider them more secure than any other form of cryptocurrency storage. This is technically true, although it comes with some setbacks.

Note that paper wallets are vulnerable to water and fire damage. You must also protect your paper wallet against theft or loss. You must not let others see your security information or misplace it for personal use.

Hardware wallets

A hardware wallet is a crypto wallet that stores the private keys of the user on a secured hardware device. There are several obvious perks. First of all, crypto assets are protected even on an unsafe computer. Hardware wallets provide extra protection against malware, phishing sites, cyber-attacks, and other threats.

Hardware wallets are connectable to multiple blockchain networks at once. There is also the matter of convenience. A hardware wallet is often a small, plug-in device that allows you to access your crypto assets from any location securely. Without the need to create new accounts, a hardware wallet provides you with access to multiple Dapps.

You can also trade directly from your hardware wallet. Technically, this is the safest method to conduct crypto transactions.

Examples of popular cold wallets

Because of the growing demand, several hardware crypto wallet options have been launched in recent years. Each has its unique characteristics. Consequently, each has its fans and, in some cases, detractors. Here’s a quick look at the most popular of these.

1. Trezor Model One

The Trezor One model is a well-known crypto hardware wallet. It was produced by Satoshi Labs, a pioneering company in the crypto space. It supports over 1000 assets. While Trezor One was certainly the pioneer of these kinds of hardware wallets, other, newer devices have set about improving certain key features.

2. Ledger Nano S & X

Ledger is a French start-up that produces the Nano S and X models. These hardware wallets look similar to a USB thumb drive but feature a steel shell. Any personal computer or mobile device that supports Bluetooth or USB can connect with the device. At the time of writing, Ledger supports over 5,500 assets.

3. NGRAVE

Instead of using Bluetooth or USB ports, NGRAVE uses a one-way QR code to communicate information to connected devices. It provides info to these devices while staying online. This means that users won’t have to worry about software being compromised.

4. Ballet Wallet

The Ballet Wallet resembles a regular credit card. The card features a serial number. On the bottom of the card, users will also find a scratch-off wallet passphrase. To unlock the card’s funds, users must also peel off the sticker to reveal its QR code. The card works in conjunction with mobile software.

Hot wallet vs. cold wallet

Hot wallets are more user-friendly and often connect to cryptocurrency exchanges. This makes it easier to transfer your holdings than with a cold wallet. It is generally safe for day traders and those that are not working with colossal amounts of crypto.

Cold wallets are quite safe. They have no internet connectivity and, as such, are the more secure option. They’re easy to carry around. And because they regularly feature a wide array of crypto, it is easy to manage your portfolio. Because cold wallets cannot be accessed via the internet, these wallets are the best way to hold cryptocurrencies. Hacking one of these wallets is nearly impossible, and privacy is better protected.

Hot Wallets |

Cold Wallets |

||

|---|---|---|---|

Pros |

Cons |

Pros |

Cons |

More accessible to Dapps |

Holds private keys in browser or app |

Holds private keys offline |

Limited variety of crypto support |

Typically free |

Vulnerable to cyber attacks |

Non-custodial |

More expensive |

More convenient for everyday purchases |

May have location restrictions for some features |

Lightweight and portable |

Less convenient for everyday purchases |

Easy to use |

More prone to hacks |

Less prone to hacks |

More difficult to use |

Can be a desktop app, mobile app, or web extension |

Some are custodial |

etter for holding large sums of money over time |

Vulnerable to theft |

Better for activities like staking or liquidity providing |

Importance of wallet security

Whether you are an individual or a business, wallet security is as important as self-custody. As crypto and blockchains become more widely used, more people, and subsequently businesses, will need wallets.

When you factor in the additional functionalities wallets provide today, the result is more attack vectors. The more complex the wallet, the larger the surface area of attack for hackers, making security even more paramount.

That being said, there are ways to mitigate the vulnerabilities associated with wallets. You should take these steps to protect your crypto:

- Choose a reputable wallet

- Use strong and unique passwords

- Use two-factor authentication

- Keep your wallet software updated

- Use secure internet connections

- Store private keys offline

- Back up your wallet

- Be cautious of phishing scams

The result of poor wallet security is lost funds. There are many risks to wallet security; the three biggest are yourself, code risk, and counterparty risks.

For example, weak passwords, falling for phishing scams, or using public Wi-Fi is a risk that falls upon you alone. On the contrary, a weak random number generator (RNG) is a code risk. Wallets use RNGs to generate private keys.

If the hashing algorithms used to generate private keys do not follow the properties of strong algorithms (pre-image resistance, second pre-image resistance, collision resistance), the result is a private key that is easily brute-forced.

On the other hand, with a custodial wallet, private keys are held or shared by a counterparty. Hackers may access your private keys and steal your funds if they are able to penetrate the servers.

The infamous Solana Slope wallet hack is an example of counterparty risk with custodial wallets. In this situation, users’ seed phrases were saved on a third-party server in plain text.

Should you switch to a hot or cold wallet immediately?

Cryptocurrency investors need to be concerned about where and how they store their digital assets. However, choosing between hot wallets and cold wallets must be done according to a crypto user’s unique requirements. If you are looking to safely store your cryptocurrency, a cold wallet may be the best choice. If you are looking for convenience and don’t mind the risk, hot wallets are also an option.

Whatever your choice happens to be, it’s certain that given the rise of blockchain technology, you’ll have plenty of options from which to choose.

< Previous In Series | Wallets | Next In Series >

Frequently asked questions

Are cold wallets better than hot wallets?

Is Coinbase a hot or cold wallet?

Is a cold wallet worth it?

Are hot wallets safe?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.