Ethereum ETFs are here! Well almost! The U.S. Securities and Exchange Commission (SEC) has approved several spot Ethereum ETFs as of May 2024, marking this a watershed moment for the crypto industry. Yet, the approval isn’t simply what it seems. That means you cannot simply go online and start taking positions in ETH ETFs, like the Bitcoin ETFs. Confused!

Don’t be as in this Ethereum ETF guide; you will learn everything about this highly controversial ETF segment and its existence.

Methodology

In selecting the best platforms for users to buy Ethereum in 2024, BeInCrypto conducted a thorough analysis considering various factors such as ease of use, security features, trading tools, deposit methods, commissions, and additional features offered by the platforms. Our product teams tested a number of leading exchanges over a period of six months before narrowing down the options. Below is a snapshot of the rationale for the selection of each platform:

1. Coinbase:

Coinbase’s user-friendly interface makes it accessible to both beginners and experienced traders. The platform’s intuitive design simplifies the buying process, allowing users to purchase Ethereum with ease.

Coinbase also provides users with advanced trading tools and charts, empowering them to make informed decisions. These tools enable users to analyze market trends and execute trades effectively.

Security is paramount when it comes to purchasing Ethereum and any other crypto. Coinbase employs state-of-the-art encryption protocols to safeguard users’ funds and personal information, providing peace of mind to investors.

2. OKX:

OKX stands out for its support of leverage trades, catering to both casual investors and seasoned traders looking to maximize their returns. This feature enhances the platform’s appeal to a wide range of users.

The global platform also offers multiple deposit methods, providing flexibility and convenience to users worldwide.

OKX also notably offers competitive commissions, allowing users to trade Ethereum cost-effectively. Lower fees translate to higher potential returns for investors, making OKX an attractive choice.

3. Uphold:

Uphold’s cross-asset swap feature enables users to seamlessly exchange Ethereum with other cryptocurrencies and traditional assets. This functionality enhances liquidity and diversification opportunities for investors.

The platform also offers automated trading support, allowing users to implement trading strategies and execute trades automatically. This feature is particularly beneficial for those seeking to optimize their trading activities.

Finally, Uphold’s direct card integration facilitates seamless purchases of Ethereum using debit or credit cards. This integration streamlines the buying process, offering convenience and accessibility to users.

Considering the user-friendly interfaces, advanced trading tools, robust security measures, and additional features offered by Coinbase, OKX, and Uphold, BeInCrypto identified these platforms as the best options for users to buy Ethereum in 2024.

Whether users prioritize simplicity, trading flexibility, or additional features, these platforms cater to diverse needs, providing a comprehensive solution for Ethereum investors.

To learn more about BeInCrypto’s verification methodologies, follow this link.

- Best platforms to buy ETH before spot ETF approval

- Coinbase

- OKX

- Uphold

- What is Ethereum ETF?

- The mechanics of ETH ETFs explained

- Types of ETH ETFs

- Spot Ethereum ETF vs. Ethereum Futures ETF

- Popular Spot Ethereum ETF players

- The current state of Spot Ethereum ETFs

- Ethereum ETF guide: Which ETFs to pick?

- Ethereum ETP vs. Ethereum ETF explained

- Pros and cons of Ethereum ETFs

- What is the difference between Ethereum and Ethereum ETF?

- Ethereum ETF vs. Bitcoin ETF

- How do I invest in ETH ETF?

- Can ETH ETF be the ultimate ‘flippening’ instrument?

- Frequently asked questions

Best platforms to buy ETH before spot ETF approval

Suppose you want to purchase some ETH before spot ETFs burst onto the scene, like officially for trading. In that case, these platforms can facilitate safe and seamless ETH transactions for beginners — while offering some nifty features for advanced traders. Remember that ETH ETF approval and its trading exposure don’t guarantee profits.

Coinbase

•Easy to navigate

•Powerful tools and charts

•State-of-art encryption

OKX

•Supports leverage trades

•Multiple deposit methods

•Competitive commissions

Uphold

•Cross-asset swaps

•Automated trading support

•Direct Card integration for seamless purchases

What is Ethereum ETF?

Ethereum ETFs are nothing fancy. Fundamentally, they still function very much like Bitcoin ETFs. The purpose is to offer a transparent, accessible, and regulated pathway to legacy investors to have exposure to Ethereum — in one way or the other. Note while a spot ETH ETF is expected to offer direct exposure to Ether’s prices, Ethereum futures ETFs already exist in U.S. markets, for trading.

These ETFs — Exchange-Traded Funds — are available on leading stock exchanges and are listed as shares. When traders or investors buy ETF shares, they gain exposure to crypto without having to use centralized and decentralized exchanges or install and manage crypto wallets.

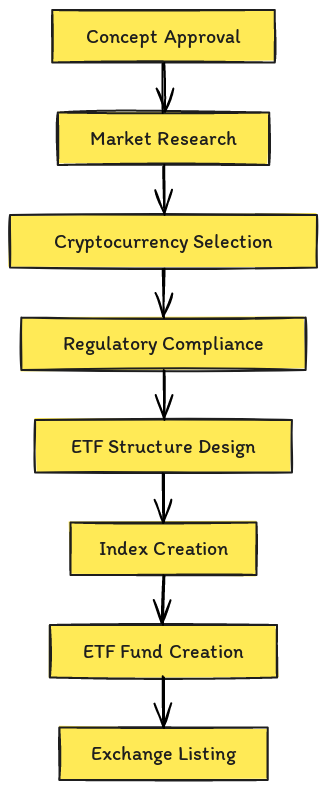

The mechanics of ETH ETFs explained

Spot Ethereum ETFs have arrived, for the most part. These ETFs will pool investor capital to purchase actual ETH, making it the underlying asset of the ETF. This is a significant development as it provides a direct way for traditional investors to gain exposure to Ethereum without dealing with the complex elements of crypto exchanges and wallets. But there is more to the approval!

The SEC’s approval process for these Ethereum ETFs, under the 19b-4 filings, involved a period where they invited public comments. They wanted feedback on aspects like market structure, liquidity, and potential risks. This feedback was crucial in addressing various concerns. The SEC also took a close look at how the spot and futures markets for Ethereum are related, making sure there’s a strong correlation to avoid market manipulation.

Even though the ETFs got the green light, they aren’t ready for trading just yet. The SEC’s process includes multiple review stages and additional requirements before these ETFs can be listed on exchanges. This involves finalizing custodial arrangements, making sure everything complies with the SEC’s rules, and ironing out any remaining regulatory issues.

Even though the SEC has approved the ETFs, they are not yet ready for trading. Issuers must still obtain approval for their S-1 registration statements, which detail investor disclosures and ensure compliance with SEC regulations. This additional approval process might take several weeks to months before the ETFs can be listed and traded on exchanges.

Hope the confusion is clear by now! Let us now shift focus to the ones available:

Which ETFs are available for trading?

Regarding the futures ETFs related to Ethereum, the fund managers offer exposure to the Futures contracts, where the capital is used and pooled to purchase contracts.

As the contracts have expiration dates, contract rollovers are involved in maintaining the exposure of ETF shares to Ethereum. The process involves selling near-expiry contracts and using the funds to purchase the contracts with a long-due expiration date. In the case of a Futures Ethereum ETF, contract management is the key.

Here is a bullish statement we came across long back:

“We are 280 days out from the BTC halvening and a spot bitcoin ETF looks to be coming by the end of the year, if not sooner. No doubt this will lead to other ETF opportunities for other cryptoassets.”

Vance Spencer, Co-Founder of Framework Ventures: X

Also, it is important to note that SEC followed different spot ETF evaluation mechanics at the backend, where the correlation between the spot and the Futures market was evaluated and studied. A higher correlation, closing in on 100% for ETH, was the secret sauce for speedy ETH ETF approval.

This step was vital to determine the accuracy of crypto index tracking or ETH price tacking in the case of spot ETFs.

SEC also used other tools, like the Howey Test, to determine if the asset warrants creating an ETF product.

Creation and redemption

Another component of the spot Ethereum ETF structure is the creation and redemption process in play. Here is how that played its part:

The creation process possibly involved APs or Authorized Participants creating new shares, buying the underlying asset or ETH, and exchanging them for the shares. This is how creation units were formed.

The redemption element comes in when APs return the shares to the issuers to get back the proportionate share of the underlying asset. The creation and redemption process is dynamic and helps keep the price of one ETF unit closer to the NAV or Net Asset Value.

That is the entire dynamic of the Ethereum ETF approval. Or at least a major one!

Types of ETH ETFs

ETH ETFs can be categorized as spot ETH ETFs and futures ETH ETFs. Only Futures ETH ETFs are available for trading. But based on how the Bitcoin spot ETFs operate, here’s how we expect the spot ETH ETFs to function:

- Provide direct exposure to ETH

- Eliminate the need for wallets and exchanges

- Offer a familiar and regulated environment for traders

Futures ETFs are functional, and the fund managers offer them exposure to Ethereum’s prices via standardized agreements at predetermined future prices. Even these fund houses or ETH ETF issuers do not hold actual Ether.

A novel yet aggressive take on the spot ETH ETF approval:

Spot Ethereum ETF vs. Ethereum Futures ETF

Even though spot ETH ETFs haven’t entered the U.S., they are available globally. Therefore, comparing these with futures ETH ETFs makes sense.

| Feature | Spot Ethereum ETFs | Futures Ethereum ETFs |

| Underlying asset | Directly hold Ethereum. | Hold Ethereum futures contracts. |

| Market exposure | The real-time market price of Ethereum. | Price movements of Ethereum futures. |

| Investment objective | Mirror the current market value of Ethereum. | Speculate on future price movements of Ethereum. |

| Volatility exposure | Direct exposure to Ethereum’s volatility. | Market volatility through futures contracts. |

| Regulatory landscape | Stringent regulatory hurdles for approval, mostly the trading bit. | More readily approved due to established futures market infrastructure. |

| Investor suitability | Investors seeking direct exposure to Ethereum’s price movements. | Investors looking for speculative opportunities or indirect exposure to Ethereum. |

| Primary advantages | Direct correlation with Ethereum’s price and simplified access. | Speculative opportunities on price movements and minimal exposure to direct crypto volatility. |

| Primary challenges | High price volatility and regulatory approval challenges, for the most part. | Futures market complexity and contango and counterparty risks in futures contracts. |

| Global examples | The Purpose Ether ETF (Canada) and The ETHE ETF by Grayscale (USA) — not a traditional ETF and follow a Trust structure. | ProShares Ether Strategy ETF (USA) and The CI Galaxy Ethereum ETF (Canada) |

Popular Spot Ethereum ETF players

Several well-known ETF issuers applied with the SEC to launch spot Ethereum ETFs. Some of the more notable names include:

- Grayscale

- Ark Invest and 21Shares

- VanEck

- Fidelity

- BlackRock

- Franklin Templeton

- Hashdex

- Invesco

Also, here are the ones that got the nod:

- VanEck Ethereum Strategy ETF (EFUT)

- ARK 21Shares Ethereum ETF

- Fidelity Ethereum ETF

- BlackRock Ethereum ETF

- Invesco Galaxy Ethereum ETF

- Franklin Templeton Ethereum ETF

- Hashdex Nasdaq Ethereum ETF

- Bitwise Ethereum Strategy ETF

Also, besides the mentioned differences, the nature of custodians also varies. For instance, for spot ETFs, custodians actually need to hold actual Ether, whereas, for futures, the same changes are made to the safekeeping of futures contracts.

Here is some ETH-specific enthusiasm, palpable since a long time:

“ETH ETF approval in May is bullish.

Delay is also bullish – longer cycle.”

Alex Svanevik, CEO of Nansen: X

The current state of Spot Ethereum ETFs

The SEC’s recent approval of spot Ethereum ETFs, as of May 23, 2024, specific to the prominent asset managers such as Grayscale, Fidelity, and Bitwise, initially led to a surge in Ethereum’s price and increased optimism in the market. The approval process included rigorous evaluations of market structure, liquidity, and potential risks, similar to the approach taken with Bitcoin ETFs.

However, the process started as more complex as the SEC demanded details, as follows:

According to Bloomberg analysts, the U.S. Securities and Exchange Commission (SEC) had requested further details regarding Ethereum ETFs, raising approval odds from 25% to 75%. This request signals a thorough review of market structure and risks, increasing optimism for approval. The SEC has asked issuers like ARK Invest and 21Shares to update their 19b-4 filings, focusing on market structure, liquidity, and associated risks.

Following this news of possible ETH approval, Ethereum’s price surged by 20% in under 24 hours in early June, reflecting investor confidence.

Analysts predicted this could lead to further gains for Ethereum and positive effects on related cryptocurrencies. However, things have been pretty tepid since, showing that the ETH ETH approval might have been priced in:

A decision regarding trading might come soon, which might lead to a bullish wave:

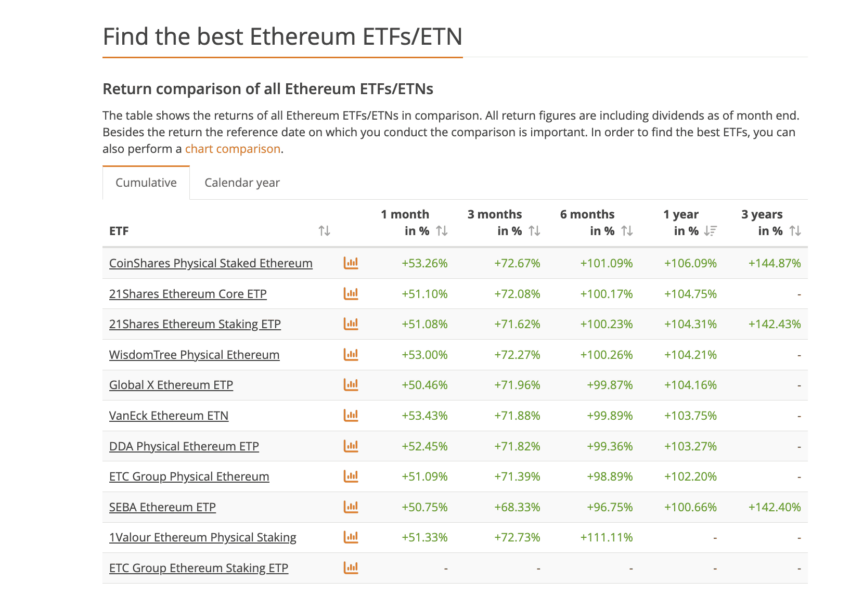

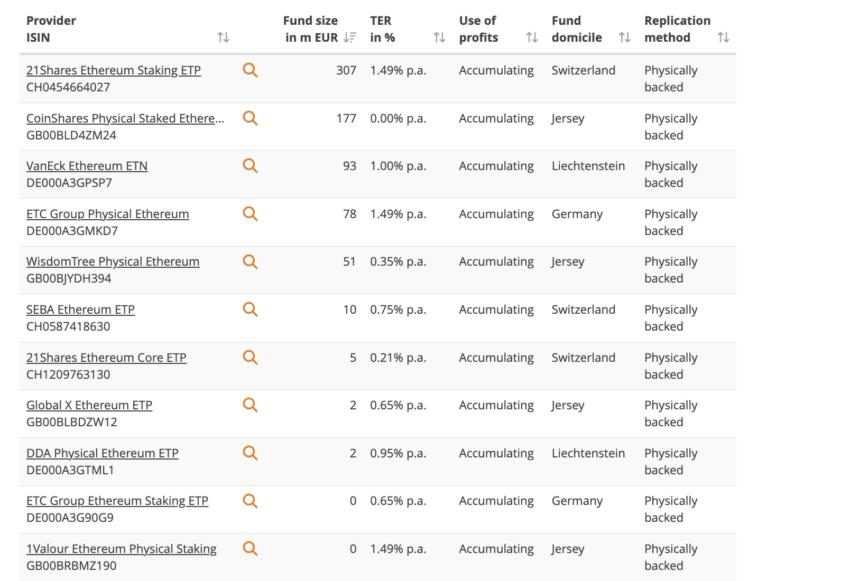

Ethereum ETF guide: Which ETFs to pick?

Now we know what an Ethereum ETF is. But which options should you pick?

As mentioned, only futures choices are currently available in the U.S. Let us take a closer look at them, depending on their geographical relevance.

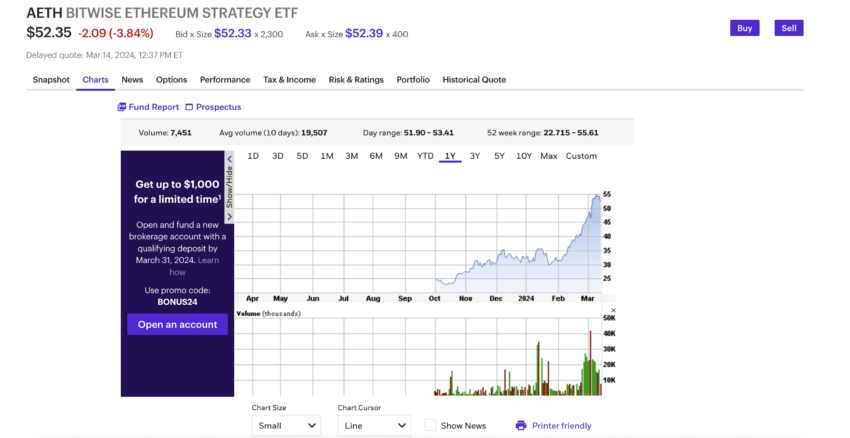

SEC-approved Ethereum ETF picks

Futures Ethereum ETFs can be traded as they have the requisite regulatory approval. Here are the options you can consider:

- Bitwise 10 Crypto Index Fund Futures (BITW)

- Valkyrie Bitcoin and Ether Strategy ETF (BTF)

- VanEck Ethereum Strategy ETF (EFUT)

- ProShares Ether Strategy ETF (EETH)

- Bitwise Bitcoin and Ether Equal Weight Strategy ETF

- Bitwise Ethereum Strategy ETF Futures (AETH)

- ARK 21Shares Active Ethereum Futures Strategy ETF (ARKZ)

- ProShares Bitcoin & Ether Market Cap Weight Strategy ETF (BETH)

- ProShares Bitcoin & Ether Equal Weight Strategy ETF (BETE)

Did you know? The VanEck Ethereum Strategy ETF (EFUT) was launched on Oct. 2, 2023? One of EFUT’s top holdings is the United States Treasury Bills.

Other Ethereum ETF picks explained

Other countries also take Ethereum ETFs seriously. Here are a few specific to Canada:

- CI Galaxy Ethereum ETF (ETHX)

- Purpose Ether ETF (ETHH)

- Evolve Ether ETF (ETHR)

- 3iQ CoinShares Ether ETF (ETHQ)

- Fidelity Advantage Ether ETF

Besides that, there are a handful of other options:

Sweden (ETPs)

- XBT Provider Ethereum Tracker One

- XBT Provider Ethereum Tracker Euro

Switzerland (ETPs)

- 21Shares Ethereum Staking ETP

- 21Shares Ethereum ETP

Jersey (ETP)

- CoinShares Physical Staked Ethereum

Others

- Germany (ETP): ETC Group Physical Ethereum

- Bermuda (ETP): Hashdex Nasdaq Ethereum ETF

- Hong Kong (ETP): CSOP Ether Futures ETF

- Guernsey (ETP): AMINA Ethereum ETP

- Australia (ETF): Global X 21 Shares Ethereum ETF

- Malaysia (ETF): Halogen Shariah Ethereum Fund

Notably, the global Ether-related cryptocurrency investment products aren’t restricted by regulatory approval and also provide spot Ethereum ETF picks. Some of the spot Ethereum ETF picks include Purpose Ether ETF, Evolve Ether ETF, and more.

Ethereum ETP vs. Ethereum ETF explained

In the section above, ETPs have been mentioned a number of times. Here is how ETPs and ETFs differ:

While ETFs are often regulated products and track the price of ETH, ETPs or Exchange Traded Products can include a wider range of options. These can include Exchange Traded Notes or ETNs, ETCs or Exchange-Traded Commodities, and more. Also, ETPs do not require the same level of regulatory oversight.

Pros and cons of Ethereum ETFs

Now that you know how diverse Ethereum ETFs are, per this Ethereum ETF guide, it is important to look at the pros and cons:

Ethereum ETF benefits

- Accessible and simplified as an TradFi-cum-cryptocurrency investment option

- Regulatory compliance catering to the more risk-averse investors

- Enhanced levels of investor protection

- High liquidity option

- Minimal management complexity

- Simplified tax reporting procedures

- Better for the price of ETH as spot ETFs can reduce the supply

- Acts like a passive investment option for the crypto folks who do not want direct Ethereum market exposure.

Ethereum ETF challenges

- Still prone to market volatility as ETH is still a crypto asset

- Tracking error

- Counterparty risks associated with Futures ETFs

- Centralization risks as Ethereum is PoS, and there might be token hoarding

When asked about the challenges, Sal Poorna told BeInCrypto:

“If the Ethereum ETF is approved and BlackRock or other institutional investors begin to invest in Ethereum, which operates on a proof-of-stake model, there could be significant implications. Should BlackRock or similar entities acquire a substantial portion of Ethereum’s coins and choose to stake them, they could effectively gain control over the network’s voting rights.

This concentration of power might lead to a centralization of Ethereum, which is contrary to the decentralized ethos the cryptocurrency aims to uphold.”

Sai Poorna, marketing and partnerships at Bluewheel Mining and early-stage Investor: BeInCrypto

Here is a lesser-known challenge in case the Spot ETH ETF arrives:

What is the difference between Ethereum and Ethereum ETF?

Ethereum is an incredibly popular blockchain protocol with Ether (ETH) as its native cryptocurrency. Purchasing Ether requires a crypto exchange — centralized or decentralized — and storing the asset requires a crypto wallet. Ethereum ETFs, however, trade on standard or traditional exchanges — the ones dealing in the stock market. Yes, the funds issuing the ETFs would hold Ethereum as the underlying asset, but that is not your concern as a trader.

Purchasing Ethereum (ETH) at key levels requires you to time the market. And even though fractional ETH buying is supported, you still have to sign up on the CEX or DEX to make a purchase. On the other hand, Ethereum ETFs trade like shares at far more competitive rates per unit.

VanEck’s EFUT is trading at $30 as of March 15, 2024, per this chart.

While Ethereum is a standard cryptocurrency prone to crypto-like volatility, an ETH ETF is a financial product that trades on stock exchanges. Even with ETFs, volatility might still be a concern.

Finally, Ethereum (ETH) can be purchased from all the leading global cryptocurrency exchanges like Binance, Coinbase, OKX, and more. Once bought, the purchased ETH can be used to take part in network activities, generate passive income opportunities via staking, and more. An Ethereum ETF, on the other hand, is just like a share sitting in your portfolio.

Ethereum ETF vs. Bitcoin ETF

While ETH ETFs work with Ethereum spot or futures as the underlying asset, Bitcoin ETFs have BTC as the empowering component. Also, the perception of BTC as a commodity, akin to “digital gold,” has somewhat facilitated a clear path to regulatory approval.

Also, as of June 2024, Ethereum ETFs mostly deal in futures, and the spot ETH ETF picks are not native to the U.S, at least for trading. Bitcoin ETFs; however, they can be categorized as spot Bitcoin ETFs, Bitcoin futures ETFs, leveraged ETFs, Inverse ETFs, thematic ETFs, and more.

How do I invest in ETH ETF?

Investing in the U.S. requires you to register with licensed brokers or platforms like TD Ameritrade, E*TRADE, and more. Once you have registered and validated your credentials, you can search for the preferred ETH ETF and start investing.

Here’s how the interface looks, with all the stock-like details listed under one roof.

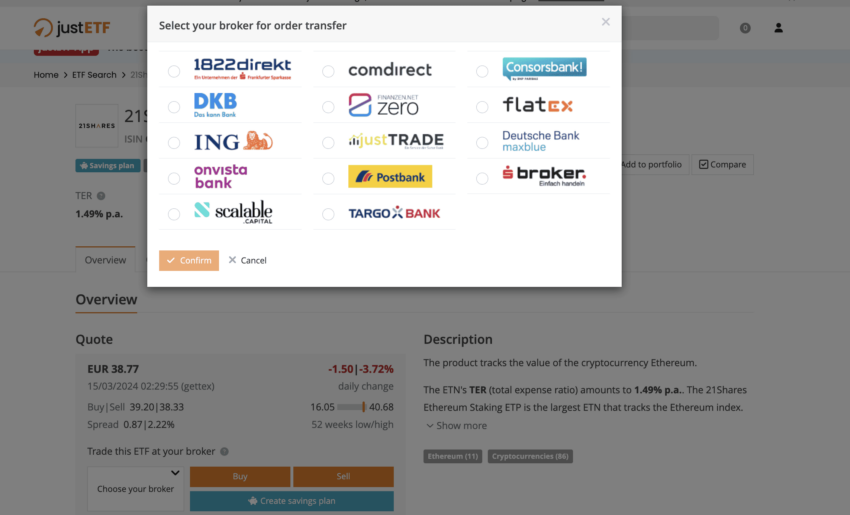

Global Ethereum ETFs can also be traded over select brokers:

Can ETH ETF be the ultimate ‘flippening’ instrument?

Flippening, where ETH overtakes BTC, is still a distant dream for the Ethereum camp. And even with the existing set of ETH ETF picks around, Ethereum’s success can be primarily attributed to its vast DApp, DeFi, and smart contract-powered ecosystem.

Therefore, Ethereum, the chain, isn’t reliant on new ETH ETFs. However, if spot ETH ETFs are available for trading, and that too in the bull market, such good news could further complement Ether’s already aggressive ascension.

Frequently asked questions

What does ETF mean in crypto?

Is ether a security?

Which regulatory body oversees ether futures ETFs?

Which Ethereum ETF is best?

How can I buy Ethereum ETF in the U.S.?

Does Ether have an ETF?

Will Ethereum ETFs be approved?

Are crypto ETFs safe?

Is it safe to invest in Ethereum?

Can Ethereum reach $50,000?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.