GameFi, once a buzzword in the cryptocurrency market, is now resurging with a vengeance. This revival is driven by innovative developments, market adaptation, and a growing global audience.

These technologies are not a rising trend but a transformative movement in the gaming industry.

The Boken Play-to-Earn Model

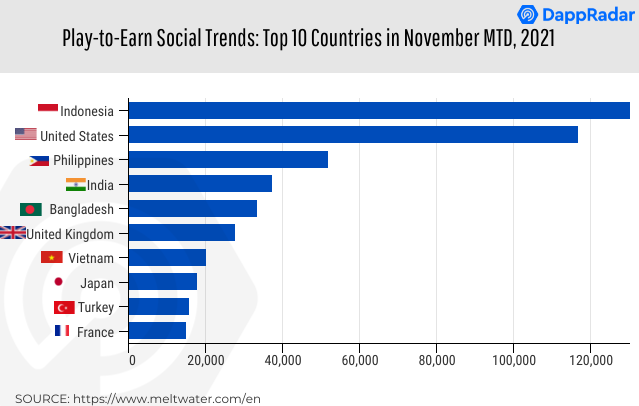

Kieran Warwick, co-founder of Illuvium, told BeInCrypto about Southeast Asia’s pivotal role in GameFi’s resurgence. According to him, Southeast Asia, with its young, tech-savvy population and high crypto adoption, is a crucial player in this sector.

The region’s preference for mobile and accessible gaming platforms integrated with blockchain technology highlights the potential of localized content and mobile-first strategies to engage players in emerging markets. Likewise, societal and cultural trends heavily influence GameFi development.

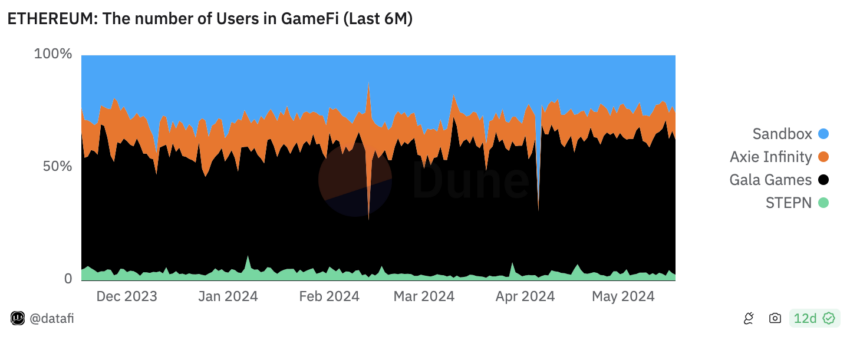

Games like Axie Infinity have successfully integrated local myths and cultural elements into game narratives, boosting player engagement significantly. Still, Axie Infinity’s tokenomics model contained a critical flaw. It prioritized immediate profits over sustained player engagement.

Participants could acquire AXS tokens by breeding Axies and selling them in the marketplace. This sparked a breeding surge, as players aimed to produce as many Axies as possible to maximize their token earnings. For this reason, Warwick highlighted the importance of balancing in-game asset scarcity with accessibility.

“Our approach to tokenomics and game mechanics aims to balance long-term player engagement with financial sustainability. Balancing in-game asset scarcity with accessibility is crucial; too much scarcity can hinder new player involvement, while too much availability may deflate value,” Warwick said.

This balance is crucial to avoid deterring new players with excessive scarcity or deflating asset value through overabundance.

Read more: Top 7 Metaverse Games to Play in 2024

The concept of real yield, offering tangible rewards within games, is another step towards sustainability. However, this also introduces risks such as hyperinflation of in-game assets and reliance on external economic factors. A balanced approach is essential for long-term viability.

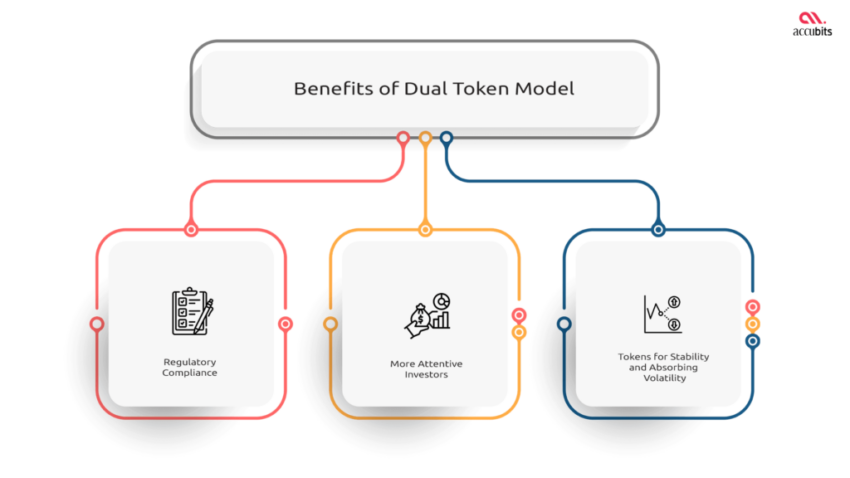

For instance, dual-token systems can offer depth in economic and governance aspects even though these systems require meticulous management to prevent economic imbalances.

“They allow for a more complex economy and give players a say in governance, enhancing engagement,” Warwick told BeInCrypto.

The transition from Play-to-Earn to Play-and-Earn or Play-to-Own models reflects a holistic approach, focusing on enjoyable gameplay alongside earning potential. Success in these models hinges on the delicate balance between fun gameplay and economic incentives.

The Catalyst for GameFi’s Resurgence

The entry of major gaming companies into GameFi is a significant trend. Potential partnerships between traditional gaming companies and blockchain innovators could revolutionize the industry.

For instance, Integrating GameFi elements into popular games like GTA VI could drastically change player expectations and encourage traditional gaming industries to explore blockchain technologies.

Virtual real estate is another growing sector within GameFi. This new economy impacts asset valuation and player investment strategies, underscoring the need for robust economic models and transparent regulatory frameworks.

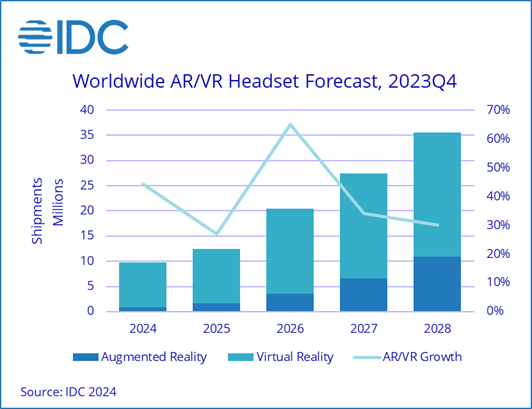

Likewise, the release of high-end VR headsets like Apple’s Vision Pro is poised to significantly impact GameFi, offering more immersive experiences.

“Adapting GameFi to these technologies will be crucial for future growth. GameFi developers must balance innovation with user experience, especially for blockchain newcomers,” Warwick affirmed.

Still, cyber security remains paramount. Warwick emphasized the importance of multi-layered security measures, regular audits, and transparent smart contract operations to protect players’ assets. “Building a secure and trusted environment is vital for the industry’s growth,” he asserted.

GameFi developers must balance innovation with user experience, particularly for blockchain newcomers. This includes intuitive interfaces, educational resources, and seamless integration of blockchain elements. Community feedback is critical in GameFi’s success, shaping projects through community-driven feature development and beta-testing feedback.

Integrating GameFi with the Metaverse promises more immersive and interactive gaming experiences. This convergence will likely lead to new forms of social interaction and digital economies within the virtual worlds.

Trusted

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.