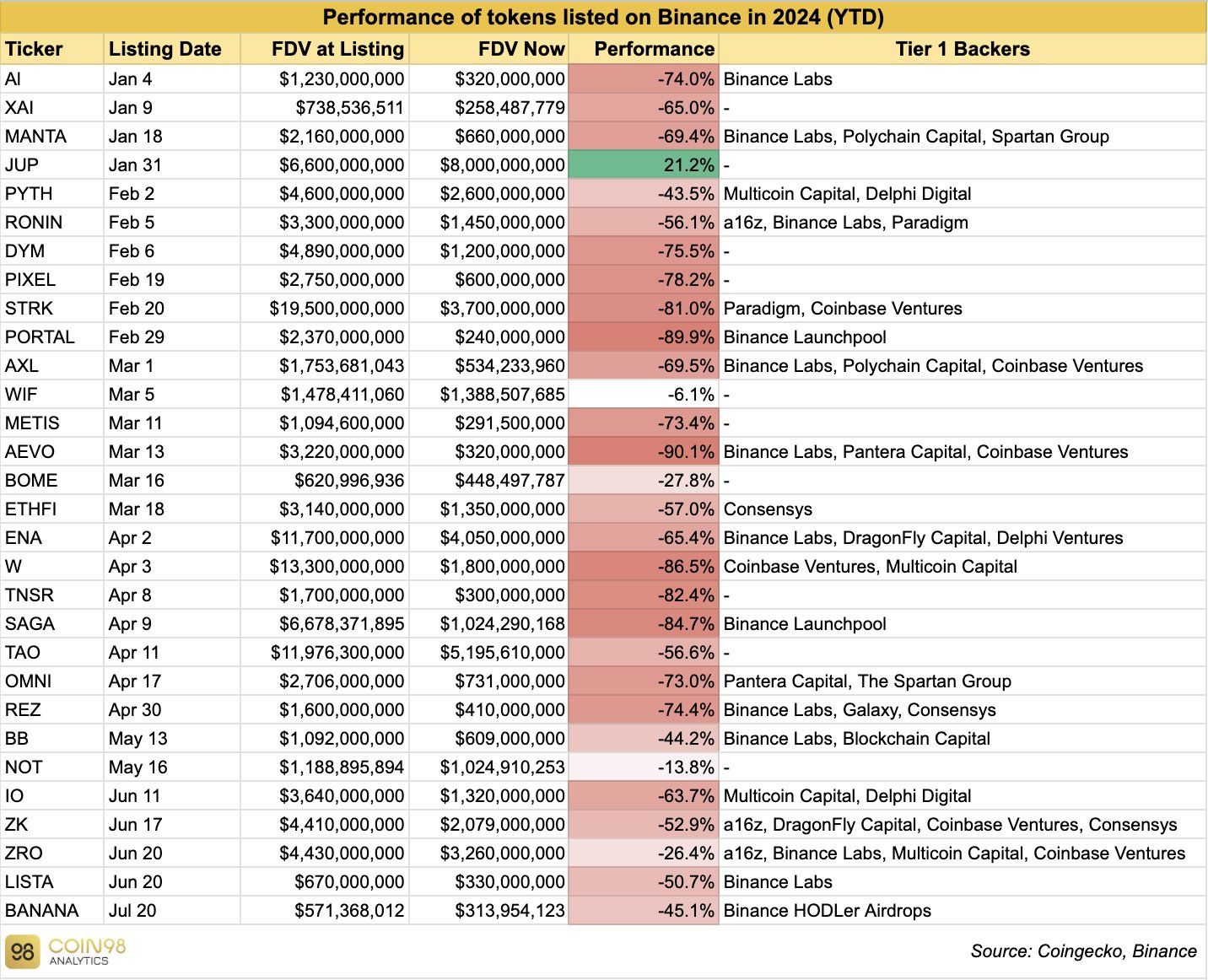

Binance, the leading cryptocurrency exchange on trading volume metrics, has listed 30 tokens since the beginning of 2024. Nevertheless, most of these new projects show decreases in performance.

Many of Binance’s new listings were introduced at high valuations, with reports that leading venture capital firms support the tokens.

Binance 2024 Listings Flop

According to Coin98 Analytics, only Jupiter (JUP) is in the green out of the 30 tokens listed on Binance this year. Surprisingly, most tokens record double-digit losses, with special interest on those with tier-one backers.

Save for JUP, the Fully Diluted Valuation (FDV) metric of all the 29 tokens has dropped significantly. This metric refers to the total market capitalization of an asset if all possible tokens were in circulation.

Tokens with Binance Labs’ backing, including AI, MANTA, AXL, ENA, REZ, BB, and LISTA, are down between 44% and 90%. Others by venture capitalists (VCs) like a16z, Paradigm, Coinbase Ventures, Galaxy, and Pantera Capital are also showing decreases.

Read more: Which Are the Best Altcoins To Invest in May 2024?

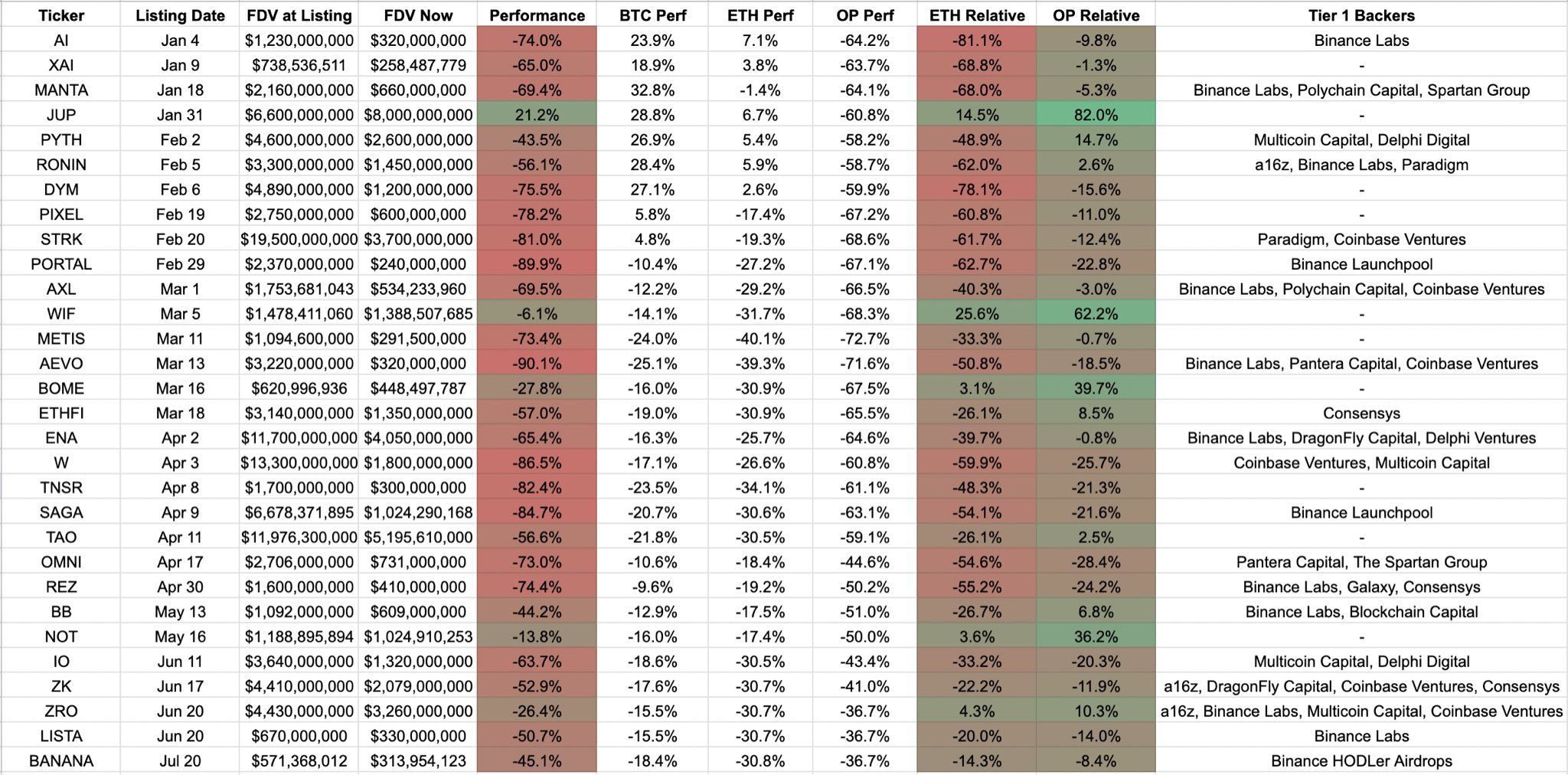

However, Vinay, a Web3 developer, poses that looking at independent token performance may be incorrect, citing market changes.

“Here’s a comparison to check the relative performance of Binance listed projects vs ETH & OP (kinda CT darling, one of the major performers from web3 space in growth). vs OP: 9 / 30 are positive, 4 roughly flat. The worst performers are mostly listed in April, market bid was gone by then,” Vinay wrote.

Based on this analogy, nine out of the 30 projects compared have shown positive performance, with only four remaining relatively flat. It suggest that despite the overall market downturn, some projects have managed to maintain stability.

This analysis also shows that the worst performers are predominantly those listed in April, when market sentiment may have shifted.

Researcher Deconstructs VCs Role

Notwithstanding, this report highlights the interest in Binance as an exchange to launch new projects. Possible reasons for this include the trading platform’s dominance and high liquidity. These metrics make it attractive for insiders to exit their investments in these assets.

As BeInCrypto reported in May, Binance was cited by cryptocurrency researcher Flow for providing exit liquidity for VCs.

“If you held a portfolio where you would invest an equal amount at each new Binance listing, you would be down over 18% in the past 6 months,” Flow stated.

Read more: How To Fund Innovation: A Guide to Web3 Grants

Recent research by Haseeb Qureshi, Managing Partner at Dragonfly, provided compelling data showing that one reason tokens dipped, particularly in April, was retail investors raging and exiting on the realization that VCs own most tokens.

“Well, maybe it wasn’t retail investors moving money out of VC tokens and into memes, but here’s a sub-theory: VCs owned too much of these projects, and that’s why retail investors left in anger. They realized (in mid-April?) that these were all scam VC tokens, and the team + VCs owned ~30–50% of the token supply. This must have been the straw that broke the camel’s back,” Qureshi expressed.

Another perspective shared in the research is that the supply of these tokens is too small to allow value discovery.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.