Since reaching its year-to-date peak of $3.61 on March 12, IMX, the native token of Immutable X, the Layer 2 (L2) scaling solution for NFTs on Ethereum, has plummeted by 68%.

This decline intensified during Monday’s general market downturn, with the altcoin falling to its lowest value since November 2023. Although IMX has seen a slight uptick in the past 24 hours, daily traders still grapple with losses.

Immutable X’s Traders Count Their Losses

The broader market rebound has led to a 3% uptick in IMX’s price over the past 24 hours. Despite this, its day traders continue to record losses.

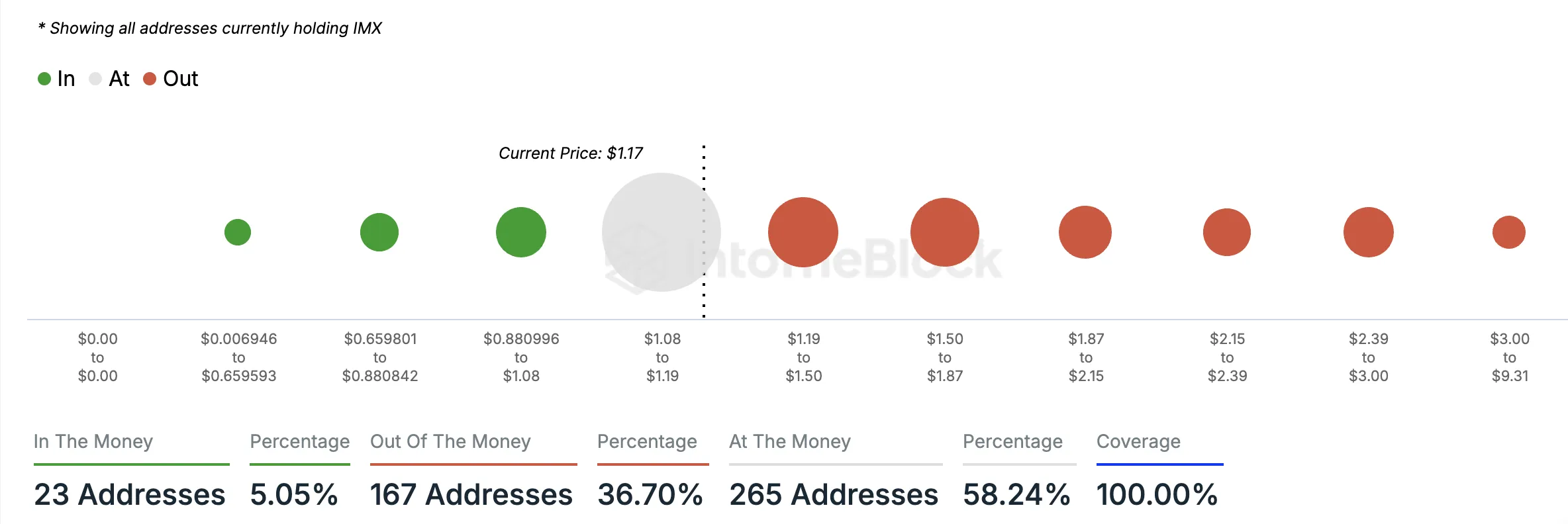

An assessment of the latest data for IMX’s Active Addresses by Profitability has revealed that 167 addresses comprising 37% of the altcoin’s daily active addresses are “out of the money.”

An address is considered out of the money if an asset’s current market price is lower than the average cost at which the address purchased (or received) the tokens it currently holds.

Conversely, only 23 addresses, representing 5% of its daily active addresses, have seen profits on their transactions.

Interestingly, 58.24% of IMX’s daily active addresses are “at the money.” This means that the average purchase price of these addresses is equal to the altcoin’s current market price. Essentially, these addresses have broken even on their investment and have made neither profit nor losses.

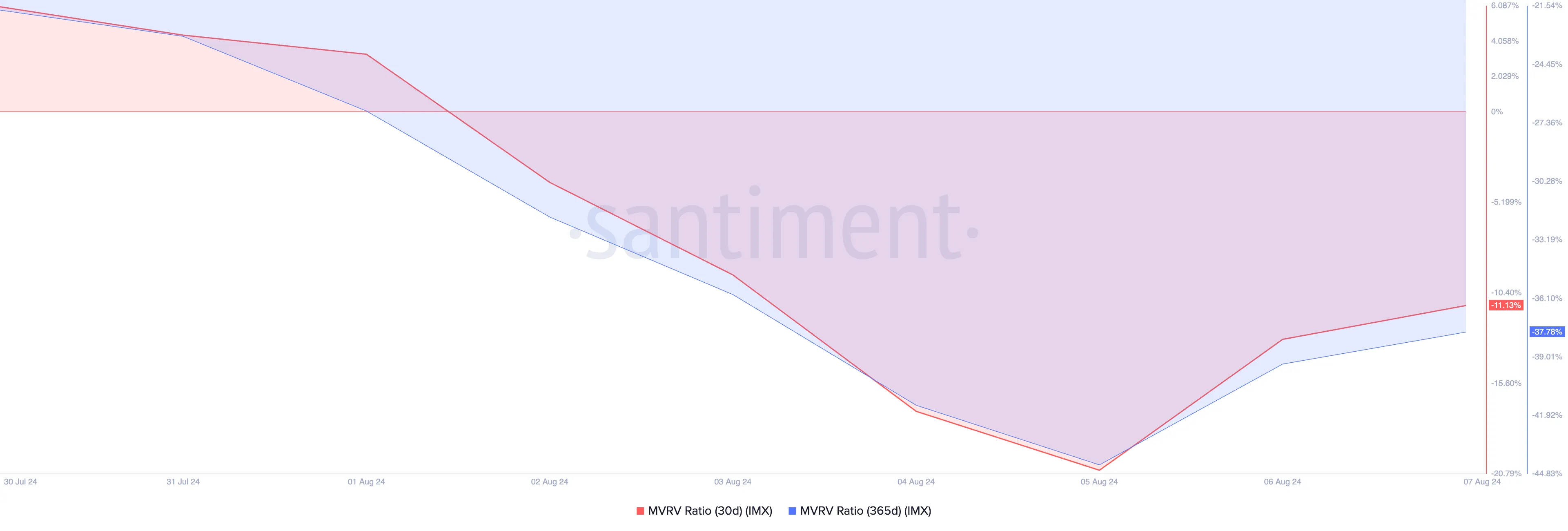

For traders looking to trade against the market, IMX’s market value to realized value (MVRV) ratio has flashed a buying opportunity. This metric returns negative values when assessed over different moving averages. According to Santiment, IMX’s 30-day and 90-day MVRV ratios are -11.13 and -37.78, respectively.

Read More: What is ImmutableX (IMX)?

This metric measures the ratio between an asset’s current market price and the average price of its coins or tokens in circulation.

An MVRV ratio below zero means the asset’s current market value is lower than the average purchase price of all its tokens in circulation. When this occurs, the asset is said to be undervalued.

Historically, this presents a good buying opportunity as the asset trades at a lower price, and traders can buy low and hope to sell high.

IMX Price Prediction: Token Lingers Within a Bearish Channel

Although IMX’s MVRV ratio has flashed a buy signal, it is key to note that the altcoin still trades within a descending channel. This channel is a bearish signal formed when an asset’s price consistently moves lower, creating a series of lower highs and lower lows.

If IMX continues to trend within this channel, its price might fall to $0.92 and aim for the lower line, which currently forms support at $0.67.

However, if the trend corrects and IMX sees an uptrend, its price may rally toward $1.58.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.