With Bitcoin and Ethereum ETFs already approved in the United States, the focus has shifted toward speculation. Which crypto is next to get an ETF? Investors are eyeing the potential of popular altcoins such as Chainlink, Solana, XRP, and more. This Chainlink ETF guide examines the potential of these regulated financial instruments and their current status in 2024.

KEY TAKEAWAYS

• Chainlink ETFs are like any other ETF, designed to provide investors with exposure to LINK.

• These ETFs are not yet approved or available in the U.S.

• While investing in ETFs can offer greater protection than direct LINK investment, this does not mean profits are guaranteed.

- Unpacking the Chainlink ETF

- Possible features of Chainlink ETF

- Chainlink ETF guide: How will things work?

- The concept of underlying assets

- Global presence of Chainlink ETFs

- Benefits of investing in Chainlink ETFs

- Chainlink ETF guide: Are there any risks?

- Chainlink vs. Chainlink ETF

- Chainlink ETF vs. Bitcoin ETF

- Chainlink ETF vs. Ethereum ETF

- Should you be excited about Chainlink ETFs?

- Frequently asked questions

Unpacking the Chainlink ETF

Chainlink ETFs expose investors to LINK, the native crypto of the Chainlink ecosystem. Chainlink is a popular decentralized oracle ecosystem that connects the blockchain world to the off-chain world.

Simply put, blockchains requiring real-time information from across the globe can take Chainlink’s assistance. LINK is used within the ecosystem as a mode of payment.

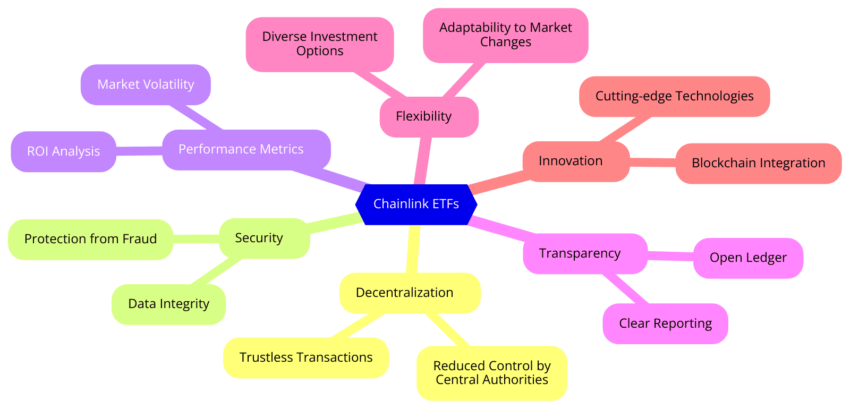

Possible features of Chainlink ETF

Here are some features that you can expect from Chainlink ETFs:

- Investors will gain direct exposure to Chainlink’s decentralized oracle network. This enables smart contracts to interact with real-world data (e.g. APIs, payment systems, and so on).

- These ETFs will hold LINK as their primary asset, allowing investors to participate in the growth of the Chainlink ecosystem.

- These products could incorporate mechanisms that align with Chainlink’s core tenets of decentralized governance. This would give ETF holders a say in strategic decisions affecting the fund’s health.

- Such ETFs could enhance investors’ exposure to DeFi platforms that use Chainlink’s oracles, potentially leading to exciting liquidity pools and yield farming opportunities.

- Chainlink ETFs could make use of smart contracts to automatically recalibrate and rebalance holdings based on market conditions or other predefined criteria.

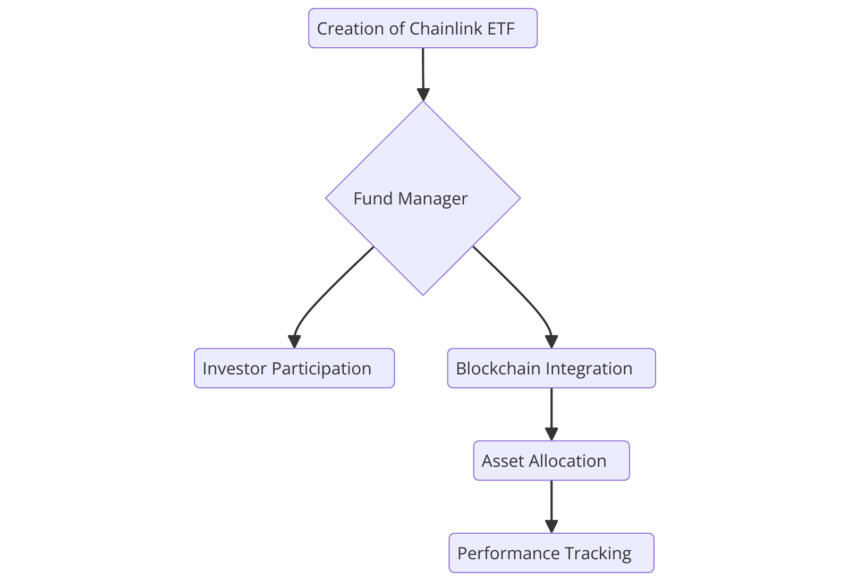

Chainlink ETF guide: How will things work?

LINK ETFs will operate similarly to traditional exchange-traded funds (ETFs) but will focus on digital assets and blockchain technology. Let’s explore this process further.

Creation and redemption process

The process of creating and redeeming shares in a Chainlink ETF is quite similar to that of traditional ETFs. Authorized participants (APs) play a crucial role.

These are typically large financial institutions that create new ETF shares by depositing an equivalent value of the underlying asset (LINK, in this case) into the fund.

In return, they receive shares of the ETF. Conversely, APs can redeem ETF shares for the underlying Chainlink tokens.

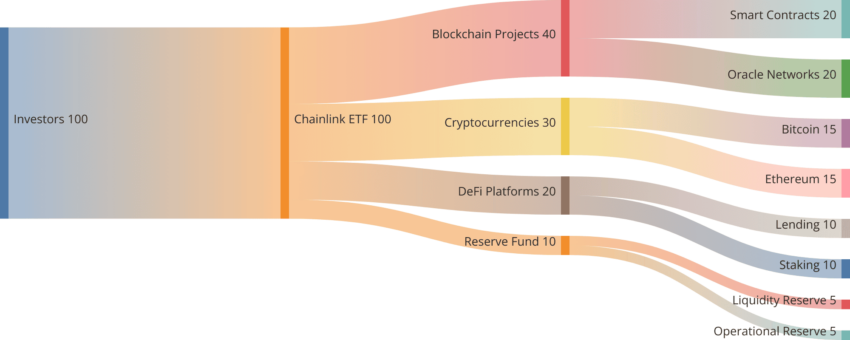

The concept of underlying assets

An underlying asset physically backs all ETFs. This means that a Chainlink ETF holds actual LINK tokens in a secure, institutional-grade custody solution. This backing provides the security and assurance that the ETF’s value is directly tied to Chainlink’s performance.

For example, the 21Shares Chainlink ETP is 100% physically backed and keeps the LINK tokens in cold storage for security.

Exchange trading in regard to Chainlink ETFs

Just like traditional ETFs, Chainlink ETFs can be listed and traded on major stock exchanges. Investors can buy and sell shares of the ETF through their brokerage accounts, making it easy to gain exposure to Chainlink without interacting with crypto wallets and exchanges.

The Global X Chainlink ETP (LI0X), for example, is traded on exchanges such as Deutsche Börse Xetra and offers cost-efficient access to Chainlink. However, as of August 2024, it is one of the few examples in play.

The concept of regulatory framework

All ETFs must undergo the rigors of regulatory scrutiny before being approved. As such, despite the global presence of comparable products like Chainlink ETNs and other ETPs, Chainlink ETFs are still unavailable in the U.S.

The APs, underlying assets (LINK in this case), and the concept of regulatory approval or the lack thereof lay the foundation of LINK ETFs.

Want to better understand the difference between crypto ETFs and crypto ETNs? Check our comprehensive comparison guide.

Global presence of Chainlink ETFs

As mentioned, Chainlink ETFs are not yet approved in the U.S. Even globally, the exchange-traded fund presence is minimal. However, there are a few exchange-traded notes (ETNs) and other exchange-traded products (ETPs) that you can look at to understand the structure and operation better. These include the following:

21Shares Chainlink ETP: Switzerland and Germany

- Name: 21Shares Chainlink ETP

- Ticker: LINK, 21XL

- ISIN: CH1100083471

- Nature: Exchange-Traded Product (ETP), listed as an ETN

- Trading platforms: SIX Swiss Exchange, Deutsche Börse Xetra

- Assets Under Management (AUM): $12 million (as of Aug. 2, 2024)

- YTD return: -3.04%

- One year return: +99.83%

- Performance metrics:

- Volatility one year: 79.71%

- Maximum drawdown one year: -41.39%

Key features

- 100% physically backed by LINK tokens

- Cold storage by institutional-grade custodian

- Carbon neutral since 2018

- Expense ratio: 2.50%

- Custodian: Coinbase Custody Trust Company, LLC

VanEck Chainlink ETN: Germany

- Name: VanEck Chainlink ETN

- Ticker: VLNK

- ISIN: DE000A3GXNV0

- Nature: Exchange-traded note (ETN)

- Trading platforms: Deutsche Börse Xetra

- Assets Under Management (AUM): $4.2 million (as of Aug. 2, 2024)

- YTD return: -10.15%

- One year return: +165.60%

- Volatility one year: 80.37%

- Maximum drawdown since inception: -41.92%

Key features

- Fully collateralized, replicates MarketVector™ Chainlink VWAP Close Index

- Direct exposure to LINK tokens stored in cold storage

- Provides right to redeem against delivery of the respective cryptocurrency

- Expense ratio: 1.50%

- Custodian: Regulated crypto custodian

Global X Chainlink ETP: Germany

- Name: Global X Chainlink ETP

- Ticker: LI0X

- ISIN: GB00BM9JYJ86

- Nature: Exchange-traded product (ETP)

- Trading platforms: Xetra

- YTD return: +22.25%

- Volatility one year: Data not available

- Maximum drawdown since inception: -41.92%

Key features

- Provides exposure to Chainlink by replicating the performance of the underlying index

- Collateralized debt obligation backed by physical LINK holdings

It is also important to mention the U.S-based ARK 21Shares Bitcoin ETF. Although not an out-and-out Chainlink ETF, it utilizes Chainlink’s proof-of-reserve (PoR) platform for its operation. This integration ensures that investors can verify the ETF’s holdings in real time, providing a higher level of trust and security. Here are the key details.

Ticker: ARKB

Nature: Bitcoin ETF

Partnership: ARK Invest and 21Shares are the key players behind this ETF. They utilize Chainlink’s technology to improve the reliability of data related to the ETF’s assets.

Impact on the price of LINK tokens: Following the integration, Chainlink’s price saw a notable increase, reflecting market optimism about the utility of Chainlink’s technology in enhancing financial products.

Benefits of investing in Chainlink ETFs

Investing in any cryptocurrency-backed exchange-traded product comes with a host of benefits. The most obvious ones include:

- Better portfolio diversification

- Easy access to crypto-focussed investing

- Improved transparency

- Better security, as the LINK tokens completely back the ETPs and ETNs while being stored in cold wallets.

- Contribution towards Carbon neutrality in line with Chainlink’s environmental commitments

- Tax benefits

- Decent returns with products like the VanEck Chainlink ETN, even reporting a one-year return of +165.60%.

Chainlink ETF guide: Are there any risks?

ETFs are closer to traditional market instruments than general crypto investments. Yet, if you are eyeing crypto ETFs, there are a few considerations to take note of:

- Regulatory risks related to cryptocurrencies exist

- Technological risks involving smart contract failures and more

- Liquidity risks, mostly on smaller exchanges

- Security risks

- Lack of historical data

- Market volatility led by changing sentiments and perceptions

- Counterparty risks

Chainlink vs. Chainlink ETF

Should you opt for the standard LINK token or look to invest in the Chainlink ETF? Here is a table to help you decide:

| Aspect | Chainlink (LINK) | Chainlink ETF |

| Ownership | Direct ownership of LINK tokens | Indirect ownership through shares |

| Security | Requires secure crypto wallet | Managed by institutional custodians |

| Accessibility | Requires understanding of crypto exchanges | Traded on traditional stock exchanges |

| Volatility | High due to direct crypto exposure | Slightly mitigated within the ETF structure |

| Regulation | Less regulated, subject to crypto regulations | More regulated, subject to financial market regulations |

Now that the token and ETF-specific differences are out of the way, let us focus on ETF-related differences.

Also, here is how a standard investor flocking would look should Chainlink ETFs be approved in the U.S.

Chainlink ETF vs. Bitcoin ETF

Here is how the Chainlink ETF compares against the original crypto-based ETF:

| Aspect | Chainlink ETF | Bitcoin ETF |

| Technology | Uses Chainlink’s proof of reserves | Uses Bitcoin’s blockchain |

| Volatility | High due to DeFi integration | High due to Bitcoin market swings |

| Use case | Focus on decentralized oracles and smart contracts | Digital gold and store of value |

| Market adoption | Growing in DeFi applications | Widely adopted as a primary cryptocurrency |

| Regulatory status | Evolving clarity | Increasing regulatory acceptance |

The below quote highlights the importance of Bitcoin ETFs in propelling the momentum around to Chainlink ETFs.

“Net new buyers drive more adoption and market cycles.”

Sergey Nazarov, Co-Founder of Chainlink: X

And, notably, nothing has driven more net new buyers than the Bitcoin ETF.

Chainlink ETF vs. Ethereum ETF

Chainlink ETFs should take cues from the recently approved Ethereum ETFs. Here is how they differ on paper.

| Aspect | Chainlink ETF | Bitcoin ETF |

| Technology | Decentralized oracle network | Smart contract and DApp platform |

| Volatility | High due to integration in multiple DeFi projects | High due to extensive DeFi and DApp use |

| Use case | Secure off-chain data for smart contracts | Platform for building decentralized applications |

| Market adoption | Growing in specialized DeFi areas | Widely adopted across various blockchain applications |

| Regulatory status | Evolving clarity | Increasing regulatory acceptance |

As you can see, some elements of the Ethereum ETF are quite similar to the Bitcoin ETF, courtesy of their presence in the U.S.

Should you be excited about Chainlink ETFs?

This Chainlink ETF guide shows that while these TradFi-friendly investment vehicles have not yet been approved in the U.S., their potential will be significant when that time comes. Note that while investing in ETFs can offer greater protection than direct LINK investment, this does not mean profits are guaranteed. ETFs in any form carry risk, and the crypto market is volatile, regardless of the form of exposure you choose.

Disclaimer: This article is for informational purposes only and should not be considered investment advice.

Frequently asked questions

What is Chainlink used for?

How does an ETF work?

Why invest in a Chainlink ETF?

What are the risks of investing in a Chainlink ETF?

How can I buy Chainlink ETF?

What makes Chainlink unique?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.